* DELIVERY-FOCUSED CONSULTANT, INTEGRATION DIRECTOR, CHARTERED ACCOUNTANT, PROGRAMME DIRECTOR: 30+ years’ leadership across multibillion M&A advisory, pre/post-merger integrations, business transformations and regulatory programmes for Banking, Financial Services, Oil, Apparel, Media, and Technology / FinTech clients.

* PORTFOLIO DELIVERY, STRATEGY: I establish clear strategies, determine standards, governance frameworks, and appreciate global cultural differences, building performant transformation and integration teams to execute programmes that achieve benefits realisation and ROI. With my focus on critical details and issues; I bring clarity, and direct resources to solve problems and achieve investor-centric outcomes; supporting both start-ups and established multinational companies in achieving business mission, strategy, objectives, and performance targets.

* BOARD, C-SUITE, STAKEHOLDER INFLUENCE: with my credibility and gravitas that fosters trusted relations, shapes strategic vision, and defines clear agenda and direction – I maximise best practice PMO, technology innovation, Agile project methodologies and organisational investment to accomplish corporate vision.

* MITIGATES RISK, LEGAL, REGULATORY, REPUTATIONAL: with my deep-rooted multijurisdictional knowledge, end-to-end deal lifecycle, organisational change and cross-border financial expertise that enables seamless delivery of buy- and sell-side M&A projects.

* GLOBAL AWARENESS, CONFIDENCE, RESULTS: my unique global perspective and multicultural awareness, I have delivered change across EMEA, Asia-Pacific and the Americas.

Building trusted advisor relations and inspiring the confidence of the Board, C-suite leaders, and senior decision-makers; I am repeatedly called upon to advise on strategy, roadmaps, and solutions to lead programmes that realise long-term tangible results.

* TRANSFORMATIONS, INNOVATION: I am highly skilled at shaping successful transformations and deploying innovation, new approaches and digital solutions to ensure teams can deliver realistic and sustainable business benefit; understanding the broader picture whilst assessing risk and change complexity.

* CULTURE, CAPABILITY: I thrive in challenging environments, building on existing strengths and cultures to add value and commercial benefit with a reputation for establishing scalable, resilient, and fit-for-purpose solutions that elevate operational excellence, staff engagement and consumer experience.

Available For: Advising, Consulting, Influencing, Speaking

Travels From: London, England , United Kingdom

Speaking Topics: ESG, Banking in the new world , Leadership in challenging times

| John Martin | Points |

|---|---|

| Academic | 0 |

| Author | 15 |

| Influencer | 43 |

| Speaker | 6 |

| Entrepreneur | 130 |

| Total | 194 |

Points based upon Thinkers360 patent-pending algorithm.

Harnessing AI in Private Equity: How John Martin and Plutus Consulting Group see 2025 as a transformational year for dealmaking

Harnessing AI in Private Equity: How John Martin and Plutus Consulting Group see 2025 as a transformational year for dealmaking

