Sep23

The path to creating new disciplines is often forged by the convergence of existing fields, particularly when a new technology presents unprecedented challenges and opportunities. While cryptography and informatics are well-established, their powerful union in the context of decentralized systems has given rise to a new, urgent field: Cryptanalytics. This discipline is the study, design, and implementation of secure, decentralized information systems that leverage cryptographic principles to ensure data integrity, transparency, and resilience. As demonstrated by a series of algorithmic trading case studies, Cryptanalytics is not a theoretical concept but a practical necessity for navigating and capitalizing on the complexities of decentralized markets.

The central problem that Cryptanalytics seeks to solve is the inherent risk of trusting a centralized authority. In traditional information systems, a single entity controls the data, creating a single point of failure and a high potential for data manipulation. Blockchain technology, and the cryptocurrencies built upon it, offer a radical alternative. However, simply using a blockchain is not enough; the strategies for interacting with these systems must be equally robust. This is where Cryptanalytics comes in, providing the rigorous, data-driven frameworks necessary to build and validate resilient applications.

The efficacy of Cryptanalytics is best illustrated through its application in the volatile world of algorithmic trading. Developing a profitable trading strategy is not simply about finding a pattern in historical data; it is about creating a model that can adapt to ever-changing market conditions without succumbing to the fatal flaw of overfitting. Overfitting occurs when a model becomes overly tailored to past data, causing it to fail in live trading and misinterpret noise as genuine market signals. The core methodology of Cryptanalytics addresses this directly through Walk-Forward Optimization (WFO). As a framework, WFO divides historical data into sequential, non-overlapping windows. Parameters are tuned on an "in-sample" period and then validated on the subsequent, unseen "out-of-sample" data. This iterative process provides an unbiased and reliable measure of a strategy's actual viability in the real world.

The results from four distinct algorithmic trading case studies on different cryptocurrency pairs—SOL/USD(1), ETH/USD(2), BTC/USD(3), and LDO/USD(4)—serve as compelling proof of concept for this new discipline. By utilizing a machine learning model validated through WFO, each strategy achieved remarkable performance metrics, demonstrating a genuine market edge.

|

Cryptocurrency Pair |

Average Out-of-Sample Sharpe Ratio |

Total Compounded Return |

Worst Out-of-Sample Max Drawdown |

Total Trades |

|---|---|---|---|---|

|

LDO/USD |

6.91 |

651.52% |

30.39% |

516 |

|

BTC/USD |

3.85 |

553.26% |

29.92% |

559 |

|

ETH/USD |

5.88 |

546.89% |

30.56% |

491 |

|

SOL/USD |

6.85 |

697.43% |

30.27% |

472 |

These findings are more than just a testament to the success of a single trading strategy; they highlight the principles of Cryptanalytics. The consistently high Sharpe Ratios across all assets indicate strong, risk-adjusted returns, suggesting that the strategy was not merely lucky but was based on sound, adaptable logic. The impressive compounded returns, despite significant drawdowns, underscore the resilience of a framework designed to learn and recover from market volatility. This is the essence of Cryptanalytics: building systems that are not just profitable but robust, transparent, and capable of withstanding the unpredictable nature of decentralized systems.

In conclusion, formalizing Cryptanalytics as a technological discipline is a logical and necessary next step. Its principles of rigorous, transparent validation and decentralized data management are essential for building the next generation of resilient systems. The success of the algorithmic trading strategies presented here provides a clear blueprint for this new field, demonstrating that the future of information lies in a framework that systematically addresses the challenges of a trustless, decentralized world.

