Chairman & Comm'r George Mentz is the Founder of GAFM ® and the CWM Chartered Wealth Manger ® Institute. Mentz is the CEO of the Global Academy of Finance and Management ® Certification and Education Institute Worldwide which is an EU Accredited and ISO 21001 and ISO 29993 Certified Educational Body. Mentz is a governmental Commissioner for the Civil Service Commission and also a Commissioner for the Airport Commission. In addition to his legal and corporate career, Counselor Mentz has taught and designed over 300 graduate and undergraduate courses specializing in finance, business, and law. Mentz enjoys teaching: Introduction to Financial Planning, Advanced Wealth Management, Ethics, and Financial Innovations. Mentz has an earned Doctor of Jurisprudence/JD from Loyola (EU - ( Doctorat en Droit - Doktor der Rechtswissenschaft ), an MBA in financial planning/international business and a CILS graduate Certificate in International Law. Mentz holds a B.A. degree with a focus in politics from LSU. Mentz earned and held clean FINRA/NASD licenses of Series 7. 63, and 65 in the late 1990s as an investment banker for a Wall Street Firm. Mentz has held various designations such as: ChMC, CFC, QFP, CWM, and completed a tax preparation certificate with Jackson Hewitt. Mentz has been recently ranked #2 in the world as a Wealth Management influencer and #5 in the world as a Management and project management "thought leader". Professor Mentz is a strategic advisor to the University of Colorado CU Leeds School of Business Executive Programs.

Hon. George Mentz was elected in 2025 as The Chairman for the Civil Service Commission for the Government - Police and Fire Officers with over 1,500 fire and police officers and staffs including SWAT teams and a budget of roughly $200 Million Dollars Per year. Mentz also serves on the TRE and other Boards that have facilitated over $100 million dollars in charity to those in need in the last 3 years.

Mentz has volunteered for several US presidents and in 2019-21 has served as a US Commissioner for the White House Presidential Scholars Program 2019-22 while Mentz has also volunteered as an economic analyst writer for the Dept. of Labor from 2007-21. Mentz is also a government Commissioner for the Colorado Springs Airport which is larger than JFK and Laguardia combined, and Counselor Mentz is also a Commissioner for the Civil Service Commission Colorado.

Mentz has written and published over 100+ books and audio books and has written for the US government, O-Books UK, eFinancialCareers, & National Underwriter. Mentz continues to write as a wealth & economics commentator for top news media outlets and has won several awards as an author and professor.

Mentz has been ranked in the Top 50 Thought Leaders for Project Management, HR, B2B and Wealth Management. Mentz was recently Honored to be Ranked as a #2 in the World as a Wealth Management. In 2021, Mentz won a "Best Books of All Time won a "Best Books of All Time" book award with his "Wealth Management Intelligent Investor" making it to BookAuthority's Best Wealth Management books in History!

Over the years, many of Mentz’s books have been Amazon bestsellers on in areas of Wealth Management, Personal Growth, Management, Finance, Education and Training, Money and Monetary Policy, Comparative Religion, Developmental Psychology, Metaphysics & Philosophical Criticism, Cognitive Neuroscience & Cognitive Neuropsychology, Mysticism, Project Management, Civil Service Test Guides, Religion, and in Spirituality.

Mentz is a licensed counselor of law LA/EDLA and Fed Cts Colorado, and he is the Seigneur of the Ancient Norman Fief Blondel which is one of the oldest legally recognized privatly owned fiefs in the UK Crown Dependencies. Mentz is an Associate of St. George House Windsor Castle UK 2020-21, and he serves on the Board of Directors of Loyola University Alumni Association 2020-2. Mentz is a distinguished member of the Order of St. Georg Habsburg Lorraine and has been approved as The Chancellor of the Worldwide Anglican Church. Professor Mentz is an award winning professor for the Top Ranked Texas A&M Law School Graduate Programs where he received professorial excellence recognition from students & veterans 2023.

Mentz and his companies have trained and certified thousands of professionals in over 150 countries and Mentz has served on the advisory board of the World e-Commerce Forum in London, and the GFF Global Finance Forum in Switzerland. Mentz has been featured or quoted in the AP, The Hill, National Law Journal, Forbes, Reuters, Wall St. Journal, The Hindu National, El Norte Latin America, the Financial Times, NYSSA, The China Daily, & The Arab Times. Mentz enjoys tennis, travel and spending time with his 3 children. www.GMentz.com

Counselor Mentz's recent Judicial, Diplomatic, and Law Professor Work Include:

* Judicial Chancellor for WAC Worldwide Anglican Church - Presiding Legal Officer over Law and Cases.

* Judge for White House Presidential Sholars Awards for the US Federal Government (Commissioner & Federal Awards Judge)

* Election Judge for Election Integrity - Colorado USA, El Paso County, State USA

* Expert Witness on Financial Banking Securities Law - NASD FINRA Arbitration Mediation - Federal Issues

* Editor of Canon Law and Disciplinary Law for Patriarch and Seminary and House of Bishops

* Crafting diplomatic agreements with NGOs, Charities, Fortune 500 Style Companies, Non Profits, and International Organizations

* Teaching various sections of Banking, FinTech, & Wealth Management Law to Post Doctoral Students in a National Top Tier Accredited Law School Graduate Program.

2024 - I am honored serve as the New Secretary of The Council for Business Teaching and Research of the National Business Education Association via appointment by the President. The Council for Business Teaching and Research (CBTR) works with post-secondary education worldwide serving as GWA's or good will ambassadors to boost relations worldwide. www.NBEA.org

2024 - George Mentz was honored with the Title of: "Datuk Seri" * This is very rarely granted to Europeans or Americans ! *His Royal Highness Sultant and Sovereign of the Diraja Airtiris Melayu Kampar Sultanate, Bestows the Noble Title of "Datuk Seri" to American Lawyer Comm’r George Mentz, JD MBA. This esteemed title, *Datuk Seri, represents the **Order of the Noble Seri Mahkota* of the Diraja Airtiris Melayu Kampar Sultanate (D.M.S.M.K.D.), bearing the honorific title of YBhg *Yang Berbahagia (YB) to Mentz* Datuk Seri Diraja Airtiris Melayu Kampar . The conferment signifies high recognition of Commissioner Mentz’s educational contributions to society and is a symbol of cross-cultural and interfaith unity. The award also is conferred to the wife of the recipient, and she has the title of Honourable and "Datin Seri".

Available For: Advising, Authoring, Consulting, Influencing, Speaking

Travels From: Colorado Springs

Speaking Topics: Wealth Management, Human Potential, Success, and Management Consulting

| George Mentz | Points |

|---|---|

| Academic | 130 |

| Author | 356 |

| Influencer | 1652 |

| Speaker | 13 |

| Entrepreneur | 50 |

| Total | 2201 |

Points based upon Thinkers360 patent-pending algorithm.

