May29

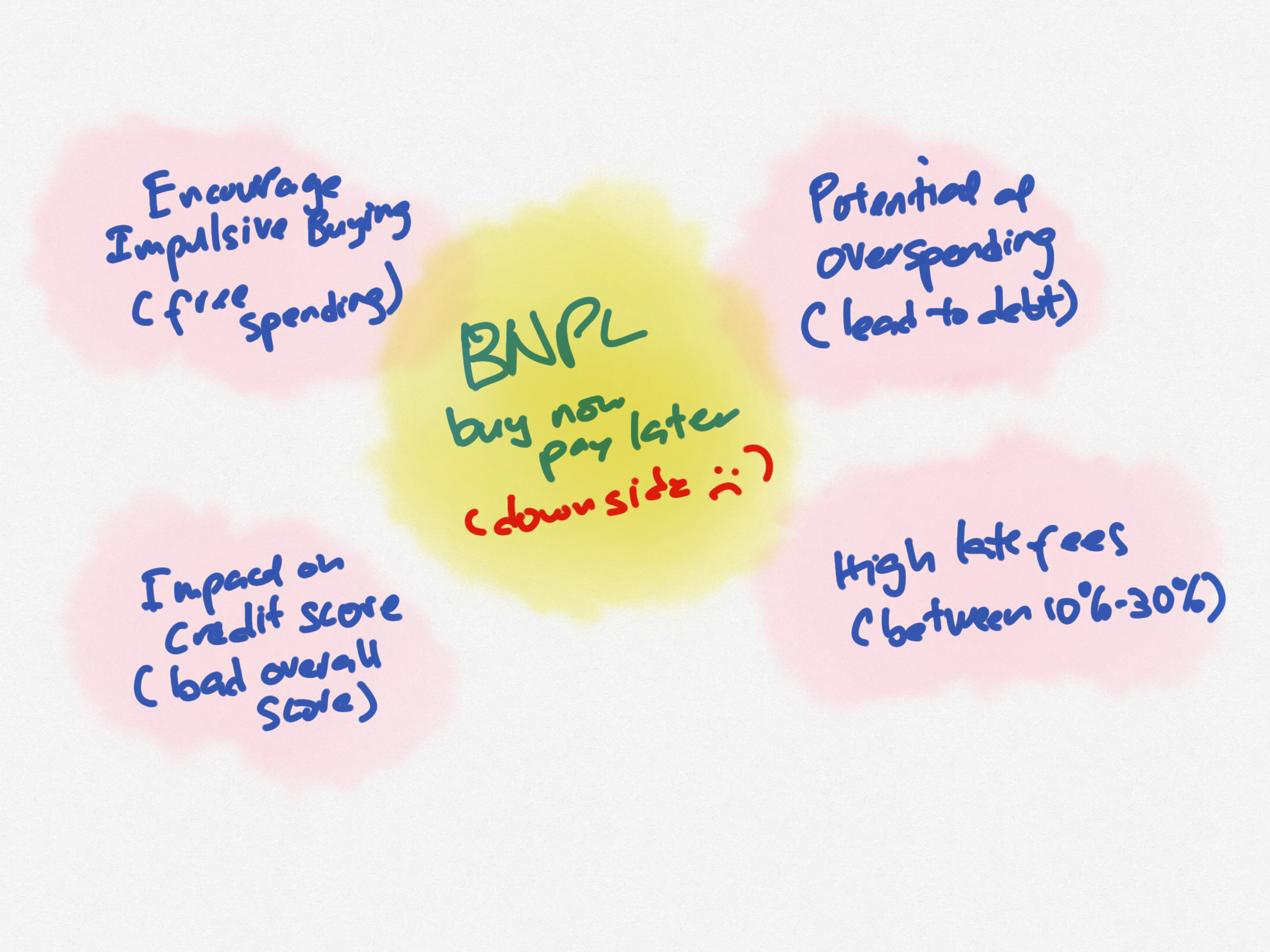

Is BNPL (Buy Now Pay Later) a game changer? In terms of access to credit, probably yes. In terms of credit risk? No way!

BNPL is on rapid growth among youth and young consumers in Southeast Asia including Malaysia and Indonesia. The idea of some providers to serve the underbanked or underserved is somewhat misleading. Although economically this segment is quite large, their ability to repay is quite concerning.

Here are some key figures from different location and areas concerning BNPL:

Late Payments: According to a survey conducted by Credit Karma in 2020, nearly 40% of US consumers who used BNPL services had missed at least one payment. Late payments can result in fees and can potentially impact a user's credit score.

Debt Accumulation: A report from ASIC (Australian Securities and Investments Commission) in 2020 found that one in five consumers in Australia were missing payments. The report also found that over 20% of BNPL users had to cut back on or went without essentials such as meals, and over 15% had taken out an additional loan to make their BNPL payments.

Young Consumers: Younger consumers, who may be less experienced with managing credit, are particularly drawn to BNPL services. A survey by Ascent in 2021 found that nearly 45% of Gen Z and 37% of Millennials in the US had used BNPL services, compared to just 8% of Baby Boomers.

Understanding Terms: A survey by CompareCards in 2020 found that nearly 30% of BNPL users in the US didn't fully understand what they were signing up for when they chose to use these services.

Regulation: As of 2021, BNPL services were not as heavily regulated as traditional credit products in many countries. This has raised concerns about consumer protection. For example, in the UK, a review by the Financial Conduct Authority (FCA) found that the BNPL market needed to be regulated to protect consumers.

These figures highlight some of the potential risks associated with BNPL, including late payments, debt accumulation, and a lack of understanding about the terms and conditions of these services. They also underscore the need for more consumer education and potentially more regulation in the BNPL industry.

BNPL also is known to charge exorbitantly high late fees, between 10%-35% depending on scheme and platforms. There should be a better design for access to online credit and the regulators should go hard to mischievous providers.

This is an example of innovation that can be harmful to customers if they are not careful. Lack of education of proper financial lliteracy may contribute to this problem however providers with great foresight should have designed a better product that is useful and meaningful for customers.

Brickbats please reach out to donkhairul@gmail.com

Keywords: Design Thinking, FinTech, Innovation

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026