References

Keywords: Cryptocurrency, Open Source, Predictive Analytics

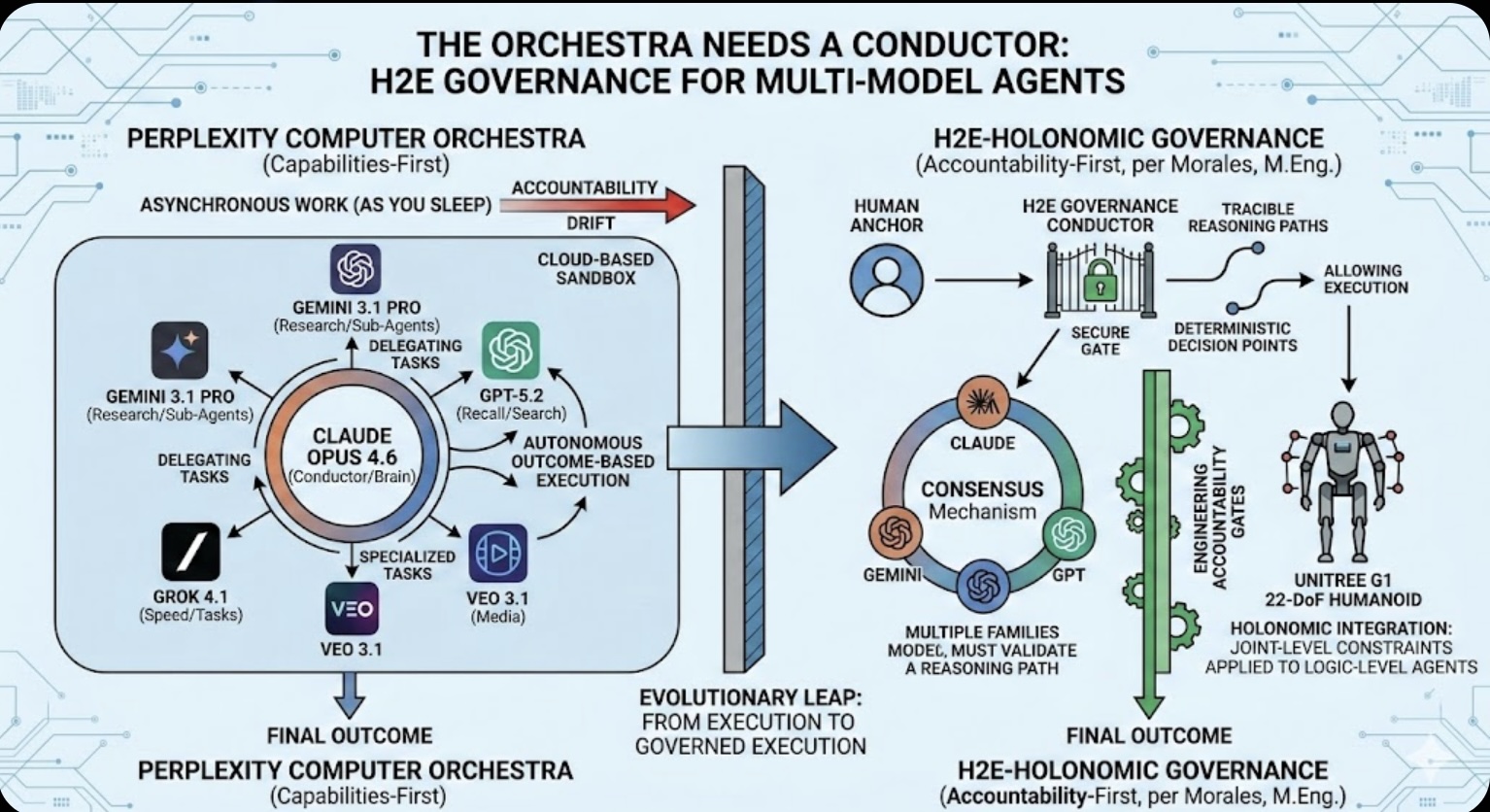

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

