My objective is to provide top quality FINTECH TRAINING FOR BANKERS.

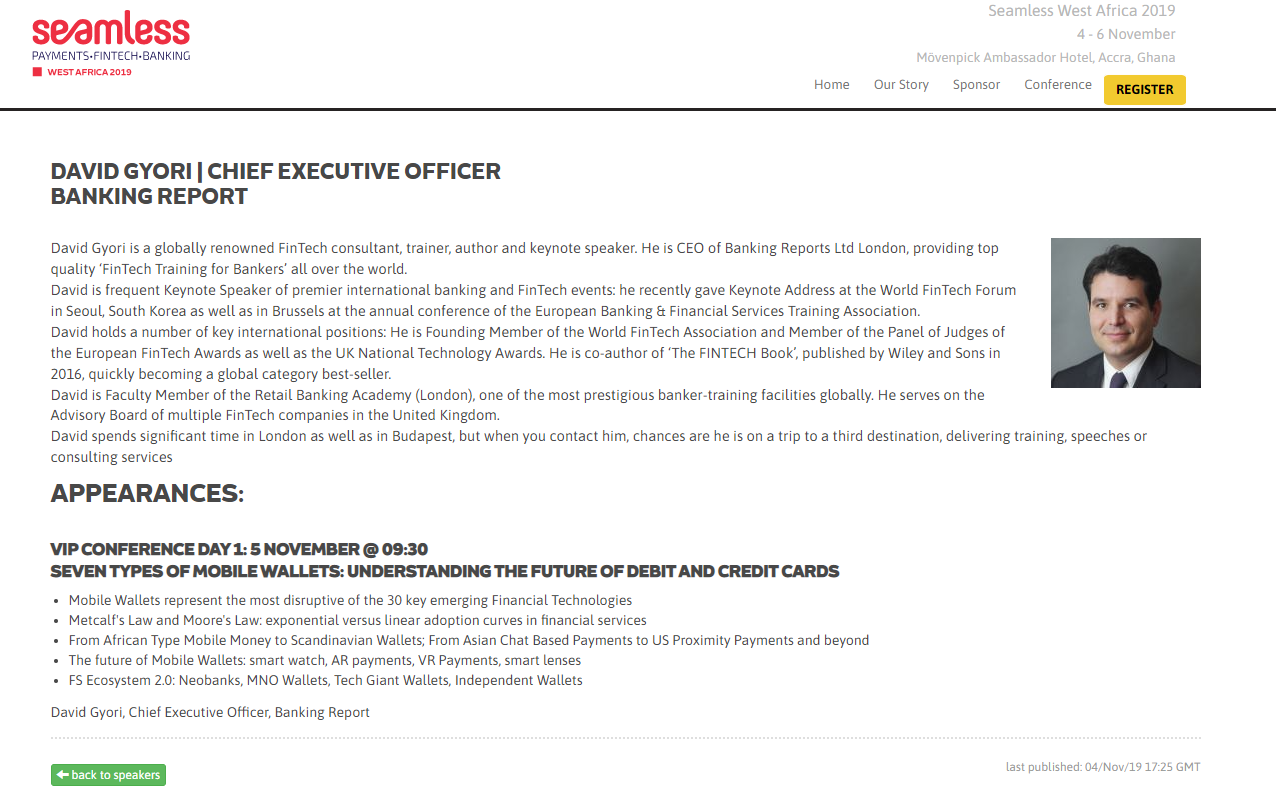

David Gyori is a globally renowned Financial Technology trainer, author, consultant, and keynote

speaker. David is CEO of Banking Reports London, providing top quality ‘FinTech Training for Bankers’ all over the world. He is a ‘Top 50 Global Thought Leader and Influencer on FinTech’.

David is co-author of five internationally published books:

+ ‘The FinTech Book’ (Wiley & Sons, London, 2016)

+ ‘The WealthTech Book’ (Wiley & Sons, London, 2018)

+ 'The PayTech Book' (Wiley & Sons, London, 2020)

+ 'The AI Book' (Wiley & Sons, London, 2020) as well as

+ ‘WealthTech: Wealth and Asset Management in the FinTech Age' (IAP, USA, 2019)

‘The FinTech Book’ has quickly risen to the status of a global best seller. It has been translated to 10 languages and being sold in 100+ countries.

David is frequent keynote speaker of top international banking and FinTech events. He has provided advanced training programs face to face as well as online in 50+ countries in five years.

David holds multiple key international positions: He is Founding Member of the World FinTech Association (Seoul); CEO of Banking Reports Limited (London); International Resource Director of The Asian Banker Group (Singapore); Member of the Panel of Judges of the ‘International Excellence in Retail Financial Services Program’ (one of the most rigorous, prestigious and transparent awards programs for consumer financial services worldwide) as well as Member of the Panel of Judges of the ‘Financial Technology Innovation Awards Program’ (Singapore).