Tags: Business Strategy, Digital Transformation, FinTech

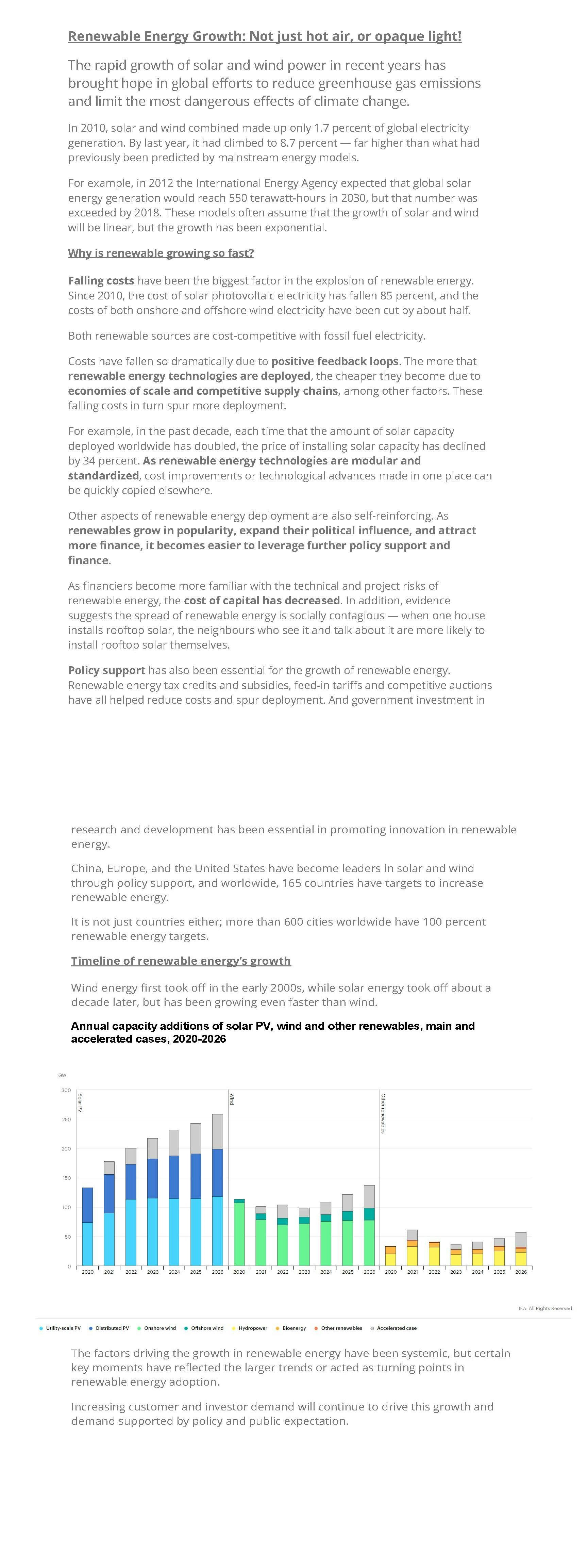

Renewable Energy Growth: Not just hot air, or opaque light!

Renewable Energy Growth: Not just hot air, or opaque light!

Tags: Renewable Energy

Climate Change investments – 3 ‘R’s (Reduce, Remove and Retrofit)

Climate Change investments – 3 ‘R’s (Reduce, Remove and Retrofit)