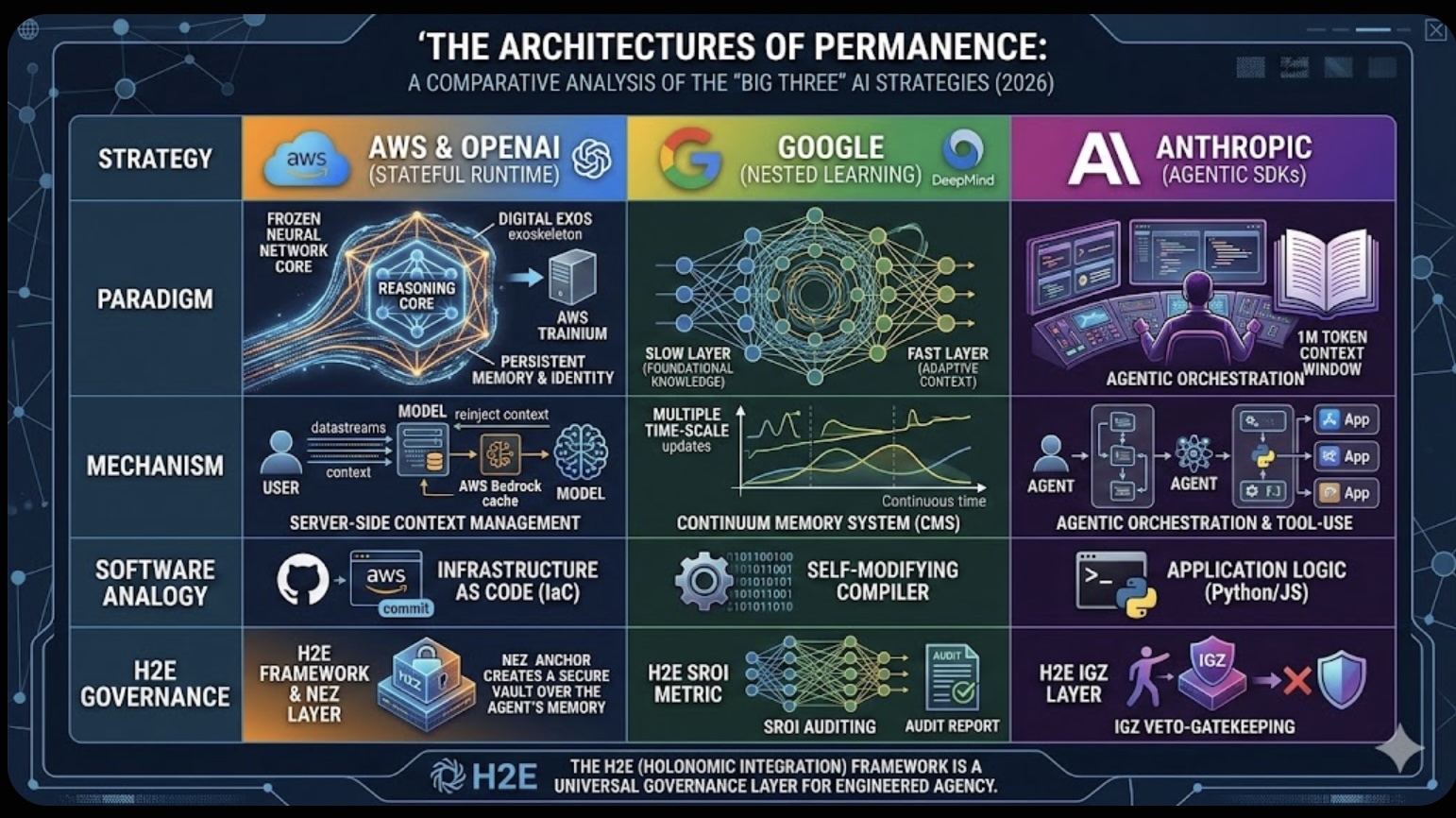

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

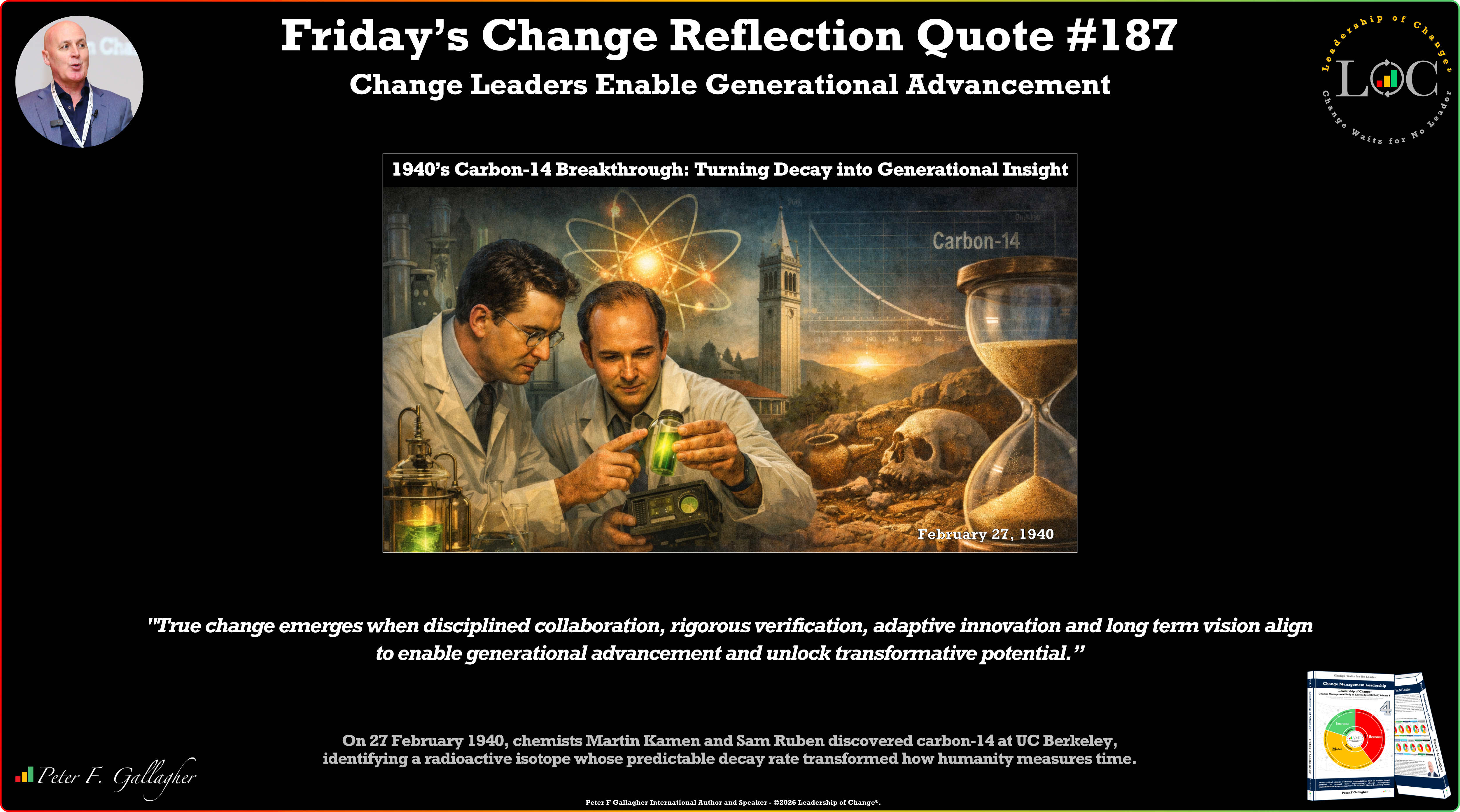

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026