David spends significant time in Budapest, London as well as the Adriatic and when you contact him chances are he is delivering one of his global best seller training programs face to face or online to leading bankers in one of the 50+ countries he is actively working in.

Available For: Advising, Authoring, Consulting, Influencing, Speaking

Travels From: London

Speaking Topics: FinTech, Digital Banking, Banking Innovation

| David Gyori | Points |

|---|---|

| Academic | 0 |

| Author | 320 |

| Influencer | 302 |

| Speaker | 50 |

| Entrepreneur | 130 |

| Total | 802 |

Points based upon Thinkers360 patent-pending algorithm.

Banking Frontiers Technoviti Awards

Banking Frontiers Technoviti Awards

Tags: AI, Blockchain, FinTech

Member of the Panel of Judges of the International Excellence in Retail Financial Services Program (Singapore)

Member of the Panel of Judges of the International Excellence in Retail Financial Services Program (Singapore)

Tags: Blockchain, Business Strategy, FinTech

Member of the Panel of Judges of the Financial Technology Innovation Awards Program (Singapore)

Member of the Panel of Judges of the Financial Technology Innovation Awards Program (Singapore)

Tags: AI, Blockchain, FinTech

Crypto Crash: The Capital Currency-Crisis Coming

Crypto Crash: The Capital Currency-Crisis Coming

Tags: Cryptocurrency, FinTech, Risk Management

10 WealthTech Trends

10 WealthTech Trends

Tags: Digital Transformation, FinTech, Innovation

21 Financial Technology Trends for 2021 by David Gyori

21 Financial Technology Trends for 2021 by David Gyori

Tags: AI, Business Strategy, FinTech

Intelligent Machines: The New Clients of Banks?

Intelligent Machines: The New Clients of Banks?

Tags: AI, Business Strategy, FinTech

Gamification in Banking

Gamification in Banking

Tags: Business Strategy, Digital Transformation, FinTech

20 WAYS BANKS CAN WIN AI

20 WAYS BANKS CAN WIN AI

Tags: AI, Emerging Technology, FinTech

AI in Banking

AI in Banking

Tags: AI, Digital Transformation, FinTech

The Next Generation of Payments? YES.

The Next Generation of Payments? YES.

Tags: Business Strategy, FinTech, Management

Interview with David Gyori, CEO of Banking Reports

Interview with David Gyori, CEO of Banking Reports

Tags: Business Strategy, FinTech, Risk Management

The Deutsche Moment : Why Uncertainty Around Deutsche Bank Marks the End of the 2008 Crisis?

The Deutsche Moment : Why Uncertainty Around Deutsche Bank Marks the End of the 2008 Crisis?

