Nov21

FCRQ173 Leadership Learning!

On 21st November 2023, Changpeng Zhao pleaded guilty to violations relating to the Bank Secrecy Act and stepped down as chief executive officer of Binance. This marked the conclusion of one of the most significant enforcement actions in cryptocurrency history, as announced by the U.S. Department of Justice (DOJ). The settlement required Binance to pay over 4 billion dollars in penalties, representing a watershed moment for an industry that had long operated in regulatory grey zones. Founded in 2017, Binance rapidly ascended to become the world's largest cryptocurrency exchange CNBCTechCrunch, processing billions of dollars in trading volume and serving millions of customers globally. The platform's meteoric rise was fuelled by expansion strategies, low trading fees, and a borderless operational structure that operated without a traditional headquarters or clear jurisdictional boundaries. The company prioritised growth, market share and profits over compliance with United States law in a deliberate and calculated effort to profit without implementing controls required by law U.S. DOJ. The prosecution revealed systemic failures in anti-money laundering (AML) protocols. Zhao caused Binance to fail to implement an effective AML programme, creating vulnerabilities that were exploited. Internal communications exposed the cavalier attitude towards compliance, with one staff member noting the platform had become attractive to those seeking to launder proceeds from criminal activities. Court documents showed Zhao told employees it was “better to ask for forgiveness than permission,” according to CoinDesk, a philosophy that pervaded the organisation's approach to regulatory requirements. The DOJ announced charges including conspiracy to violate banking laws and violating the International Emergency Economic Powers Act. These charges underscored how the platform had enabled transactions involving sanctioned jurisdictions, collecting substantial fees whilst circumventing fundamental safeguards designed to protect financial system integrity. The settlement's scale reflected the gravity of the violations. This prosecution represented the Department’s largest corporate guilty plea that also involved the guilty plea of a chief executive officer. Beyond monetary penalties, the agreement mandated comprehensive compliance enhancements, the appointment of an independent monitor, and Zhao's resignation from operational involvement for three years following the monitor's appointment. The case demonstrated that technological innovation cannot serve as justification for regulatory circumvention. The resolution sent an unambiguous message to the broader cryptocurrency industry about the consequences of prioritising expansion over compliance. It highlighted the tension between the decentralised ethos of cryptocurrency and the practical necessity of regulatory frameworks that protect consumers. The significance extends beyond Binance itself. The settlement established precedent for how authorities would approach cryptocurrency exchanges operating globally. It clarified expectations regarding AML obligations, sanctions compliance, and registration requirements. For an industry that had often operated in ambiguous regulatory territory, the case provided stark clarity about the boundaries of permissible conduct. The event marked a pivotal moment in cryptocurrency's maturation, signalling the end of an era where platforms could leverage regulatory arbitrage as competitive advantage. It underscored that participation in the American financial system requires adherence to established rules, regardless of technological sophistication or innovation. The resolution balanced enforcement with pragmatism, allowing Binance to continue operations under enhanced oversight whilst extracting substantial penalties and operational reforms. This approach reflected a regulatory philosophy that sought to bring the industry into compliance rather than simply punishing past misconduct, setting a framework for how authorities might engage with cryptocurrency enterprises moving forwards.

Change Leadership Lessons: This case illustrates how leadership choices reverberate beyond financial penalties, shaping organisational culture and resilience. The lessons for change leaders are clear: compliance frameworks are not optional guardrails but essential foundations for sustainable transformation. Leaders of change establish organisational culture by allocating resources, maintaining consistent messaging, and visibly rewarding compliance with regulatory frameworks. They create environments where teams prioritise business goals over legal obligations by framing regulations as obstacles rather than foundations. Change leaders generate compliance vulnerabilities that become serious threats when scaling operations without investing in compliance capabilities. They show that growth increases accountability for compliance failures, as regulators impose significant penalties regardless of organisational position. Leaders of change find that investing in compliance frameworks early is far less expensive than fixing violations after they occur. Change Leaders Instil Compliance Frameworks.

“Leading change requires balancing innovation velocity with institutional integrity, recognising that sustainable growth emerges from foundational compliance rather than circumventing established frameworks.”

Application - Change Leadership Responsibility 3 - Intervene to Ensure Sustainable Change: The Binance case demonstrates the consequences of leadership failing to intervene when rapid growth outpaces ethical and regulatory safeguards. Change leaders must recognise when innovation and expansion begin to create structural vulnerabilities that expose the organisation to legal, operational, and reputational risk. Intervening early means scrutinising decision making, resourcing compliance functions properly, and challenging narratives that frame regulation as an obstacle rather than a foundation. Sustainable change depends on leaders embedding oversight mechanisms that are proportionate to scale, ensuring that governance, financial controls, and ethical standards remain strong even under pressure. When leaders intervene decisively, they shift organisational culture from reactive correction to proactive resilience, protecting both long-term purpose and public trust.