Tags: Sustainability, Entrepreneurship, Climate Change

The growing role of audit in ESG information integrity and assurance

The growing role of audit in ESG information integrity and assurance

Tags: Emerging Technology, Future of Work, Mergers and Acquisitions

ESG Reporting: A summary of challenges

ESG Reporting: A summary of challenges

Tags: Management, Mergers and Acquisitions, Project Management

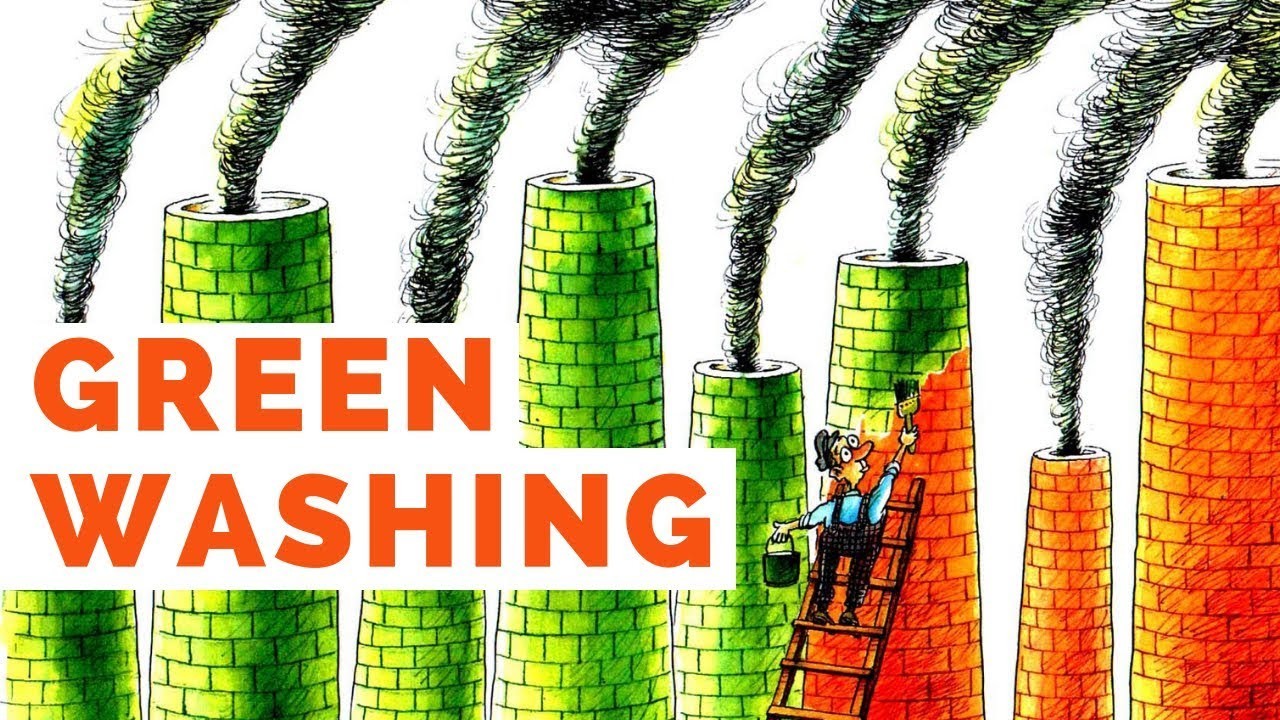

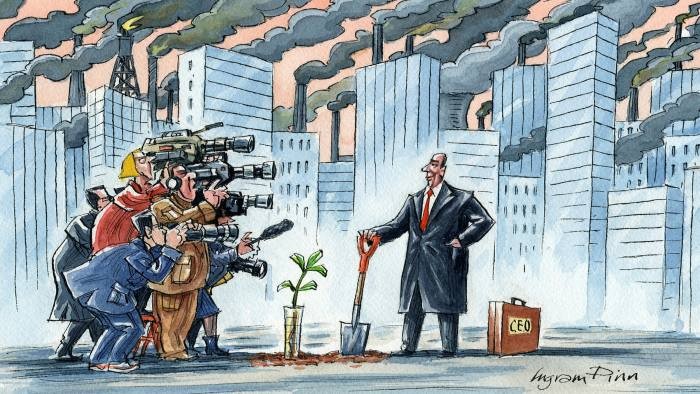

Greenwashing in the news, yet again…. No, not ‘washday’ in Ireland!

Greenwashing in the news, yet again…. No, not ‘washday’ in Ireland!

Tags: Management, Mergers and Acquisitions, Project Management

Why CIOs must prioritise system integration in 2022 and beyond

Why CIOs must prioritise system integration in 2022 and beyond

Tags: Analytics, Risk Management

GPMIP: UK Financial Services – reconciling M&A strategy & deal delivery

GPMIP: UK Financial Services – reconciling M&A strategy & deal delivery

Tags: Business Strategy, Mergers and Acquisitions, Project Management

Responsible Banking - a myth of truth?

Responsible Banking - a myth of truth?

Tags: FinTech, Business Strategy, Mergers and Acquisitions

Are Big Oil companies doing enough to change ‘behaviours’?

Are Big Oil companies doing enough to change ‘behaviours’?

Tags: Leadership, Business Strategy, Climate Change

The End of LIBOR….December 2021 – you think it is way off.?

The End of LIBOR….December 2021 – you think it is way off.?

Tags: Social, Leadership, Mergers and Acquisitions

The Growth of Populism..

The Growth of Populism..

Tags: Innovation, Leadership, Business Strategy

Transparency and Collaboration....

Transparency and Collaboration....

Tags: Social, Leadership

Globalisation and Power shifts

Globalisation and Power shifts

Tags: Social, Leadership, Business Strategy

Cybersecurity Risks of Automotive Over the Air (OTA) technology

Cybersecurity Risks of Automotive Over the Air (OTA) technology

Tags: AI, Autonomous Vehicles, Cloud

Why businesses cannot afford to overlook cyber security due diligence in modern day M&A

Why businesses cannot afford to overlook cyber security due diligence in modern day M&A

Tags: Big Data, Cloud, FinTech

ESG Energy Trends: From Transition to Transformation

ESG Energy Trends: From Transition to Transformation

Tags: Business Strategy, Emerging Technology, Renewable Energy

Plutus Consulting Group Limited

Plutus Consulting Group Limited

Tags: Leadership, Entrepreneurship, Mergers and Acquisitions

ESG and Sustainable IT – Not a ‘Nice to Have’

ESG and Sustainable IT – Not a ‘Nice to Have’

Tags: CSR, Emerging Technology, Sustainability

Tags: Social, Leadership, Business Strategy

Unlocking the Power of ESG Data Management: How to Optimize Your Environmental, Social, and Governance Programmes

Unlocking the Power of ESG Data Management: How to Optimize Your Environmental, Social, and Governance Programmes

Tags: Analytics, Ecosystems, Sustainability

A Thought Leadership Group Driving Sustainable Change with Plutus ESG Sustainability Hive

A Thought Leadership Group Driving Sustainable Change with Plutus ESG Sustainability Hive

Tags: Analytics, Climate Change, Sustainability

‘Greenhushing’ and why is it a risk for sustainability professionals?

‘Greenhushing’ and why is it a risk for sustainability professionals?

Tags: Climate Change, Ecosystems, Sustainability

Mergers and Acquisitions: What's the Difference?

Mergers and Acquisitions: What's the Difference?