Tags: Business Strategy, FinTech, Risk Management

Albania: a Diamond Being Polished

Albania: a Diamond Being Polished

Tags: Business Strategy, FinTech, Risk Management

7 Versions of Brexit

7 Versions of Brexit

Tags: Business Strategy, FinTech, Risk Management

RISING STARS: Overview of the great opportunities of FinTech in Africa

RISING STARS: Overview of the great opportunities of FinTech in Africa

Tags: Blockchain, Cryptocurrency, FinTech

5+1 Key Points of the Greek Tragedy

5+1 Key Points of the Greek Tragedy

Tags: Digital Transformation, FinTech, Risk Management

LUXEMBOURG - The Best Kept FinTech-Secret

LUXEMBOURG - The Best Kept FinTech-Secret

Tags: Digital Disruption, Digital Transformation, FinTech

5+1 Reasons Why the FED Should Raise Rates in June

5+1 Reasons Why the FED Should Raise Rates in June

Tags: Business Strategy, FinTech, Risk Management

The AI Book

The AI Book

Tags: AI, Business Strategy, FinTech

The PayTech Book

The PayTech Book

Tags: Business Strategy, Digital Transformation, FinTech

WealthTech: Wealth and Asset Management in the FinTech Age

WealthTech: Wealth and Asset Management in the FinTech Age

Tags: AI, Business Strategy, FinTech

The WealthTech Book

The WealthTech Book

Tags: Business Strategy, Digital Transformation, FinTech

The FinTech Book

The FinTech Book

Tags: Business Strategy, Digital Transformation, FinTech

International Resource Director

International Resource Director

Tags: Blockchain, Business Strategy, FinTech

CEO

CEO

Tags: Blockchain, Business Strategy, FinTech

Founding Member

Founding Member

Tags: Blockchain, FinTech, Risk Management

CEO

CEO

Tags: Blockchain, Business Strategy, FinTech

Chairman of FINNOVEX Europe 2022

Chairman of FINNOVEX Europe 2022

Tags: Digital Transformation, FinTech, Business Strategy

How My Knowledge from Budapest Corvinus University Helps Me Professionally

How My Knowledge from Budapest Corvinus University Helps Me Professionally

Tags: Business Strategy, FinTech, Management

SEVEN TYPES OF MOBILE WALLETS: UNDERSTANDING THE FUTURE OF DEBIT AND CREDIT CARDS

SEVEN TYPES OF MOBILE WALLETS: UNDERSTANDING THE FUTURE OF DEBIT AND CREDIT CARDS

Tags: FinTech, Mobility, Risk Management

Sanctions, SWIFT, Crypto, the Metaverse: how can future banking leaders adapt to the Fintech disruption

Sanctions, SWIFT, Crypto, the Metaverse: how can future banking leaders adapt to the Fintech disruption

Tags: Cybersecurity, FinTech, Risk Management

Tags: Business Strategy, Digital Transformation, FinTech

Tags: AI, Digital Transformation, FinTech

The word is "Empathy" | AGI Inception Ep 9 | AI Podcast | David Gyori Fintech Influencer | On AiRR

The word is "Empathy" | AGI Inception Ep 9 | AI Podcast | David Gyori Fintech Influencer | On AiRR

Tags: AI, Business Strategy, FinTech

Tags: AI, Business Strategy, FinTech

Tags: AI, Business Strategy, FinTech

EIAC Discusses FinTech with Mr. David Gyori

EIAC Discusses FinTech with Mr. David Gyori

Tags: AI, Business Strategy, FinTech

Tags: AI, Business Strategy, FinTech

Banking in 2050: What does the future hold?

Banking in 2050: What does the future hold?

Tags: Business Strategy, FinTech, Innovation

Tags: Business Strategy, Digital Transformation, FinTech

Global FinTech Summit

Global FinTech Summit

Tags: Blockchain, Business Strategy, FinTech

Panel Moderator of the Innovators Panel at FINNOVEX Europe 2022

Panel Moderator of the Innovators Panel at FINNOVEX Europe 2022

Tags: Business Strategy, Digital Transformation, FinTech

CBDC Masterclass: Central Bank Digital Currencies, Banking in the Age of Cashless Society

CBDC Masterclass: Central Bank Digital Currencies, Banking in the Age of Cashless Society

Tags: Blockchain, FinTech, Business Strategy

Risk Management in the Age of FinTech

Risk Management in the Age of FinTech

Tags: Cybersecurity, FinTech, Risk Management

CRM Fundamentals and Practice

CRM Fundamentals and Practice

Tags: Business Strategy, CRM, Digital Transformation

Blockchain in Mortgage Securitization

Blockchain in Mortgage Securitization

Tags: Blockchain, Business Strategy, FinTech

Tags: AI, Business Strategy, FinTech

Tags: Blockchain, Business Strategy, FinTech

Ambidextrous Organization Strategy: 10 Factors of Success

Ambidextrous Organization Strategy: 10 Factors of Success

Building an Ambidextrous Organization is one of the best strategic answers to digital market disruption, yet corporations around the globe struggle to implement it successfully. Learning from case studies of traditional banks setting up digital-only subsidiaries I am sharing 10 factors of success delivering the Ambidextrous Organization Strategy!

Allocate Over USD 1 Billion Over 7+ Years Into Your Digital Unit

#1 Factor of Success

Building a successful and profitable digital-only unit is very expensive and slow. Case studies in banking show that total investment has to be over USD 1 BN and minimum 7 years have to pass to break even. Corporate decision makers around the world typically underestimate the strategic magnitude and duration of this "project" by one magnitude.

Make Sure Functional Areas are Present in Both Units Separately and Independently

#2 Factor of Success

After 50 years of massive mantra in mainstream management-literature of 'getting rid of redundancies' and 'have only and exactly one of each functional area in your organization' it is hard to cut your company into two horizontal units and duplicate every functional area. Yet this is the winning formula. A marketing department in your 'Business as Usual' Unit and a totally separate and independent marketing department in your 'Emerging Business' unit. And the same with HR, IT, Procurement, Legal, Compliance, Sales, R&D, etc.

Manage Inter-Unit Conflicts Proactively

#3 Factor of Success

There are constant conflicts between the units. The Top Management of your organization must manage these inter-unit conflicts consciously and proactively. When USA Today set an 'internet journalism' unit up in the early 2000s the traditional journalists of the Business as Usual print unit were furious and claimed what the new unit is doing has nothing to do with what they call 'journalism'. Banks and other corporations setting up Emerging Business Units have to cross finance these heavily and over the course of many years from the profit of Business and Usual. This heavy and persistent one way street style, asymmetric cross financing between the units causes virulent conflicts which the top management has to proactively manage.