Commissioner George Mentz Appointed and Serves as Judge for 2024-2025 ABA Mediation Competition

Commissioner George Mentz Appointed and Serves as Judge for 2024-2025 ABA Mediation Competition

Tags: EdTech

Year End Tax Tips

Year End Tax Tips

Tags: GovTech

Tags: Diversity and Inclusion, Finance, Sustainability

A New Era of Global Stability: Why 2025 Is Fundamentally Different From Earlier Market Cycles

A New Era of Global Stability: Why 2025 Is Fundamentally Different From Earlier Market Cycles

Tags: Leadership, Management, Project Management

Manifesting Your Destiny: The Quantum Mechanics of Creation by: Comm'r George S Mentz JD MBA DSS CWM ChE

Manifesting Your Destiny: The Quantum Mechanics of Creation by: Comm'r George S Mentz JD MBA DSS CWM ChE

Tags: Leadership, Management, Project Management

Thankful to make the Top 10 Influencers & Thought Leaders in Transformation

Thankful to make the Top 10 Influencers & Thought Leaders in Transformation

Tags: Leadership, Management, Project Management

100% Chance of Market Boom by Year End - 10 Reasons that Trump Policy Will Work

100% Chance of Market Boom by Year End - 10 Reasons that Trump Policy Will Work

Tags: Leadership, Management, Project Management

Trump's 10 Secrets to Success to 100,000 Cheering College Students

Trump's 10 Secrets to Success to 100,000 Cheering College Students

Tags: Leadership, Management, Project Management

Certifications Designations and Credentials - The Rise of Board Certifications - Skills Certifications - Charter Designations & Micro Credentials

Certifications Designations and Credentials - The Rise of Board Certifications - Skills Certifications - Charter Designations & Micro Credentials

Tags: Leadership, Management, Project Management

Chairman George Mentz was elected today as The Chairman for the Civil Service Commission for the Police and Fire Departments

Chairman George Mentz was elected today as The Chairman for the Civil Service Commission for the Police and Fire Departments

Tags: Leadership, Management, Project Management

10 Common Estate-Planning Mistakes and How to Avoid Them

10 Common Estate-Planning Mistakes and How to Avoid Them

Tags: Leadership, Management, Project Management

2025: The Year of Personal Transformation and Mastery

2025: The Year of Personal Transformation and Mastery

Tags: Leadership, Management, Project Management

Commissioner George Mentz Awarded Hon. Colonel Merit Award by Commonwealth Government - Dec 2024

Commissioner George Mentz Awarded Hon. Colonel Merit Award by Commonwealth Government - Dec 2024

Tags: Leadership, Management, Project Management

Trump to Empower Middle Class via Online Education

Trump to Empower Middle Class via Online Education

Tags: Leadership, Management, Project Management

Manifestation Guide to Prosperity and Achieving Goals: A Synthesis of Faith, Focus, and Action

Manifestation Guide to Prosperity and Achieving Goals: A Synthesis of Faith, Focus, and Action

Tags: Leadership, Management, Project Management

Here are 12 Steps to Extreme Prosperity By Commissioner George Mentz JD MBA CWM

Here are 12 Steps to Extreme Prosperity By Commissioner George Mentz JD MBA CWM

Tags: Leadership, Management, Project Management

Prosperity and Consciousness: Awakening to the Wealth Within

Prosperity and Consciousness: Awakening to the Wealth Within

Tags: Leadership, Management, Project Management

12 Reasons Your Life Sucks - Top 12 Economic Disasters of the Biden-Harris Admin

12 Reasons Your Life Sucks - Top 12 Economic Disasters of the Biden-Harris Admin

Tags: Leadership, Management, Project Management

The Unspoken Path to Success : Avoiding Silly People, Dangerous Places, and Risky Things.

The Unspoken Path to Success : Avoiding Silly People, Dangerous Places, and Risky Things.

Tags: Leadership, Management, Project Management

Republican Party and Trump Release 2024 Platform Commitment to American Citizens

Republican Party and Trump Release 2024 Platform Commitment to American Citizens

Tags: Leadership, Management, Project Management

Sales Tax Inflation at 50-Year High! - Triple Taxes on the Poor

Sales Tax Inflation at 50-Year High! - Triple Taxes on the Poor

Tags: Leadership, Management, Project Management

Elder Care Inflation 39% in Just Three Years - The Big Swindle of Our Americas Seniors

Elder Care Inflation 39% in Just Three Years - The Big Swindle of Our Americas Seniors

Tags: Leadership, Management, Project Management

Change Without Improvement is Worthless - Time for Innovation and Success 2024

Change Without Improvement is Worthless - Time for Innovation and Success 2024

Tags: Leadership, Management, Project Management

20 Productivity Secrets to Achieve Success in 2024

20 Productivity Secrets to Achieve Success in 2024

Tags: Leadership, Management, Project Management

Secrets to Shaping Your Destiny

Secrets to Shaping Your Destiny

Tags: Leadership, Management, Project Management

The Science of Gratitude - 25 Concepts to Contemplate

The Science of Gratitude - 25 Concepts to Contemplate

Tags: Leadership, Management, Project Management

Like Attracts Like

Like Attracts Like

Tags: Leadership, Management, Project Management

2023 Resolutions - Go for Spectacular Innovation

2023 Resolutions - Go for Spectacular Innovation

Tags: Leadership, Management, Project Management

THE WINTER NIGHT CLUB

THE WINTER NIGHT CLUB

Tags: Management, HR, Project Management

The Crown and the Shadow : Mastering Power, Wealth, and Self-Realization Laws of Power

The Crown and the Shadow : Mastering Power, Wealth, and Self-Realization Laws of Power

Tags: Leadership, Management, Project Management

The Leadership Handbook – A Primer on Leadership - The Greatest Authors & Books on Leadership

The Leadership Handbook – A Primer on Leadership - The Greatest Authors & Books on Leadership

Tags: Management, Leadership

POWER ! : The Spiritual Laws of Success Prosperity & Abundance - High Powered Teachings in Transpersonal and Humanistic Psychology

POWER ! : The Spiritual Laws of Success Prosperity & Abundance - High Powered Teachings in Transpersonal and Humanistic Psychology

Tags: Management, HR, Project Management

The Rosicrucian Handbook & Hermetic Textbook of Success Secrets: The Original American Illuminati Loge de Parfaits d' Écosse - 1764

The Rosicrucian Handbook & Hermetic Textbook of Success Secrets: The Original American Illuminati Loge de Parfaits d' Écosse - 1764

Tags: Social, Leadership, Project Management

The Illuminati Handbook – The Path of Illumination and Ascension: The Testament of the Mystical Order and The Secret Teachings that Make them Great

The Illuminati Handbook – The Path of Illumination and Ascension: The Testament of the Mystical Order and The Secret Teachings that Make them Great

