Oct05

The integration of artificial intelligence (AI) into financial markets has undergone a significant transformation since its inception in the 1980s. Back then, rule-based expert systems provided rudimentary support for stock trading decisions, relying on predefined logic to guide investors. By the 1990s, the advent of machine learning introduced more dynamic approaches, such as neural networks and decision trees, which began to model complex price prediction patterns. The 2000s marked the rise of algorithmic trading, fueled by statistical models and time-series analysis. This era, bolstered by the internet and exponential growth in computational power, allowed for faster and more precise market analysis.

The launch of Bitcoin in 2009 introduced a new layer of complexity. Its decentralized nature and extreme volatility challenged traditional financial models, pushing AI research toward more sophisticated methodologies. The 2010s saw deep learning techniques, such as Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) models, gain prominence for their ability to capture temporal dependencies in financial data. However, their black-box nature and lack of interpretability limited their adoption in high-stakes financial applications. By the late 2010s, large language models (LLMs) such as BERT and GPT had emerged, blending natural language processing with numerical analysis to provide more interpretable insights.

In the 2020s, advancements in efficient fine-tuning techniques, such as Quantized Low-Rank Adaptation (QLoRA), revolutionized the field of machine learning. QLoRA enabled the resource-efficient adaptation of massive models, such as Mistral-7B, a 7-billion-parameter language model renowned for its performance in natural language tasks. This project leverages this historical progression to transform Mistral-7B into a specialized "Crypto Orac" for Bitcoin price prediction, addressing the unique challenges of cryptocurrency markets with cutting-edge AI techniques.

The cryptocurrency market is notoriously volatile, driven by factors such as social media sentiment, regulatory changes, macroeconomic trends, and technological advancements. Traditional financial models, such as ARIMA or basic regression, often struggle to capture these multifaceted influences. Predicting Bitcoin's 12-hour price direction—whether it will rise or fall—offers traders and analysts a strategic edge, especially when paired with clear, interpretable rationales.

This project aims to convert Mistral-7B into a Crypto Oracle using QLoRA, making advanced AI accessible to a broader audience through open-source deployment on the Hugging Face Hub. By focusing on a classification task (UP or DOWN) rather than precise price forecasting, the model simplifies the prediction problem while maintaining practical utility. The inclusion of technical rationales enhances its value, enabling users to understand the reasoning behind each prediction. This approach not only supports trading decisions but also fosters collaboration and innovation in financial AI.

Large language models excel at processing and generating text, but raw time-series data, such as stock or cryptocurrency prices, poses a significant challenge. Numerical inputs are often poorly tokenized, leading models to memorize sequences rather than infer meaningful patterns. This project addresses this issue through a novel data transformation strategy, converting raw numbers into structured, interpretable formats that leverage the LLM's natural language reasoning capabilities.

The dataset is built from 12.5 years of Bitcoin Open-High-Low-Close-Volume (OHLCV) data, extracted from a SQLite database. To enrich this dataset, technical indicators—specifically the 20-period Simple Moving Average (SMA) and the 14-period Relative Strength Index (RSI)—are calculated and integrated. These indicators transform raw price and volume data into statistical signals that capture market trends and momentum, making them more suitable as input for the model.

The core innovation lies in the instructional formatting. A sliding window approach processes 72 hours of historical data into a structured Markdown table (th" "Conte" t"). The model is then tasked with an explicit instruction to predict the 12-hour price direction (UP or DOWN) and provide a technical explanation (the "Response"). This method shifts the task from numerical forecasting to contextual decision-making, allowing Mistral-7B to interpret quantitative patterns as if they were textual narratives. This approach maximizes the model's ability to reason over complex financial data while producing outputs that are readable by humans.

The dataset creation process begins by loading 12.5 years of hourly Bitcoin OHLCV data, spanning from 2013 to 2025, which results in approximately 109,500 data points. After preprocessing, which includes calculating SMA, RSI, and log returns, and removing rows with missing values, the dataset is reduced to 89,769 rows. A custom function, format_for_llm(), transforms this data into an instruction-tuning format, generating 88,788 training samples and 897 validation samples. Each sample includes:

This structured dataset enables the model to learn and interpret financial patterns contextually, aligning with its strengths in natural language processing.