Create and Tell Your Crystal Clear Strategic Narrative

#4 Factor of Success

Even the most practiced shareholders often have a hard time to understand 'why' you - the CEO - decide to create and Ambidextrous Organization. You have to have a very smart, honest, confident and balanced, public and open, sophisticated and simple Strategic Narrative to explain it. To explain it to: the board, to your colleagues, to the mid-management, to operative employees, to the shareholders, to clients, to potential clients, to the media, to the wider public, to vendors, to business partners, to suppliers and yes, even to competitors 'why' you are doing this. In order to do this successfully and build your first class strategic narrative you must be very familiar with the April 2004 article of Charles A. O'Reilly and Michael L. Tushman in Harvard Business Review (HBR) titled 'The Ambidextrous Organization'.

Define Different KPIs for Different Units

#5 Factor of Success

Business as Usual and Emerging Business have different tactical objectives. Therefore they need to have different KPIs (Key Performance Indicators). For Business as Usual profitability, CIR (Cost to Income Ratio), ROI and some other well known metrics are adequate. Yet, for Emerging Business these metrics are meaningless and even misleading in the first years. Number of Millennial and GEN Z users or number of clicks to onboard would be much more meaningful KPIs. This is how Emirates NBD - the market-leading retail bank in the United Arab Emirates - differentiates KPIs between its core business the digital-only banking unit set up in February 2017 under the brand name 'Liv'.

Cherish Cross-Cannibalization Between Units

#6 Factor of Success

"What if some clients go from the old unit to the new one? We are cannibalizing ourselves!" I hear this line of thought very often from senior decision makers in banking, They intend to ue this as an argument against the ambidextrous structure. Thinking about it deeper it is quite apparent that this in fact is an argument pro ambidexterity. As a smart CEO from a major bank put it: "I want to make our bank the company which disrupts us." Make no mistake: Cannibalization between units is in fact the sign of loud success and meaningful transition.

Avoid Stigma of Failure in Emerging Business

#7 Factor of Success

Fail often and fail fast. This is the new 'modus vivendi' (Latin phrase that means "mode of living" or "way of life") at times of disruption and market inflexion. Intel has set a New Business Unit up in an ambidextrous manner. Only 5 of their 48 projects in this unit succeeded. Avoid stigma of failure in your emerging business unit. Use pretotyping as a product-development method. (In a later Blog here in Thinkers 360 I will write about 'pretotyping'.)

Stretch the Brand as Far as You Wish

#8 Factor of Success

Go with the flow when it comes to branding your Emerging Business Unit. There are different schools here among consultants, pundits, advisors, executives, business schools and marketing gurus. Guess what? Empiric observations show that:

A. Using your original brand;

B. Using a new brand but with similar colors, shapes and characteristics as the original;

C. Using the original brand but with different colors;

D. Using a totally new brand with totally different characteristics but referring back to the old one such as 'Liv by Emirates NBD';

E. Using a totally independent brand without linking it to ypur Business as Usual.

are equally efficient and good. Do not get stuck with making meticulous arguments for or against one of the above. This will not be a strategic factor.

(*Empiric observations refer to my observations of dozens of case studies of banks and other financial services providers going ambidextrous.)

Keep Your Senior Team Perfectly Intact

#9 Factor of Success

While the two units have to be horizontally independent, they are connected by the senior management. Keeping the top management intact and impartially open towards supporting both units is key. Avoid the situation when Organizational Ambidexterity directly or indirectly divides your senior team. The philosophy of 'Divide et impera' was great for Caesar, but we are now 22 centuries ahead.

Harness Your Past to Build Your Future

#10 Factor of Success

You past, your traditions, your incumbent position, your existing clientele are key resources to win your transition into your future. It is a mystery and a conundrum to me why - even some great - leaders often perceive the past of their company as something to cancel, delete, forget, unlearn, reverse and minimise. There is continuity between your company's past and future even if there is discontinuity and disruption on a market, industry and technology level. One of the beauties of The Ambidextrous Organization Strategy is that this strategy honors your existing business and uses it as a resource to build your future.

The Ambidextrous Organization Strategy is a powerful tool to make your company a winner of disruption! Yet many leaders fail to implement it the right way. Consider my '10 Factors of Success' and see you in the 22nd Century!

Tags: Digital Transformation, FinTech, Business Strategy

Consulting on Digital Transition in Banking

Consulting on Digital Transition in Banking

Location: London, Global Fees: 2000 per day

Service Type: Service Offered

Risk Management in the Age of FinTech Training Program

Risk Management in the Age of FinTech Training Program

Location: Johannesburg, South Africa (online, global) Date : December 01, 2021 - December 03, 2021 Organizer: Masterclass Events South Africa and Banking Reports London