Tags: Social, Leadership

GAFM Global Academy of Finance & Management

GAFM Global Academy of Finance & Management

Tags: Management, HR, Project Management

Tags: Leadership, Startups, Transformation

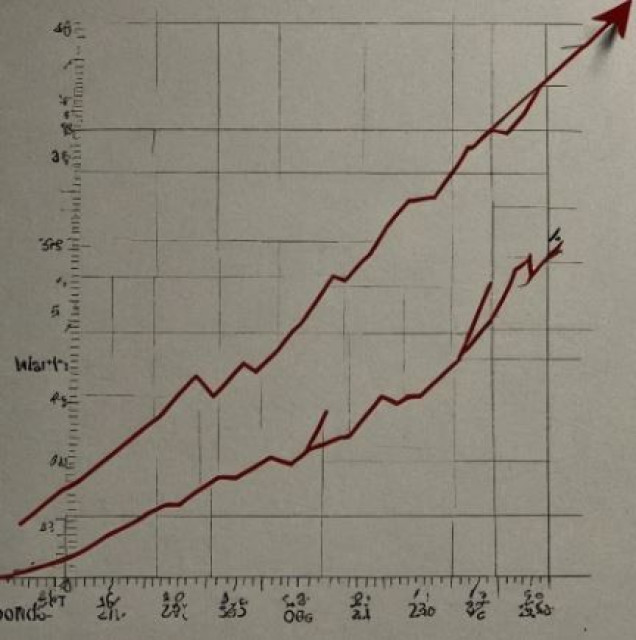

The Triggers of a Bull Market - How Trump is Building the Age of Prosperity

The Triggers of a Bull Market - How Trump is Building the Age of Prosperity

Tags: Cryptocurrency, Lean Startup

S&P 500 Goes To 10,000 - Why the Next Five Years Could Be the Greatest in S&P 500 International Growth: A Global Demand Supercycle Is Coming for Exports & Profits

S&P 500 Goes To 10,000 - Why the Next Five Years Could Be the Greatest in S&P 500 International Growth: A Global Demand Supercycle Is Coming for Exports & Profits

Tags: Cryptocurrency, Finance, FinTech

Tags: Entrepreneurship, Leadership, Management

Tags: Agile, Blockchain, Cloud

The New Lawfare of Fake Justice & Fake Evidence

The New Lawfare of Fake Justice & Fake Evidence

Tags: Business Strategy, Entrepreneurship, Leadership

2023 Resolutions

2023 Resolutions

Tags: Management, Leadership, Entrepreneurship

George Mentz Wealth Management Professor on Rob Carson Show - Economic Outlook

George Mentz Wealth Management Professor on Rob Carson Show - Economic Outlook

Tags: Entrepreneurship, Finance, Management

The Big Swindle of Our Americas Seniors – Elder Care Inflation up over 39.58 % in Just 3 Years.

The Big Swindle of Our Americas Seniors – Elder Care Inflation up over 39.58 % in Just 3 Years.

Tags: Finance, Management, Sustainability

Tags: Entrepreneurship, FinTech, Sustainability

47 Nations Lower Tariffs on the USA - Peace and Trade - How Trump’s Initiatives and Lower Deb Burdens Are Reshaping the Global Markets and Economy

47 Nations Lower Tariffs on the USA - Peace and Trade - How Trump’s Initiatives and Lower Deb Burdens Are Reshaping the Global Markets and Economy

Tags: Finance, International Relations, Risk Management

The Probability of a Stock Market Correction is Very Low in 2025

The Probability of a Stock Market Correction is Very Low in 2025

The New Variables of Global Stock Market Liquidity and FinTech in 2025.

By George Mentz JD MBA CWM Chartered Wealth Manager, ChE Chartered Economist

As the lead wealth management professor for a top 25 law school and a former Wall Street Firm Wealth Advisor to HNW High Net Worth clients, the global investing environment and economic variables have changed dramatically in the last 25 years. The year 2025 marks a dramatic economic shift compared to the landscapes of 2000 and 2009. While each of those earlier years was shaped by technological transitions and uncertainty, 2025 stands out as a period of stabilization, technological maturity, and unprecedented global participation in U.S. markets. Interest rates and energy prices are steadily trending downward, tariffs are easing, artificial intelligence has evolved into a profit-generating layer of mainstream commerce, and a world of eight billion people—many of them wealthy investors—provides a deep, international pool of liquidity and demand for U.S. assets. Together, these forces along with Trump’s new corporate tax laws [i] create a fundamentally different environment for growth, investment, and innovation.

The new global economic landscape is defined by abundant liquidity, worldwide investors, lower tariffs, reduced corporate taxes, cheaper energy, eight billion customers, five billion internet users, and dramatically lower supply-chain costs. People also forget that if there is any market correction, estimates suggest that over $7 trillion is currently sitting in money market funds in the U.S., with total household cash holdings around $18 trillion. [ii]

The year 2000 was characterized by the Clinton Market Crash and fast rising interest rates, which essentially killed the dot-com boom. Borrowing was more expensive, risk capital was harder to access, and markets were still largely domestic in nature. By contrast, 2009 was the wreckage of the global housing crisis and lack of confidence in US leaders. While the “Clinton Crash” was the largest in history ($10 Trillion), the Obama-Bush Crash was almost as much but hit the working folks much harder with housing equity losses. [iii] [iv] Interest rates in 2009 later plummeted toward zero as the Federal Reserve sought to stimulate a devastated economy through emergency measures and unconventional monetary policy to salvage the loss of about 5 million jobs in Obama’s first year in office. [v] Remarkably, interest rates were pushed to essentially zero beginning in late 2008 and stayed there through 2009–2010, marking the early Obama era as a period defined by ultra-cheap, almost free money.

In 2025, interest rates are again trending downward slowly—but for a very different reason. Unlike 2009, the economy is not in collapse; instead, inflation has cooled after several years of post-pandemic turbulence. Central banks are carefully lowering rates to normalize credit conditions, support economic expansion, and encourage investment. Many nations offshore have loans 50% cheaper than the USA as the Democrat Federal Reserve seems to deny President Trump a speedy recovery from the inflation years of Biden. The decline in rates today is strategic and gradual, not a rescue operation. Capital is flowing not because investors are fleeing risk, but because the world is flush with wealth seeking opportunity.

In 2000, globalization was accelerating, but global trade remained tied to strategic national interests, and major world economies still imposed substantial tariffs and trade barriers. By 2009, the financial crisis had triggered protectionist pressures, but world leaders cautiously maintained open trade to avoid worsening the downturn.

In 2025, tariff reductions serve a different purpose. Governments realize that global supply chains cannot operate efficiently under restrictive tariffs, and technology-driven industries require smoother, more predictable trade relationships. As tariffs ease, companies enjoy reduced input costs, faster supply cycles, and expanded access to foreign markets. Unlike earlier periods, tariff declines today reflect competitive cooperation rather than geopolitical fragility. Most now understand that Trump already won the Tariff battle regardless of the Supreme Court’s decision as nations representing 4 billion people have already lowered tariff related taxes and fees on American exports in places like the EU, China, India, Indonesia and more.