Fine-tuning a 7-billion-parameter model like Mistral-7B is computationally intensive, often requiring multiple high-end GPUs. QLoRA (Quantized Low-Rank Adaptation) overcomes this barrier by enabling efficient fine-tuning on a single GPU, such as the NVIDIA A100-SXM4-80GB. The methodology includes several key components:

This approach reduces the computational footprint while enabling precise, domain-specific adaptation of Mistral-7B for Bitcoin price prediction.

The code executed on Google Colab with an NVIDIA A100-SXM4-80GB GPU orchestrates the creation of the Crypto Oracle. The script is structured into several key blocks:

The fine-tuned LoRA adapter and tokenizer are saved to Mistral-7B-BTC-Expert and uploaded to the Hugging Face Hub under the frankmorales2020/Mistral-7B-BTC-Expert repository. Robust error handling ensures successful deployment, making the model accessible for inference and collaboration. The deployment process includes a primary method via SFTTrainer and a fallback using the base model and adapter stored in Google Drive.

This project advances the application of LLMs in finance by enabling Mistral-7B to interpret technical indicators and generate reasoned predictions. QLoRA's efficiency democratizes access to advanced AI, supporting trading automation, market analysis, and educational tools. The open-source deployment fosters collaboration, providing a scalable blueprint for domain-specific AI agents in other financial markets or asset classes.

The training process concluded at 07:34 AM EDT on October 04, 2025, after 5,550 steps (100% completion, Epoch 1.00/1). Final evaluation metrics include:

These results demonstrate robust convergence, with minimal overfitting and strong predictive performance for Bitcoin's 12-hour price direction. The model's mean token accuracy of 92.20% reflects its ability to generate coherent technical rationales based on RSI and SMA indicators. In contrast, the processing of 90,112,000 tokens ensures comprehensive exposure to diverse market conditions.

The MISTRAL_FT_BTC.ipynb notebook represents a transformative milestone in financial AI. The Crypto Oracle reimagines Mistral-7B as a tool to decode Bitcoin's volatile price movements with precision and clarity. By leveraging 12.5 years of data and anQLoRA's efficiency, this project redefines predictive analytics, turning raw data into actionable insights for traders and innovators.

QLoRA enables fine-tuning of a 7-billion-parameter model on a single GPU, democratizing access to advanced AI. By quantizing the model to 4-bit precision and injecting low-rank adapters, the project achieves computational efficiency without sacrificing performance. This approach solves the resource challenge that previously made full fine-tuning inaccessible to most users.

The project's most significant innovation lies in its data handling. By converting numerical time-series data (OHLCV, SMA, RSI) into structured Markdown tables, the model can read financial patterns as text. This approach transforms a numerical forecasting task into a classification problem (UP or DOWN), leveraging the LLM's strengths in contextual reasoning. The inclusion of technical indicators enhances the model's ability to interpret complex market dynamics.

The 12.5-year dataset, spanning multiple market cycles, provides robustness and mitigates data scarcity. With 89,769 preprocessed rows and 88,788 training samples, the model learns from diverse market conditions, improving its generalization. Feature engineering, including SMA, EMA, RSI, and log returns, ensures the model reasons over analyst-level inputs rather than raw prices.

The methodology—combining QLoRA, a proprietary instruction-tuned dataset, and open-source deployment—offers a scalable framework for other financial applications. The final model, expressed as:

[ M_{\text{final}} = \text{QLoRA}{\text{Adapter}}(\text{Mistral 7B}) \text{ trained on } D{\text{prop}} \text{ (12.5 years of BTC Instruction Data)} ]

Represents a significant intellectual property advantage. This approach can be adapted to other assets, such as stocks or commodities, or extended to other domains requiring time-series analysis.

The Crypto Oracle, born from the MISTRAL_FT_BTC.ipynb notebook, marks a new era in financial AI. By transforming Mistral-7B into a specialized model for Bitcoin price prediction, this project demonstrates the power of combining QLoRA, innovative data handling, and open-source collaboration. With a mean token accuracy of 92.20% and a validation loss of 0.2019, the model delivers reliable predictions and interpretable rationales, empowering traders and analysts. As a beacon for the future of predictive analytics, this work inspires a global community to reshape financial intelligence through AI innovation.

