Aug15

Leadership Learning!

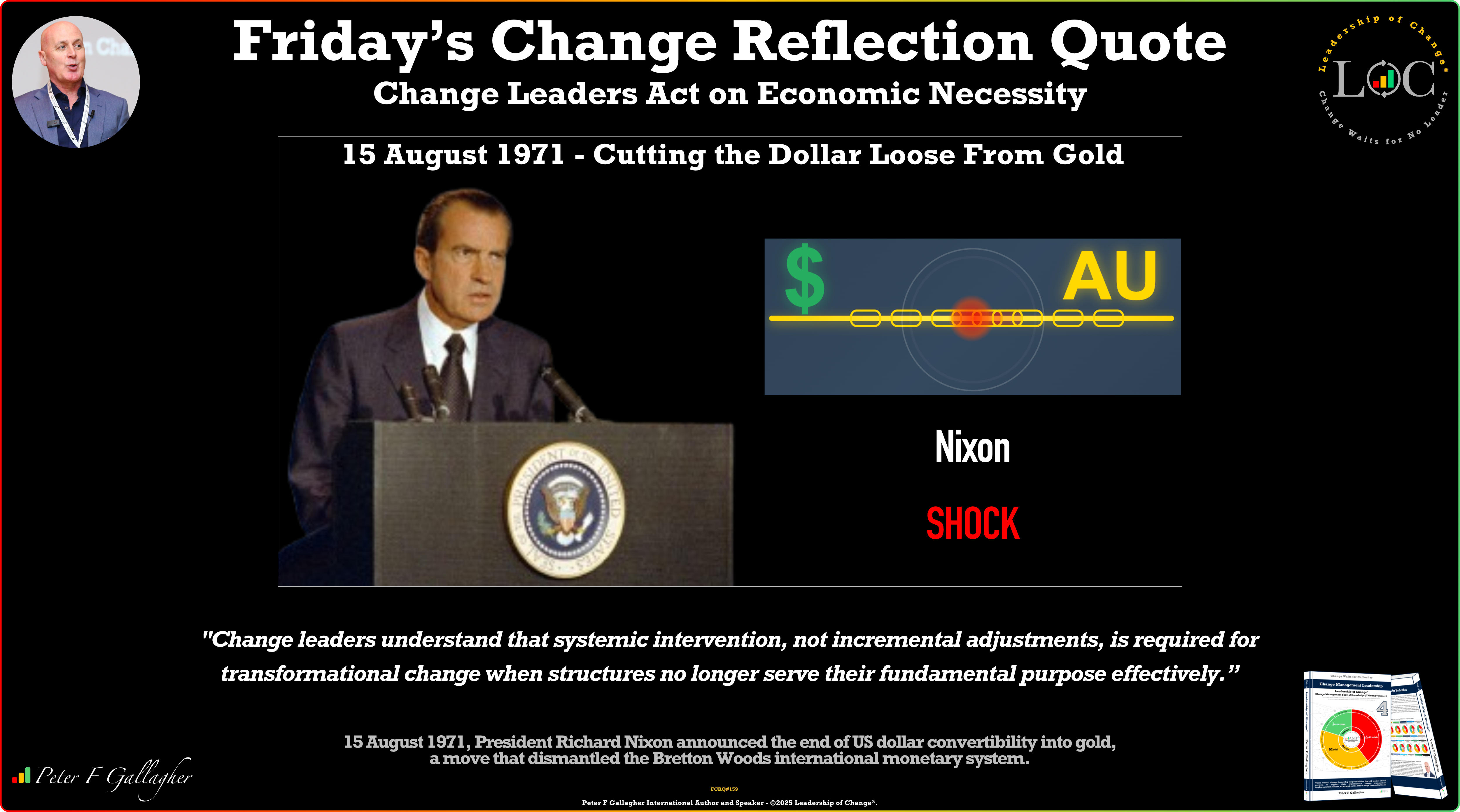

On this day, 15 August 1971, President Richard Nixon announced the end of US dollar convertibility into gold, a move that dismantled the Bretton Woods international monetary system. Delivered via televised address, the decision transformed the dollar into a fiat currency and reshaped global finance. Nixon’s unilateral cancellation of direct international convertibility—the act frequently described as cutting the dollar loose from gold—became known as the “Nixon Shock”, one of the most significant economic policy reversals in modern history. The context was mounting economic pressure. During the 1960s the United States endured fiscal strain from Vietnam War spending and expanded domestic social programmes. At the same time, trade partners such as Germany and Japan accumulated large dollar reserves and kept currencies deliberately undervalued to support export growth. As American gold reserves fell, Nixon acted partly to force surplus nations to revalue, using convertibility suspension as leverage, and to buy time to address inflationary pressure and employment concerns. The decision emerged after three days of secret deliberations at Camp David in August 1971, where Nixon and his principal economic advisers debated the nation’s monetary future. The gravity of this choice was not lost on key participants; Treasury Secretary John Connally observed in advance, “We may never go back to it [convertibility]. I suspect we never will.” The move combined political theatre with economic brinkmanship, a reminder that leadership often blends public symbolism with technical policy-making. Markets reacted almost immediately. Exchange rates began floating freely, producing unprecedented volatility and uncertainty. What had been a stable, predictable exchange-rate mechanism suddenly became fluid and market-driven, and currencies moved in response to news and sentiment rather than fixed parities. Countries holding substantial dollar balances found themselves relying on the “full faith and credit” of the United States rather than tangible gold backing. The consequences reached far beyond technical adjustments. The end of gold convertibility entrenched the dollar’s position as the dominant global reserve currency, granting the United States unique privileges—including the ability to run persistent trade deficits—while also creating systemic vulnerabilities tied to US fiscal and monetary policy. The immediate volatility morphed into a new normal for floating exchange regimes, altering how nations conducted trade, managed reserves, and framed monetary policy. The Nixon Shock shows how even robust, complex systems can be overturned when economic realities change. Bretton Woods had supplied stability for two decades, yet once its foundations eroded, bold intervention became inevitable. The speed and comprehensiveness of the shift and the readiness to defy precedent demonstrate how decisive leadership can reconfigure global structures almost overnight.