Final Thoughts: AI continues to accelerate organisational transformation, making strong compliance frameworks more essential than ever. Leaders who balance innovation with moral responsibility will guide their organisations through uncertainty with credibility and clarity. The future belongs to those who pair technological progress with ethical, principled leadership.

Further Reading: Change Management Leadership - Leadership of Change® Volume 4.

Peter F. Gallagher consults, speaks, and writes on Leadership of Change®. He works exclusively with boards, CEOs, and senior leadership teams to prepare and align them to effectively and proactively lead their organisations through change and transformation.

For insights on navigating organisational change, feel free to reach out at Peter.gallagher@a2B.consulting.

#LeadershipofChange #Leadership #ChangeLeadership #FCRQ #Thinkers360 #GlobalGurus #ChangeManagement #ChangpengZhao #Binance #Cryptocurrency

For further reading please visit our websites: https://www.a2b.consulting https://www.peterfgallagher.com Amazon.com: Peter F Gallagher: Books, Biography, Blog, Audiobooks, Kindle

Leadership of Change® Body of Knowledge Volumes: Change Management Body of Knowledge (CMBoK) Books: Volumes 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, A, B, C, D & E available on both Amazon and Google Play:

~ Leadership of Change® Volume 1 - Change Management Fables

~ Leadership of Change® Volume 2 - Change Management Pocket Guide

~ Leadership of Change® Volume 3 - Change Management Handbook

~ Leadership of Change® Volume 4 - Change Management Leadership

~ Leadership of Change® Volume 5 - Change Management Adoption

~ Leadership of Change® Volume 6 - Change Management Behaviour

~ Leadership of Change® Volume 7 - Change Management Sponsorship

~ Leadership of Change® Volume 8 - Change Management Charade

~ Leadership of Change® Volume 9 - Change Management Insanity

~ Leadership of Change® Volume 10 - Change Management Dilenttante

~ Leadership of Change® Volume A - Change Management Gamification - Leadership

~ Leadership of Change® Volume B - Change Management Gamification - Adoption

Keywords: Leadership, Change Management, Business Strategy

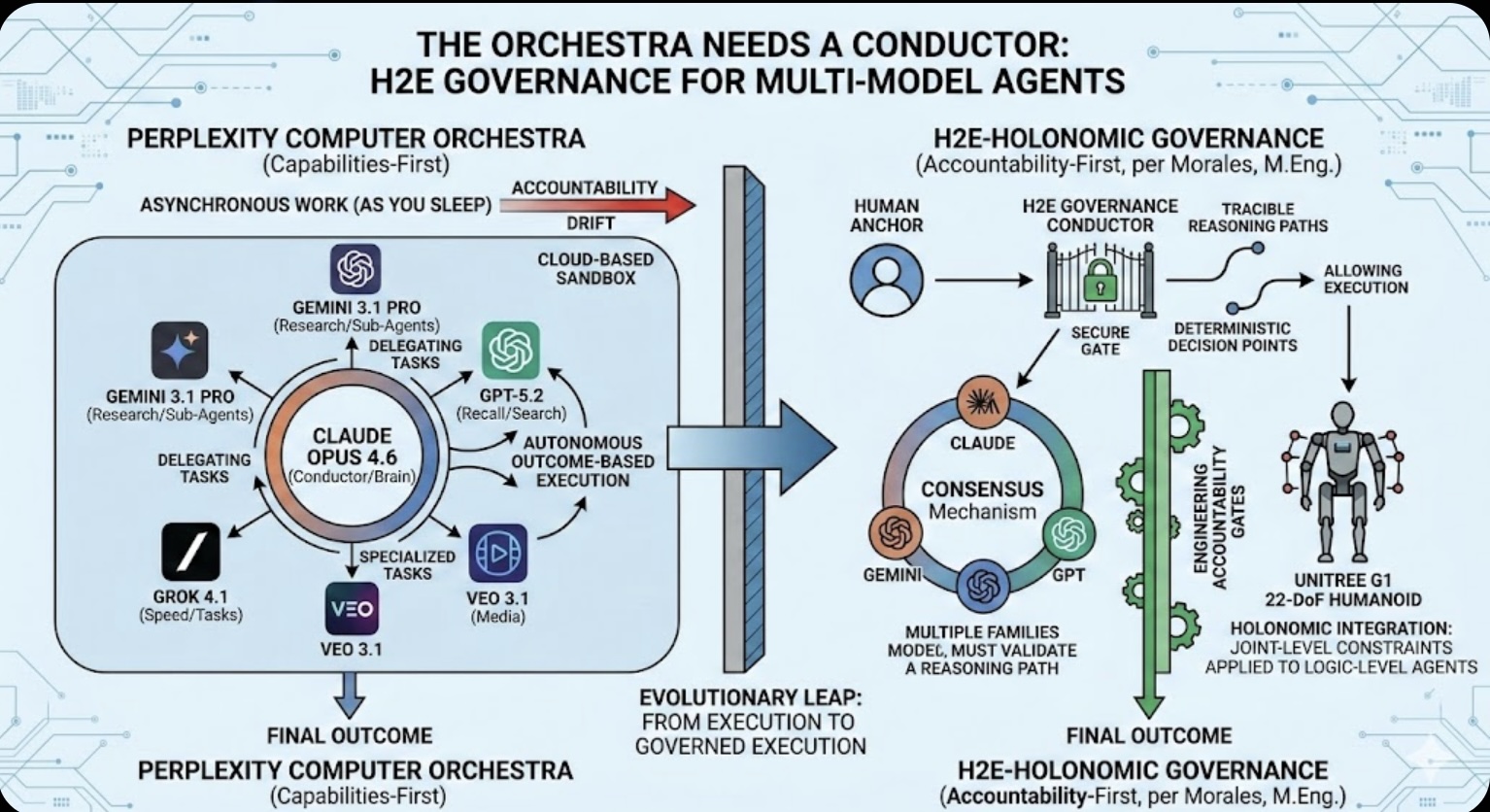

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

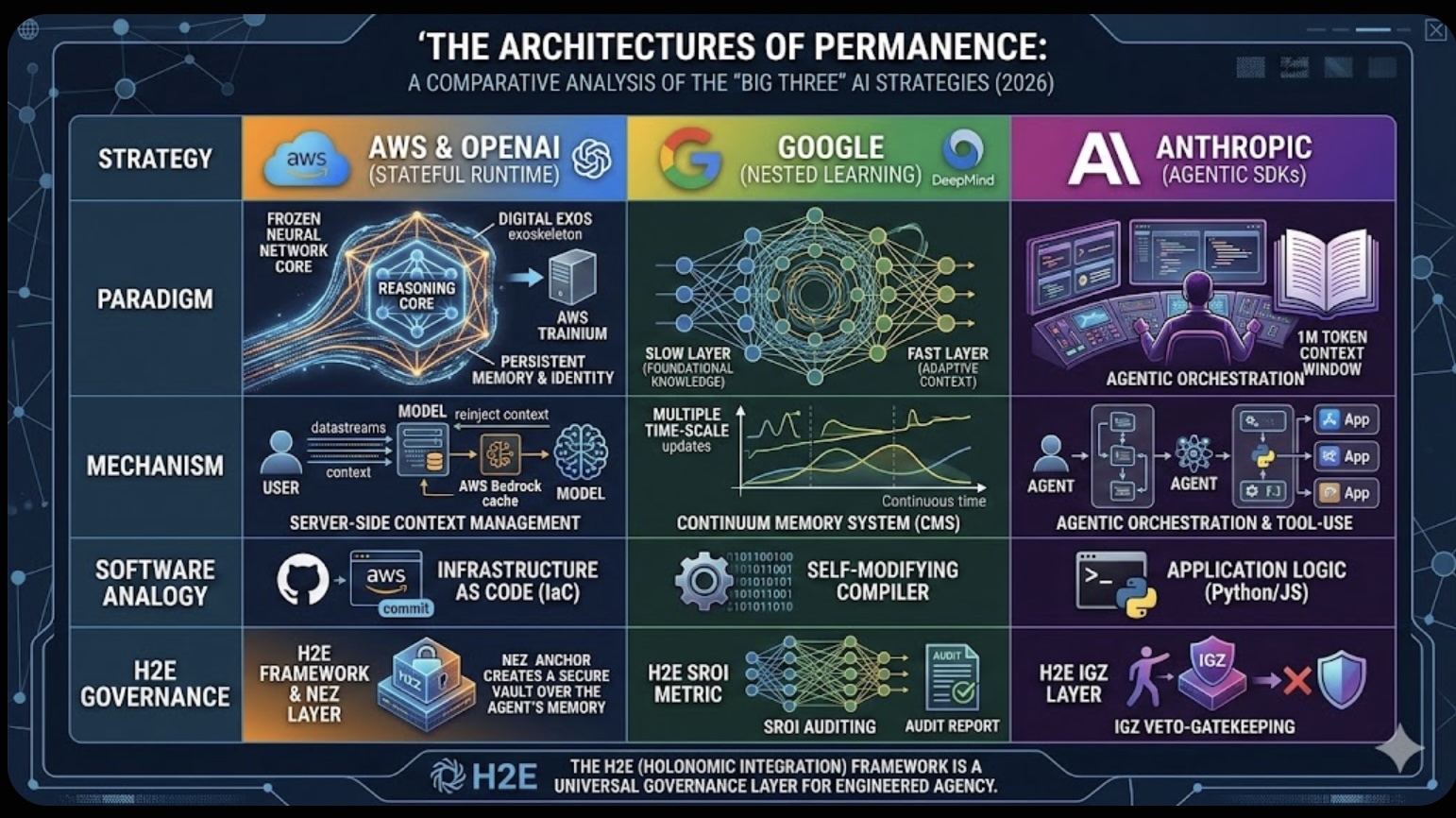

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026