The type of Technology Maturity sharply distinguishes 2025 from both earlier eras.

In 2025, AI is deeply integrated across existing product lines. AI companies now assist existing companies in generating real revenue streams, unlike many speculative tech ventures of 2000 or the early post-crisis startups of 2009. AI is no longer a futuristic gamble—it is a profitable enhancement to established offerings:

This stability means the AI sector is not a bubble built solely on hope; it is an accelerant added to mature industries. AI in 2025 is less a standalone category and more a universal infrastructure layer supporting nearly every sector of the economy. With all of these factors, we can foresee productivity and GDP in the USA going up quickly.

One of the most profound differences between 2025 and the earlier eras is the sheer scale of global population and wealth. Foreign investors hold about 17% of U.S. equities, 27% of U.S. corporate debt, and 33% of U.S. Treasuries. As of mid-2024, foreign ownership of all U.S. securities was approximately 21%. [vi]

Today, with a planet of 8 billion people, wealth has multiplied and diversified. Millions of high-net-worth individuals now exist across over 200 nations, and international investors actively support the liquidity of U.S. stock, bond, and property markets. This worldwide capital base provides:

This global participation means that the United States is not relying solely on domestic savings or institutional investors. Instead, the world itself acts as a partner in the American economic engine. Overall, with the expansion of internet investing globally, the US stock markets are a good investment by foreign investors with relatively low sovereign risk.

With that being said, the US markets have global investors to support stock prices with any correction. This means that the tolerance for a prolonged correction in US equity markets is much lower with investors and institutional investors worldwide looking to buy on a dip. Rather than the US Markets going down 35-40 like it did in the 2000 Clinton Crash or with the 2009 Bush-Obama Crash, these days a market can snap back fast when a buying opportunity such as 15-20% triggers buying by both people and the machines and sovereign wealth investors.

The digital world of 2025 is incomparable to 2000 or 2009. Cloud systems, 5G networks, quantum-inspired computing, fintech systems, tokenized assets, and advanced logistics enable a global economy that operates 24/7 with little friction. Capital moves instantaneously. Investments cross borders instantly. Retail commerce runs on AI. Productivity tools enhance every profession from law to real estate to healthcare.

Unlike 2000’s dial-up internet and 2009’s embryonic cloud industry, the technology of 2025 is not experimental—it is foundational.

Conclusion: 2025 Is an Era of Technological Integration, Global Liquidity, and Economic Stability

The differences between 2025, 2009, and 2000 reflect more than just economic cycles—they reveal a world transformed by population growth, technological advancement, fiscal policy, interest rates, tax policy, trade deals, and global financial integration.

The probability of any long-term meaningful stock market correction is close to zero. Firms like Morgan Stanley and Goldman are simply misreading the vast number of new variables in the investing environment that differ dramatically from those that drove prior downturns. [vii] Over the past 25 years, the massive expansion of 401(k) participation has created a deep, stable base of long-horizon capital that consistently supports equities. In addition, the explosive growth of ETFs and index-tracking funds has produced a perpetual demand engine for U.S. securities. These structural forces—steady retirement inflows, automatic allocation cycles, and broad passive-investment buying—provide a built-in buoyancy that makes a significant correction highly unlikely under current conditions.

Interest rates are drifting downward not out of crisis, but out of stabilization. Tariffs are easing to promote efficiency and collaboration. Millions more in 200 nations have access to invest in the US Markets online. Huge companies that own the top AI systems are already profitable, practical, and deeply embedded in the global economy. And with eight billion people—millions of whom including governments are wealthy investors—capital flows into U.S. markets at a scale unimaginable in earlier decades.

In 2025, the global system is more interconnected, more technologically sophisticated, and more financially liquid than at any moment in modern history. It is a new era—one shaped not by rescue or speculation, but by integration, innovation, and worldwide participation in the engines of growth. The statistical odds of any prolonged correction in the markets are much lower than ever before.

[i] Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit – ITEP

[ii] How much cash is really on the sidelines?

[iii] The Stock Bubble Created the Budget Surplus: Not Bill Clinton's Tax and Spending Policies – CEPR

[iv] The Stock Market Crash of 2008

[v] Employment during the 2007–2009 recession : The Economics Daily : U.S. Bureau of Labor Statistics

[vi] Record-High Foreign Ownership of the US Equity Market - Apollo Academy

[vii] Goldman Sachs, Morgan Stanley warn of a market correction

Tags: FinTech

The Triggers of a Bull Market: How Trump is Building the Age of Prosperity

The Triggers of a Bull Market: How Trump is Building the Age of Prosperity

The Triggers of a Bull Market: How Trump is Building the Age of Prosperity

Bull markets—long stretches of rising stock values—are never accidents. They are cultivated when governments, businesses, and consumers operate in an environment of low costs, fairness, and opportunity. A truly bullish economy is one where people keep more of what they earn, businesses expand without suffocating barriers, and global trade works to the nation’s advantage. [i] Whether you draw inspiration from Dr. Art Laffer, Larry Kudlow, Stephen Moore, or President Donald Trump, all would agree: the foundation of prosperity rests on sound policies that encourage growth.

Below are the Top 10 Key Factors in a Great Economy that Spark a Bull Market.

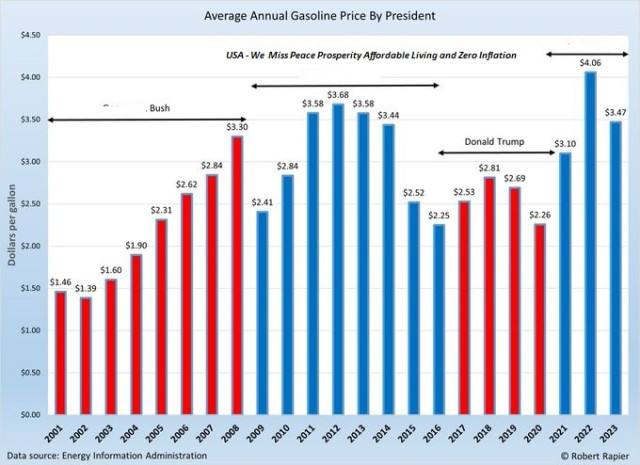

Energy affordability is one of the most powerful growth levers. When gasoline, electricity, and natural gas are affordable, companies see higher margins and households pocket more income. Lower fuel costs ripple into farming, manufacturing, and shipping—cutting grocery bills and reducing costs on nearly every good in the economy. With oil under $62 a barrel, U.S. consumers are already seeing savings that translate directly into stronger markets. [ii]

Markets hate uncertainty. Peace reduces risk premiums, stabilizes trade, and allows capital to flow toward innovation rather than destruction. Every war brings inflation and shortages; every era of peace supports growth. Trump’s active peace efforts across 6–12 nations, coupled with his resolve to avoid new wars while still selling billions in defense hardware, provide stability without entanglement.