Keywords: Cryptocurrency, Predictive Analytics, Generative AI

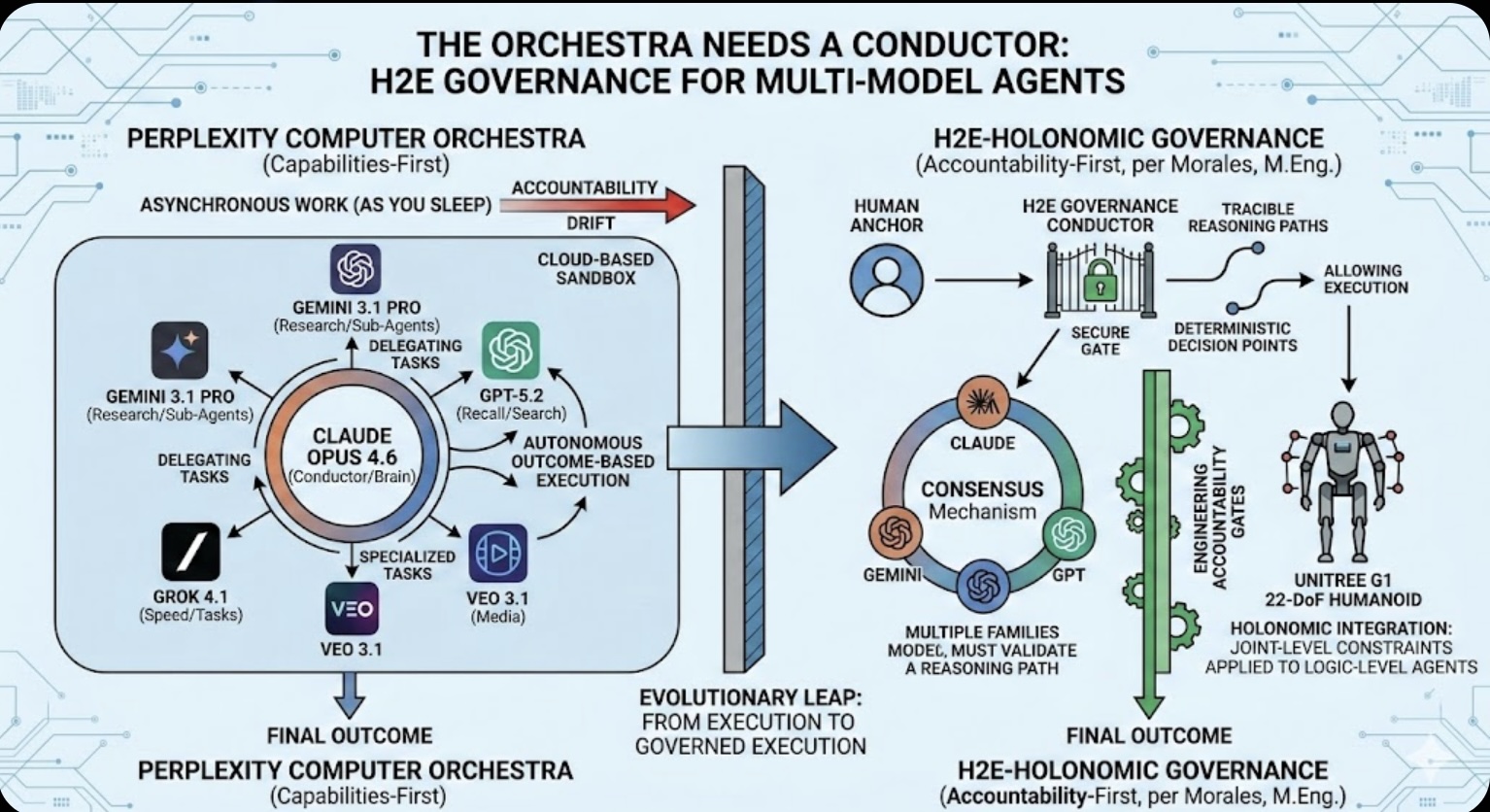