Change Leadership Lessons: This historic moment offers profound insights into systemic transformation and the courage required to abandon familiar frameworks when they no longer serve their purpose. Nixon’s unilateral action, taken despite the risk of international backlash, shows how leaders must sometimes prioritise long-term strategic interests over short-term diplomatic convenience. The enduring consequences of this decision continue to shape global economic relations, monetary policy, and the structure of international finance. Leaders of change recognise when incremental adjustments prove insufficient to address fundamental structural problems requiring comprehensive systemic transformation. They create secure environments for intensive analysis away from external pressures and media scrutiny during critical decision-making processes. Change leaders act unilaterally when circumstances demand immediate intervention rather than seeking consensus that might result in paralysing organisational delays. They must recognise when underlying conditions make transformation inevitable and act decisively to maintain control over complex transition processes. Leaders of change require intellectual courage to dismantle familiar structures when changing circumstances render their core assumptions fundamentally obsolete. Change Leaders Act on Economic Necessity.

“Change leaders understand that systemic intervention, not incremental adjustments, is required for transformational change when structures no longer serve their fundamental purpose effectively.”

Application: Change Leadership Responsibility 1 - Articulate a Change Vision: The Nixon Shock demonstrates that articulating a compelling change vision requires leaders to confront systemic failure whilst presenting a credible alternative pathway forward. When existing structures become economically unsustainable, the vision must clearly communicate both the necessity for transformation and the potential stability that new approaches can provide. Effective change visions acknowledge current pressures without creating paralysing uncertainty for stakeholders. Leaders must frame fundamental shifts as inevitable responses to changed realities rather than experimental departures from proven methods. The vision should emphasise long term organisational sustainability over short term convenience, ensuring that all stakeholders understand the rationale for abandoning familiar frameworks. This requires transparent communication about underlying conditions that make transformation essential whilst maintaining confidence in the organisation's capacity to navigate complex transitions successfully. The change vision for this situation communicates that abandoning gold convertibility, whilst disruptive, provides essential monetary flexibility to address economic pressures and establish sustainable fiscal foundations for future prosperity.

Final Thoughts: Transformational change requires leaders who recognise when economic realities make familiar systems obsolete and act decisively despite uncertainty. The courage to abandon established frameworks, even when they have provided decades of stability, distinguishes truly effective change leadership from incremental management.

Further Reading: Change Management Leadership - Leadership of Change® Volume 4.

Peter F. Gallagher consults, speaks, and writes on Leadership of Change®. He works exclusively with boards, CEOs, and senior leadership teams to prepare and align them to effectively and proactively lead their organisations through change and transformation.

For insights on navigating organisational change, feel free to reach out at Peter.gallagher@a2B.consulting.

For further reading please visit our websites: https://www.a2b.consulting https://www.peterfgallagher.com Amazon.com: Peter F Gallagher: Books, Biography, Blog, Audiobooks, Kindle

Leadership of Change® Body of Knowledge Volumes: Change Management Body of Knowledge (CMBoK) Books: Volumes 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, A, B, C, D & E available on both Amazon and Google Play:

~ Leadership of Change® Volume 1 - Change Management Fables

~ Leadership of Change® Volume 2 - Change Management Pocket Guide

~ Leadership of Change® Volume 3 - Change Management Handbook

~ Leadership of Change® Volume 4 - Change Management Leadership

~ Leadership of Change® Volume 5 - Change Management Adoption

~ Leadership of Change® Volume 6 - Change Management Behaviour

~ Leadership of Change® Volume 7 - Change Management Sponsorship

~ Leadership of Change® Volume 8 - Change Management Charade

~ Leadership of Change® Volume 9 - Change Management Insanity

~ Leadership of Change® Volume 10 - Change Management Dilenttante

~ Leadership of Change® Volume A - Change Management Gamification - Leadership

~ Leadership of Change® Volume B - Change Management Gamification - Adoption

Keywords: Business Strategy, Change Management, Leadership

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026