Every great bull run has been powered by new technology—railroads, electricity, aviation, semiconductors, the internet, and now AI. The U.S. leads Europe in artificial intelligence, biotech, and digital innovation, fueling new industries, high-paying jobs, and unprecedented wealth creation. We all remember the Internet Bubble of the late 1990s, and we remember the worst crash in history with $10 Trillion in market losses under the Clintons in 2000-2001. [iii]

Open trade expands efficiency, reduces costs, and enlarges markets. This applies both internationally and domestically: states with lower crime, lower taxes, and fewer barriers outperform their peers.

The Power of Tariff Reductions

When a president successfully negotiates with 167 nations of the World Trade Organization to lower tariffs on U.S. goods, the result is a boom opportunity. Exporters gain market access, American industries grow more competitive, and foreign capital flows in to capture U.S. growth. Entire sectors experience renewed demand, triggering surging stock prices and job creation. [iv]

Stable, low inflation preserves the value of wages and investments. It reassures consumers and businesses alike, allowing for long-term planning, higher confidence, and sustained expansion. Under President Biden, many seniors and workers had their buying power cut by 30%. [v] Now that inflation is under control and coming down, a sustainable boom could happen.

Low rates make mortgages, loans, and credit cards more affordable. Consumers spend more, small businesses expand, and corporations finance growth cheaply. Easy credit is the bloodstream of a thriving bull market. [vi] Until the Democrat controlled Federal Reserve lowers interest rates, the Bull Market is moving ahead hesitant to take off. Most countries are charging 100% less for loans, and many US S&P 500 nations have access to cheaper loans abroad in spite of the Fed’s desire to inhibit Trump’s performance and benefits for the workers.

Taxes and hidden surcharges are invisible weights on prosperity. Cutting them unleashes growth:

Simpler, fairer rules reduce compliance costs and unleash innovation. Trump’s deregulatory push mirrors success stories abroad: Dubai’s tax-free zones and business-friendly visas, for example, attract thousands of entrepreneurs who turn vision into value. [vii]

Affordable training and education feed a skilled workforce ready for high-value industries. States that prioritize skills and vocational training outperform those that don’t. A competitive labor force is a magnet for global investment. [viii] [ix]

Bull markets thrive when companies can expand payrolls quickly. Flexible labor policies ensure opportunity isn’t lost due to rigid costs, regulations, fixed wages, or barriers. States with smart employment, health care, and disability laws that balance flexibility with fairness see the greatest gains. [x] [xi] Presently, the USA needs skilled and affordable labor, but there are up to 750 million people that would move to the USA if given the chance. This is why the USA must do like the other winners such as: Dubai, Singapore, Hong Kong and Switzerland and turn the USA immigration system into a sustainable system of visas and tourism that has leftover revenues to help feed and house the poor. [xii]

20 Bull Market Catalysts: Policies, Events & Innovations

From history, here are proven catalysts that sparked powerful market expansions:

Global Proof: Dubai, Monaco, and Hong Kong

One only needs to look at Dubai, Monaco, Singapore, Switzerland, Saudi Arabia, and Hong Kong to see the power of fair business treatment:

These examples prove prosperity blossoms where government empowers rather than burdens. The economic miracle in these nations rests on visionary leadership that built: world-class infrastructure, strategic diversification of services, a highly business-friendly environment with low taxes [xiii] and free zones, bold tourism and branding projects that attracted millions of visitors, investments in technology and innovation, strong human capital development through world-class universities and healthcare, diplomatic and international relations that opened global markets, and of course, a thriving financial services sector, and social stability that fostered investor confidence and positioned these nations as a cosmopolitan centers of opportunity.

Confidence and Sentiment

Optimism fuels markets. When consumers see lower costs and businesses see fairness, both expand with confidence. This self-reinforcing cycle is the heartbeat of a bull market.

Conclusion

Building the Next American Age of Prosperity

Bull markets do not happen by chance—they are the product of discipline, vision, and leadership. History shows that prosperity follows when governments reduce barriers, protect peace, and create an environment where businesses and families can thrive. Affordable energy, low taxes, restrained inflation, and access to credit are not just abstract economic ideals—they are the fuel that drives growth, wages, innovation, and rising stock values.

Under President Trump’s policies, the groundwork is being laid for what could become one of the most dynamic economic expansions in American history. Negotiating tariff reductions with 167 nations, cutting hidden fees and taxes that burden consumers, and freeing small business from suffocating regulations creates a ripple effect that reaches every household. These actions restore confidence, increase disposable income, and stimulate investment. When capital flows freely, when Americans keep more of what they earn, and when peace reduces global uncertainty, markets respond with historic gains.

The lessons from Dubai, Monaco, Singapore, and Hong Kong prove the model: prosperity follows when governments empower citizens rather than weigh them down. A strategic mix of low taxation, business-friendly policies, global trade access, and visionary leadership transformed those nations into magnets for capital and talent. The United States—larger, more resource-rich, and more innovative—has the potential to replicate and even surpass these miracles on a grand scale.

If government waste is reduced, debt service costs are lowered, and interest rates decline, Americans could collectively save trillions—capital that would return directly into the hands of families, entrepreneurs, and investors. With that momentum, the United States could experience a new “Roaring ’20s,” not fueled by speculation alone, but by sound policy, global stability, and an expanding base of skilled labor.

The path to a bull market is clear: empower workers, liberate entrepreneurs, negotiate fair trade, control inflation, inspire immigration, incentivize corporate investing into the USA, and keep energy affordable. Do this, and the United States will not only enter an age of prosperity but will redefine what is possible for free markets in the 21st century. The choice is not whether a bull market will come, but how strong and how long it will last when leadership stays committed to growth.

[i] The Bull Market Is Alive and Well | Newsmax.com

[ii] The Trump Economy Will Take Off in 6-9 Months | Newsmax.com

[iii] The Next Financial Crisis: 2024 | Newsmax.com

[iv] Half the World Lowers Taxes on America | Newsmax.com

[v] Social Security benefits in 2024 have lost 20% of buying power compared to 2010

[vi] Fed Lending Rates the Worst of World's Civilized Nations | Newsmax.com

[vii] Trump to meet with OMB director to plan cuts to 'Democrat Agencies' | Just The News

[viii] The Value Proposition of College, Graduate Degrees | Newsmax.com

[ix] College Education for Free ? – 2020 Campaign and Online Education Facts and Economics | Newsmax.com

[x] US Claims 3.8% Unemployment. It's at Least 10%. | Newsmax.com

[xi] George Mentz: Why It Doesn't Pay to Work in America - Trump's vs Biden's Policies | Newsmax.com