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

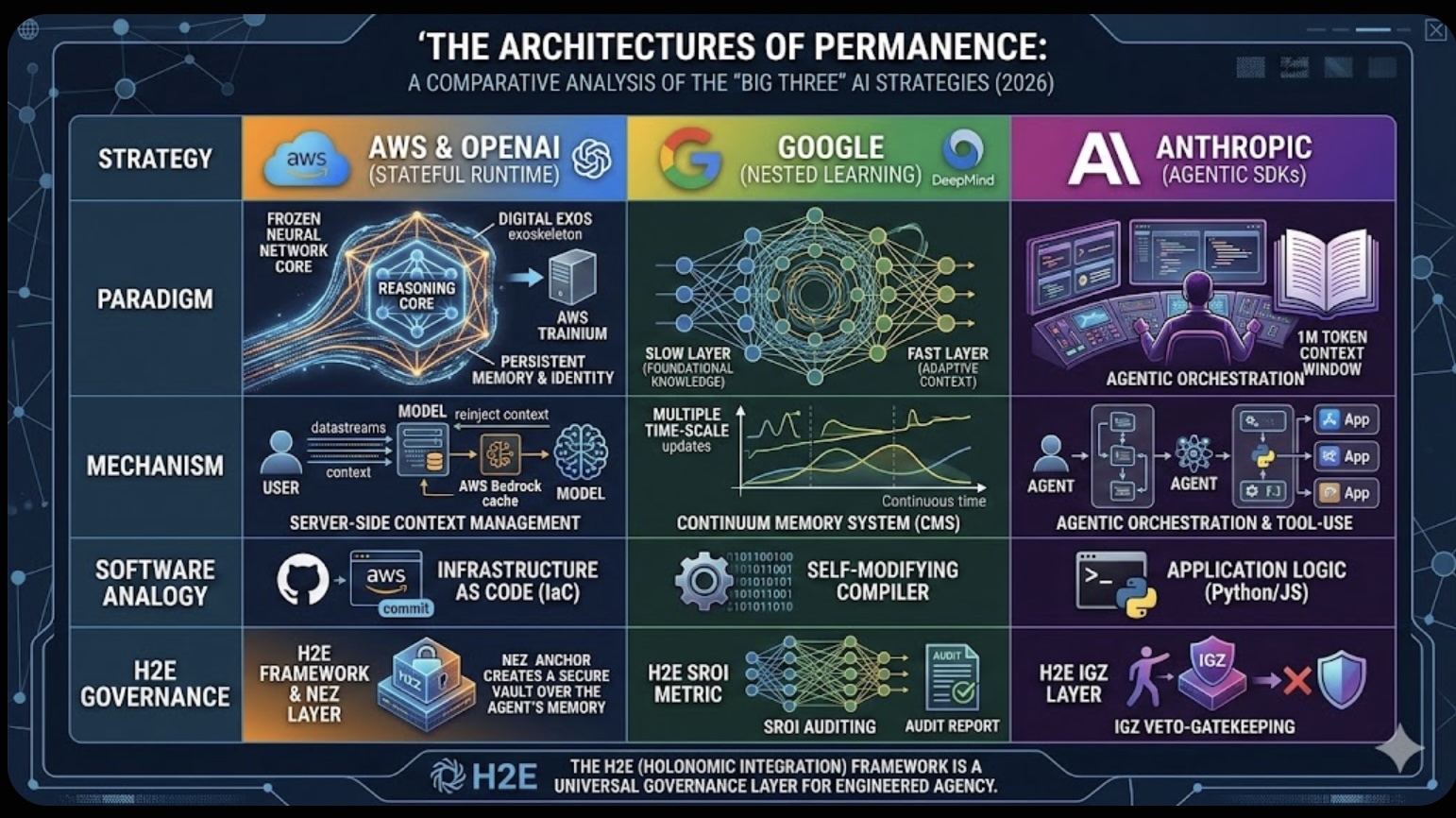

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026