Feb10

When companies decide where to build factories, smelters, data centres, or processing plants, they tend not to wax lyrical about climate goals.

They look at spreadsheets.

Energy costs. Price volatility. Reliability. Long-term risk. Exposure to fuel shocks. Regulatory uncertainty. The probability that today’s cheap power becomes tomorrow’s liability.

That is why South Australia has quietly become one of the most interesting industrial case studies of the past decade.

Once mocked for moving “too fast” on renewables, it now runs on a grid dominated by wind and solar, backed by batteries and interconnection. Wholesale prices are volatile in the short term, yes. But long-term electricity costs are falling. Exposure to gas price shocks has collapsed. Reliability metrics have improved. And increasingly, businesses are choosing to locate there because of it.

This is not new.

Iceland has been playing this game for decades. Aluminium smelters did not move there for the scenery. They moved because clean, cheap, renewable electricity was abundant, reliable, and insulated from global fuel markets. Energy became an advantage, not a constraint.

That shift is now going global.

According to the International Energy Agency’s Electricity 2026 report, electrification is no longer a climate strategy sitting off to the side of economic planning. It is becoming the organising logic of growth itself.

Electricity demand is accelerating faster than almost anyone expected.

The IEA projects global electricity demand growth of roughly 3–4% per year through 2026, well above historical averages. This is not population growth. It is structural change.

Transport electrification. Heat pumps. Industrial electrification. Data centres. AI. Digital infrastructure. All of it runs on power.

And crucially, almost all net growth in electricity generation over this period comes from renewables, led by solar PV and wind, with storage scaling alongside them.

This changes the competitive landscape.

Countries that electrify quickly, and cleanly, gain cheaper energy, greater security, and industrial pull. Those that delay lock themselves into volatile fuel costs and stranded assets.

The divergence is already visible.

Start with the global system.

According to the IEA’s Electricity 2026 outlook, renewables account for the vast majority of new power capacity additions worldwide. Solar alone is adding more capacity each year than any other generation source in history. Wind follows close behind.

Coal generation has likely already peaked globally. Gas continues to play a role, but increasingly as a provider of flexibility rather than bulk energy. Electricity-sector CO₂ emissions are flattening as clean generation races to meet rising demand.

This is progress. Real progress. But unevenly distributed.

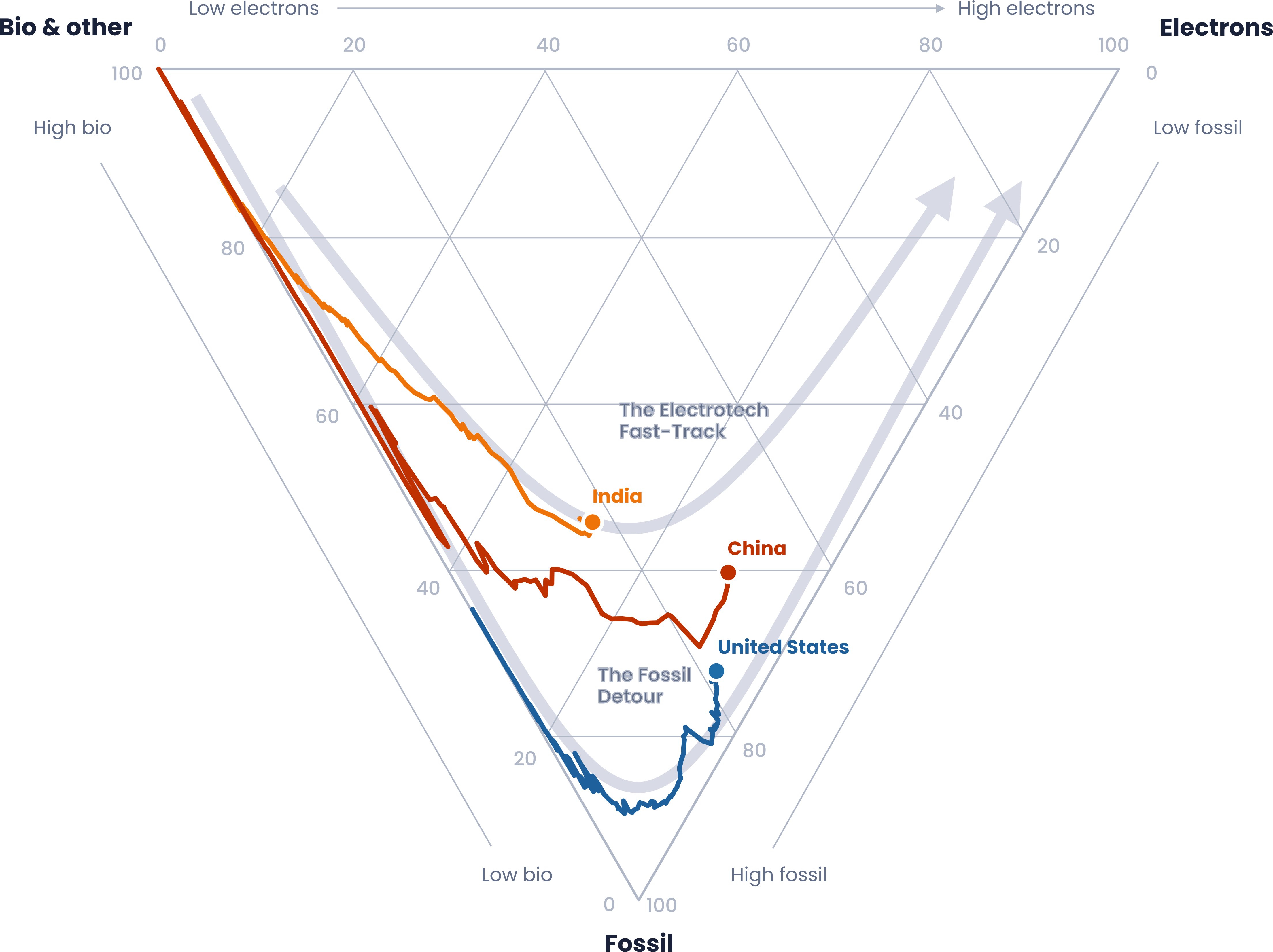

Carbon Brief’s analysis of China’s energy transition shows that clean energy drove more than one-third of China’s GDP growth in 2025. That includes renewables, EVs, batteries, grids, and associated manufacturing.