[xii] Another 750M Migrants Ready to Move to the USA | Newsmax.com

[xiii] 9 Countries With No Capital Gains Tax: Keep Your Wealth - InvestAsian

Tags: Cryptocurrency, Finance, Lean Startup

The 2025 Gold and Silver Boom: Entering a New Super Cycle

The 2025 Gold and Silver Boom: Entering a New Super Cycle

Gold and Silver’s Appreciation - Technical Breakouts, Commodity Scarcity. Why Gold and Silver can Run Up with Gold at $10,000 and Silver at $100

For over a decade, gold and silver have trailed stocks, real estate, and tuition. The Nasdaq 100 and S&P 500 posted triple-digit gains, while housing and education costs surged. Precious metals—long seen as bedrocks of financial security—lagged. Yet this divergence is not weakness, but preparation. We are in the middle of a boom in Gold and Silver, and the Bull Run on Silver and Gold may continue for 12-18 months until the prices catch up to the markets and crypto markets. [i]

According to Reuters this week, after a decade of weak performance, commodities may be on the cusp of a new super cycle driven by both supply and demand pressures. On the supply side, production and refining are highly concentrated in a handful of countries, exposing markets to geopolitical risks, while years of underinvestment, declining ore grades, and long lead times limit new capacity. On the demand side, the global push toward electrification, renewable energy, and AI-driven infrastructure is set to fuel unprecedented consumption of key resources like copper, which could face a 30% shortfall by 2035. Financially, commodities remain well below their inflation-adjusted peaks, making them relatively undervalued compared to equities, while sticky inflation and weaker bond hedges may push investors to view metals and energy as strategic portfolio stabilizers. With these structural factors aligning, conditions for the next commodities super cycle appear to be falling into place. [ii]

As inflation persists and systemic risks intensify, gold and silver are poised for a decisive move. With supply-demand constraints, sovereign recognition, and technical setups aligning, investors may soon see an explosive rotation back into metals. Unlike crypto—which lacks tangible backing—gold and silver remain scarce, industrially essential, and universally recognized.

Other nations like China, Russia, and the BRICS bloc are steadily increasing gold reserves, and if the U.S. were to revalue its Fort Knox and other gold holdings or launch a sovereign wealth fund, it could trigger a global race to accumulate gold, driving prices higher as sovereigns and institutions compete for limited supply. Since the U.S. still carries its gold at just $42.22/oz—a figure frozen since the 1970s—resetting that value closer to today’s market levels of $2,500–$3,000/oz would establish a far higher official baseline. Such a move would also highlight silver’s relative undervaluation, likely sparking speculative flows into the smaller, more volatile silver market.

Between 2015 and 2025:

This gap sets up mean reversion. When undervalued assets like metals lag so deeply, they often rebound with dramatic outperformance. [iii]

These fundamentals ensure that once investor demand collides with constrained supply, price moves could be extreme.

III. The Silver Breakout: $80 to $100 in Sight

Silver’s all-time highs around $50 serve as a ceiling. If broken, this resistance could unleash a parabolic run:

In such a breakout, silver could quickly move toward $80–$100.

Historically, the gold-to-silver ratio (gold price ÷ silver price) has ranged between 15:1 and 80:1. Recently it has hovered in the 70–85 range. If silver were to surge to $80–$100, even a conservative ratio implies much higher gold prices:

Even modest ratio compression alongside a silver breakout points to gold doubling or tripling from current levels. Thus, silver’s technical breakout would not stand alone—it could drag gold into a new secular bull market.

Investors looking for real, commodity-backed protection will likely gravitate toward gold and silver in an environment of distrust in fiat and digital-only assets.

VII. Macro Catalysts

VIII. Interest Rates

The Federal Reserve has signaled several additional interest rate reductions, and while these cuts come later than many had hoped, history shows that such moves often provide tailwinds for precious metals. Silver and gold have historically gained value during periods of lower rates for multiple reasons, including reduced opportunity costs of holding non-yielding assets and the fact that lower borrowing costs ease financial pressures across industries, including mining. With cheaper capital and lower operating costs, the supply side often becomes more efficient, while investor demand for hard assets as a store of value typically rises, creating a favorable environment for precious metals.

IX Artificial Intelligence Needs Silver

Silver is proving to be an unsung hero in the AI revolution, quietly powering breakthroughs that shape our digital future. As the most electrically conductive element, silver enables high-speed data transmission in advanced AI chips and processors, while also serving a vital role in thermal management through specialized pastes and interfaces that keep power-dense systems cool and efficient. Its applications extend to next-generation semiconductor fabrication at cutting-edge nodes, to enhancing the performance of sensors and connectors that drive real-time data exchange, and even to solar cells in AI-powered energy systems. With demand for AI hardware surging across data centers, robotics, and autonomous vehicles, analysts expect silver consumption to keep rising, creating persistent supply deficits. While silicon and GPUs may take the spotlight, silver remains the essential, behind-the-scenes enabler of AI innovation. [v]

Beyond the already powerful supply-demand dynamics, several overlooked forces may accelerate gold and silver toward new highs. The global shift away from the U.S. dollar in trade and reserves is spurring central banks to accumulate more gold as a neutral settlement asset, while talk of BRICS gold-backed systems could further intensify demand. On the supply side, both metals may have reached “peak mining,” with ore grades declining and new discoveries scarce, making future production growth difficult. Even as nominal interest rates fluctuate, negative real yields continue to erode purchasing power, enhancing the appeal of non-yielding assets like gold. Meanwhile, the worldwide push toward green energy—from solar panels to EVs—locks in long-term industrial demand for silver, while the heavily leveraged paper markets on COMEX and LBMA carry the risk of a short squeeze if physical demand overwhelms supply.

Conclusion: The Inflection Point for Metals

Gold and silver are not relics—they are strategic assets backed by scarcity, sovereignty, and industry. Their lagging decade has created conditions for a historic catch-up. Silver’s breakout above $50 could ignite a run to $80–$100, and with it, a gold price several multiples higher, as the gold-to-silver ratio realigns toward historical norms.

If it weren’t for the growing appeal of cryptocurrencies, NFTs, and digital tokens, gold might already be trading much higher—some say as high as $10,000 per ounce—because much of the speculative and hedging capital that traditionally flowed into gold has been diverted into these digital assets. For instance, in 2025 so far, Bitcoin ETFs have attracted about US$13.5 billion in net inflows, which is nearly 70% of what gold ETFs have pulled in (≈ US$19.2 billion) year-to-date. [vi] Additionally, gold-backed physically backed ETFs saw their largest quarterly inflows in three years in Q1 2025—US$21.1 billion, equal to 226.5 metric tons—suggesting that demand is strong but might be lower than it would have been without competing digital stores of value. [vii]Because Gold has not caught up with the Crypto inflation and appreciation, Gold may be seen as undervalued as it is a real, tangible asset and recognized form of wealth.

Investors have multiple ways to gain exposure to gold and silver, depending on their risk tolerance and goals. Traditional choices include tangible bullion such as coins and bars, valued for direct ownership and long-term wealth preservation. More liquid options include exchange-traded funds (ETFs) like GLD or SLV, which track spot prices, and mutual funds or mining stocks, which offer leveraged exposure through companies that produce or stream precious metals. For more advanced strategies, investors can use options to hedge or speculate, or employ leveraged ETFs that amplify daily price movements—though these carry higher risk. Many like investing in the mining stocks or funds related to mining. [viii]Together, these vehicles provide both conservative and tactical ways to participate in potential gains from gold and silver.

Some gold ETFs allow investors holding large enough positions to redeem their shares for physical bullion, though minimums, fees, and procedures make this option practical mostly for institutions or high-net-worth individuals.

Several top investing experts and billionaires see gold as a vital hedge against what they believe is a looming bubble in markets, debt, and monetary policy. Ray Dalio of Bridgewater recommends holding 10–15% in gold as protection against mounting debt crises and currency risks, noting it can shield investors from a potential financial “heart attack”. [ix] Jeffrey Gundlach, the “Bond King,” says that allocating up to 25% in gold is not excessive given rising inflation and a weakening U.S. dollar. [x] Hedge fund manager David Einhorn has made gold one of his biggest winners, using it as insurance against deficits and an erosion of confidence in fiat money. [xi] John Paulson remains long-term bullish on gold and mining assets, warning of de-dollarization and persistent monetary over-expansion. [xii] Meanwhile, Mike Wilson, Morgan Stanley’s CIO, suggests a 60/20/20 portfolio that allocates a full 20% to gold, arguing it is more “anti-fragile” than Treasurys in today’s environment of inflated asset prices and geopolitical risks. [xiii] Together, these investors highlight gold’s role as a stabilizer when traditional assets appear vulnerable.For investors seeking security, metals remain the ultimate hedge—and perhaps the next great growth trade of the decade. This New Year’s Season may be a very good one for those holding Gold, Silver and other precious metals.

Banking system fragility, political uncertainty, and rising geopolitical tensions also add safe-haven appeal to Gold and Silver. Finally, with trillions in generational wealth transfer underway, many investors view gold and silver as the ultimate store of value across lifetimes, ensuring their role as strategic anchors in both private and sovereign portfolios. For investors seeking security, metals remain the ultimate hedge—and perhaps the next great growth trade of the decade. This New Year’s Season may be a very good one for those holding Gold, Silver and other precious metals.

Disclaimer – Consult a licensed professional before making any important decision. The author has invested in Gold and Silver over the last 25 years and may continue to do so.

Tags: Business Strategy

The Bull Market of 2025-27 – Will it Mirror the 2017–2019 Bull Run

The Bull Market of 2025-27 – Will it Mirror the 2017–2019 Bull Run

The Bull Market of 2025-27 – Will it Mirror the 2017–2019 Bull Run

From January 2017 through December 2019, U.S. equities enjoyed one of the most remarkable stretches in modern history. Fueled by corporate tax reform, pro-business policies, and a backdrop of low inflation with supportive monetary conditions, the “Trump bull market” drove strong, broad-based gains across large, mid, and small-cap stocks. While volatility always reminds investors of cyclical risks, the period as a whole produced outstanding total returns across every major benchmark. This article is to provide ideas for investors with the hope that there will be a repeat of the variables in the 36 month timeframe of 2017-19.

Three-Year Total Returns by Major Index (Jan 2017 – Dec 2019)

Other Notable Overperformers

Key takeaway: While broad indexes gained solidly, growth-focused benchmarks—particularly those tilted toward technology and innovative companies—outpaced value and small-cap peers.

Sector Performance (S&P 500, Total Returns, 2017–2019 Combined)

Conclusion: Policy, Market Breadth, and Future Outlook

The 2017–2019 bull market showcased the breadth and resilience of U.S. equities. While large-cap tech dominated, gains also extended to mid- and small-caps, reflecting a healthy market structure.

Several policy drivers underpinned this advance:

Together, these forces produced a powerful bull market across indexes and sectors, demonstrating how fiscal and regulatory choices can stimulate both growth leadership in technology and broad participation across the market.

Forward-Looking Perspective (2025 and Beyond)

Looking ahead, the market backdrop could be poised for a new phase of expansion:

In sum, just as pro-growth policies fueled the 2017–2019 bull run, today’s mix of peace initiatives, lower tariffs, easing monetary policy, lower debt burdens, and more favorable global conditions suggests that both U.S. and international equities could be on the cusp of another powerful expansionary cycle.

Citations

Additional References (Trump Tax Cuts → GDP/Economic Impact)

Tags: Cryptocurrency, FinTech, Risk Management

The Value Proposition of College, Graduate Degrees

The Value Proposition of College, Graduate Degrees

As a college professor 22 years ago, I co-authored some papers with Dr. Richard Whiteside, who was Dean of Tulane University Admissions. Our articles were published in a few peer-reviewed journals and top higher education publications such as Educause and Journal of College Admission. [i]

Our papers are considered some of the earliest research to explore the use of the internet to recruit and promote colleges, universities, and business schools, as well as to attract students from across the globe. [ii]

Fast forward to today, and there are almost 4,000 [iii] colleges and universities in the United States, including around 1,000 business schools. [iv] The landscape is evolving, and we are at a critical juncture. Top-tier colleges, universities, law schools, and medical schools continue to enjoy significant advantages in recruitment and return on investment.

However, as tuition costs rise, it has become clear that attending a prestigious institution is no longer a straightforward decision. For example, some colleges in Boston charge tuition fees between $80,000 and $100,000 per year. In contrast, many excellent state schools can provide an equally valuable education for roughly $30,000 per year.

Additionally, some local colleges offer lower tuition costs, making them an even more affordable option. In a Newsmax article that I published 5 years ago, I researched several colleges that have free tuition and are free “wholly online” colleges or universities. [v] Furthermore, President Trump continues to “promote the plan” of creating a free online government university for working families and people who can’t afford college which could also cut the future federal debt by reducing defaulting student loans. [vi]

Several of my past articles have highlighted the return on investment in higher education. [vii] A student spending about $50,000 a year for a four-year degree may accumulate at least $200,000 in debt, which could increase substantially with graduate school expenses, ranging from $100,000 to $300,000.

I've met physicians who are burdened with college & medical school debts exceeding $400,000. The question remains: If you graduate with a generalized degree, will you be able to out-earn others who are entering the workforce without the debt?

In the papers that I co-published with Dr. Whiteside, we discussed the clear earning advantage of holding a college degree or a master's degree over the course of a lifetime and career. [viii]

Today, however, students must focus on careers and fields that are less susceptible to outsourcing. As I often tell my students, pursuing a trade such as plumbing or electrical work is a strong option for job security. Consider that over 1 MILLION engineers graduate each year in India [ix], and over 750 million people worldwide aspire to move to the United States. [x] With 96% of the global population living outside the U.S., it’s clear that competition for jobs and education is intensifying.