China is not decarbonising out of altruism. It is building dominance across supply chains that matter in an electrified world. Solar manufacturing. EV production. Battery chemistry. Grid hardware. Power electronics.

Coal has not vanished. But its role is changing. Growth is slowing. Capacity factors are falling. Clean electricity is doing the heavy lifting.

This is what “transition” actually looks like.

India’s path is different, and arguably more impressive.

According to Ember’s 2026 analysis, India is industrialising with far less coal and oil per capita than China did at a similar stage of development. Solar capacity is scaling rapidly. EV adoption, particularly two- and three-wheelers, is accelerating. Oil demand growth is already showing signs of slowing.

The reason is simple. The economics flipped early.

Solar plus storage in India is now cheaper than new coal. EVs beat combustion on lifetime cost. Electrification is the least-cost option, not the aspirational one.

India is not waiting to get rich before it gets clean. It is using clean power to get rich.

Africa is often discussed in the language of need. The data tells a story of opportunity.

Africa installed around 4.5 GW of new solar capacity in 2025, a 54% year-on-year increase, the fastest growth on record. According to Bloomberg, the continent could install over 33 GW by 2029, more than six times recent annual additions.

What makes Africa different is structure.

It is running two energy transitions in parallel. Utility-scale solar feeding national grids. Distributed solar and mini-grids powering homes, clinics, farms, and businesses directly.

Just as Africa skipped landlines and went straight to mobile phones, it is leapfrogging fossil-heavy power systems. Solar and storage offer energy access, resilience, and economic participation without locking in fuel imports.

This is not a marginal story. It is the early shape of a new growth model.

Electrification remains the single most effective lever for cutting emissions at scale. Replace combustion with electricity. Then clean the grid.

The IEA is clear: without electrification, emissions reductions stall. With it, they compound. Every EV, heat pump, electric kiln, and server rack powered by clean electricity locks in decades of avoided emissions.

Energy security is shifting from fuel supply to system design.

Countries that generate electricity domestically from wind, sun, and water are less exposed to geopolitical shocks. They import fewer fuels. They face fewer price spikes. They gain strategic autonomy.

Electrons do not pass through straits or pipelines.

China understands this. India understands this. Africa increasingly does too.

Here is the part still underappreciated.

Electrification lowers costs.

IEA, Lazard, and BNEF data consistently show solar and wind as the cheapest sources of new electricity in most regions. Batteries continue to fall in cost. EVs have lower running and maintenance expenses. Heat pumps slash energy bills when paired with clean power.

Once adoption starts, the economics reinforce themselves.

Distributed generation and storage make systems harder to break.

Mini-grids in Africa keep power flowing during extreme weather. Batteries stabilise grids with high renewable shares. Interconnection spreads risk. Flexibility absorbs shocks.

Resilience is no longer about building bigger plants. It is about building smarter systems.

So what should leaders do?

Because it does.

The IEA warns that grids are now the primary bottleneck. Transmission delays are curtailing renewables. Distribution networks are unprepared for EVs and heat pumps.

Permitting reform, investment acceleration, and workforce expansion are now economic priorities.

Batteries, demand response, interconnection, and long-duration storage are no longer optional. They are what allow high shares of renewables without instability.

Markets that reward flexibility move faster. Others fall behind.

Transport. Buildings. Industry.

Every year of delay locks in assets that will become liabilities.

China and India are doing this deliberately. Manufacturing, energy, and trade policy point in the same direction.

This is where the United States is faltering.

Look at where capital is flowing.

South Australia attracting industry because its grid is clean and increasingly cheap.

China using clean energy to drive GDP growth.

India building industrial capacity on solar rather than coal.

Africa scaling energy access without fossil lock-in.

And then there is the United States.

Despite unmatched innovation capacity, the US is increasingly clinging to fossil incumbents, delaying grid reform, and politicising technologies the rest of the world is deploying at scale.

This is not ideological failure. It is economic self-sabotage.

While others build the systems of an electrified economy, the US risks importing them later, at higher cost, with fewer jobs attached.

Capital follows advantage.

For much of the last century, that advantage came from access to fuels. Today, it comes from access to clean, reliable, affordable electricity.

South Australia and Iceland showed this early. China, India, and Africa are proving it at scale.

Electrification is not a moral gesture. It is an industrial strategy.

And the countries that understand that are already pulling ahead.

This article was originally posted on TomRaftery.com. Photo credit - John Morton on Flickr.

By Tom Raftery

Keywords: Climate Change, Energy, Sustainability

Lateral Moves: The Most Overlooked Succession Strategy in Companies

Lateral Moves: The Most Overlooked Succession Strategy in Companies The Asset Play: Timing, Structure & Global Arbitrage

The Asset Play: Timing, Structure & Global Arbitrage  The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)