Furthermore, there are exceptional colleges and universities around the world, many of which offer valuable programs in English. The rise of online education has made it even easier for students to earn degrees from prestigious institutions without leaving home. [xi]

Returning to the original theme, if you're accepted into a well-regarded college and offered financial aid, it could be a wise decision to attend. A friend’s son, for instance, was accepted into two great colleges: one private and one public.

The private university offered a 50% scholarship, but after factoring in the scholarship, the total cost of attending the public university was comparable to the private one. In the end, the student chose the public university.

If I were advising students on their college education—whether undergraduate, law school, or MBA programs—I would encourage them to carefully evaluate the costs and the potential for financial aid. Additionally, students should consider the location and associated travel costs of attending a specific program.

If your goal is to enter the finance world, it might be worth attending a school near a financial center for networking purposes. Similarly, if you want to work in technology, you should focus on schools in areas with thriving tech industries, such as Silicon Valley.

Factors like location, climate, employability in the area, and the opportunity to meet interesting people should also play a role in your decision-making process. Most importantly, you should choose a program that makes you feel passionate and alive. Many experts today recommend a reverse-engineering approach to choosing a college and a field of study.

For example, if you love music or communications, you might want to consider a school like Loyola University, where I studied, as New Orleans is a hub for music and historical Jazz culture. Further, many colleges have a better grade curve and inflation than others. Thus, be aware of the average GPA of a college, law school or MBA program. [xii]

It is also important to research potential job outcomes for various majors. For instance, an MBA might offer a better return on investment than a law degree if you don’t plan to work in a field that requires a law license. Today, the main reason many people pursue law degrees is for the stability and benefits of working in government.

Medical and law schools also vary significantly in cost. While some private medical and law schools can be prohibitively expensive, public universities often offer programs that cost less than half as much. These considerations are critical when deciding on a path forward, and I recommend discussing these options with a financial advisor, your parents, or your children.

As an e-learning pioneer in legal and business education, I have taught and designed over 300 courses for accredited law and business schools. I encourage everyone to consider online education programs that offer degrees from well-ranked universities.

Additionally, in 2020, President Trump signed an executive order ensuring that skills, certifications, and qualifications would be treated equally to traditional degrees when hiring for federal jobs. This means that specialized certifications could give job candidates an edge over those with general degrees.

Even today, I teach as a law faculty member and online professor for one of the top ranked law schools in the USA, Texas A&M Law School. Speaking from experience, as soon as your program is in the top 25 in the USA, the applications and competition for admissions goes up dramatically. However, I teach for the LLM and Masters of Laws programs, and we can accept students from California to New York without a student having to live on site. This type of option was not available 30 years ago, but with technology and learning platforms, this type of educational opportunity is open to all qualified applicants.

With the increasing availability of free online courses, including Massive Open Online Courses (MOOCs), everyone should take advantage of these opportunities to earn attendance certificates or other qualifications. Be sure to investigate whether these programs can count toward college credit, as this could impact your decision-making.

Finally, many top universities or even law schools in the U.S. also offer affordable nighttime courses or “city college” programs, which provide a general degree at a fraction of the cost. [xiii]

With the new accreditation standards being implemented across the country, we may see a rise in new accreditation agencies recognizing tax-paying universities that do not benefit from tax loopholes. There is also growing support for private education systems that pay taxes to contribute to local, state, and federal operations.

Unless you are pursuing a career as a doctor, CPA, lawyer, nurse, engineer, architect, or another licensed professional, you might want to consider specializing in diplomas or trade skill licensing education rather than spending 4-5 years for a traditional college degree.

While obtaining college degrees and graduate school qualifications is necessary for professions like medicine, law, accounting, and architecture, it’s also important to explore the thousands of career opportunities available in city, state, and federal government. These public sector roles often provide excellent pay, benefits, and pension programs, but knowing the specific qualifications and requirements for these positions is key to securing a stable and rewarding career.

For many years, I volunteered as an economist for the U.S. Department of Labor, helping to create content on their websites about careers, jobs, and employment, and I can attest to the wealth of opportunities in public service. Focusing on careers that can't be easily outsourced or that offer unique, non-replicable services can ensure long-term job security and success.

Furthermore, I have recently served the White House as Commissioner for the PSP Presidential Scholars Programs, where I had the privilege of acting as both a judge and a commissioner, evaluating the top resumes from high school students across the nation to award the Presidential Medals.

The best resumes typically feature a 4.0 GPA or higher, academic awards, extensive volunteer service or part-time jobs, proficiency in a foreign language, and a demonstrated ability to excel in sports, acting, martial arts, or music.

Some students impressively complete 5-10 Advanced Placement (AP) exams, and several resumes even showcase enough credits at high school graduation to earn an associate degree. These achievements highlight not only academic excellence but also an extraordinary level of dedication, drive, and ambition. Overall, if you have this type of resume, you will have access to many brand name schools and admissions as long as colleges are fair to all applicants. [xiv]

As a further secret strategy, many of colleges around the USA offer abroad programs where you can take courses under the college banner in other nations such as South America, Europe, India, Asia or Arabia. Some ambitious students even rack up 9 or more credits attending abroad programs before their freshman year begins. Keep in mind, these abroad programs are many times less expensive that attending local courses. [xv]

In conclusion, the evolving landscape of higher education requires careful consideration of costs, career prospects, and personal interests. It’s more important than ever for students to make informed decisions about their educational paths, taking into account both short-term expenses and long-term benefits.

Value Proposition Statistics:

Statistics related to the value proposition of paying for a college degree and its return on investment (ROI):

______________

Commissioner George Mentz JD MBA CILS CWM® is the first in the USA to rank as a Top 50 Influencer & Thought Leader in: Management, PM, HR, FinTech, Wealth Management, and B2B according to Onalytica.com and Thinkers360.com.

Tags: EdTech, Education

Year End Tax Tips

Year End Tax Tips A New Era of Global Stability: Why 2025 Is Fundamentally Different From Earlier Market Cycles

A New Era of Global Stability: Why 2025 Is Fundamentally Different From Earlier Market Cycles 47 Nations Lower Tariffs on the USA - Peace and Trade - How Trump’s Initiatives and Lower Deb Burdens Are Reshaping the Global Markets and Economy

47 Nations Lower Tariffs on the USA - Peace and Trade - How Trump’s Initiatives and Lower Deb Burdens Are Reshaping the Global Markets and Economy The Probability of a Stock Market Correction is Very Low in 2025

The Probability of a Stock Market Correction is Very Low in 2025 The Triggers of a Bull Market: How Trump is Building the Age of Prosperity

The Triggers of a Bull Market: How Trump is Building the Age of Prosperity The 2025 Gold and Silver Boom: Entering a New Super Cycle

The 2025 Gold and Silver Boom: Entering a New Super Cycle