Tags: Business Strategy, Change Management, Mergers and Acquisitions

Rising living costs hamper EV adoption

Rising living costs hamper EV adoption

Tags: Emerging Technology, Innovation, Mobility

African minerals are critical for the green energy transition

African minerals are critical for the green energy transition

Tags: Ecosystems, Procurement, Renewable Energy

With Sustainability Analytics, Big Data Can Save the World

With Sustainability Analytics, Big Data Can Save the World

Tags: CSR, Data Center, Sustainability

COP27 outcomes: Key takeaways from the final agreement

COP27 outcomes: Key takeaways from the final agreement

Tags: Leadership, Social, Sustainability

FCA Consultation Paper on UK Sustainability Disclosure Requirements (SDR)

FCA Consultation Paper on UK Sustainability Disclosure Requirements (SDR)

Tags: Leadership, Management, Sustainability

Regulations can burden small businesses, but our experience shows they can also help them grow.

Regulations can burden small businesses, but our experience shows they can also help them grow.

Tags: Entrepreneurship, Future of Work, Startups

Changing the approach to ESG regulation after Brexit

Changing the approach to ESG regulation after Brexit

Tags: CSR, GovTech, Sustainability

COP27: a year on from the Glasgow climate pact, the world is burning more fossil fuels than ever

COP27: a year on from the Glasgow climate pact, the world is burning more fossil fuels than ever

Tags: Climate Change, Renewable Energy, Sustainability

ESG Reporting - the current challenges

ESG Reporting - the current challenges

Tags: Analytics, Business Strategy, Climate Change

DISRUPTING THE TRADITIONAL CONSULTING MODEL

DISRUPTING THE TRADITIONAL CONSULTING MODEL

Tags: Analytics, Climate Change, Innovation

Avoid falling short of new operational resilience regulations which came into force in the UK, yesterday.

Avoid falling short of new operational resilience regulations which came into force in the UK, yesterday.

Tags: GovTech, Predictive Analytics, Risk Management

Diamonds - does the Kimberley process work?

Diamonds - does the Kimberley process work?

Tags: Analytics, Ecosystems, Entrepreneurship

Globalisation and changing dynamics

Globalisation and changing dynamics

Tags: Business Continuity, Culture, Entrepreneurship

Tags: Culture, Innovation, Management

Achieving Operational Resilience through risk management and AI

Achieving Operational Resilience through risk management and AI

Tags: AI, Cybersecurity, Risk Management

What Business Leaders Need To Know About Sustainable Technology

What Business Leaders Need To Know About Sustainable Technology

Tags: Business Strategy, Digital Disruption, Sustainability

How Sustainability Efforts Fall Apart

How Sustainability Efforts Fall Apart

Tags: Business Strategy, Ecosystems, Renewable Energy

ICRS Central London Hub / University of West London panel discussion - A Career in Sustainability

ICRS Central London Hub / University of West London panel discussion - A Career in Sustainability

Tags: CSR, Health and Wellness, Sustainability

UKSIF Autumn Conference - How can fixed income investing drive progress to net zero?

UKSIF Autumn Conference - How can fixed income investing drive progress to net zero?

Tags: Climate Change, Leadership, Sustainability

Company readiness - ESG performance evaluation

Company readiness - ESG performance evaluation

Tags: Change Management, Ecosystems, Sustainability

Tags: Innovation, FinTech, Business Strategy

The SPAC bubble era is coming to an end?

The SPAC bubble era is coming to an end?

On Wall Street, 2021 became known as the year of the SPAC and it seemed that everyone was getting involved, from former politicians to sports stars, rappers to celebrities. Special Purpose Acquisition Companies, or SPACs, are nothing new in the world of investing. They first emerged in the 1980s, but have been in the spotlight since 2020, creating a bubble that has grown so big many experts believe it’s about to burst.

SPACs, are publicly traded shells designed with the goal of merging with real profitable businesses and have raised tens of billions of dollars over the past year or so. They have come under fire as many young, volatile businesses are skipping stringent IPO norms, going public and receiving SPAC support without necessarily warranting it.

Furthermore, the SPACs of today are often structured so that those sponsoring them can profit even if regular shareholders suffer. Overly optimistic valuations and forecasting made by companies going public via SPACs—without the usual checks and balances—can grow future profits for some, but not others.

Combine the SPAC hype with the high price-to-earnings ratio (P/E ratio) of the NASDAQ and experienced investors are warning of red flags. A P/E ratio over 30 suggests the market is overvalued, as Wall Street fails to support extreme valuation for long periods of time.

With an average NASDAQ P/E ratio over 30 in the past year, there are fears that it is an indicator of trouble ahead. History shows that a high P/E ratio is a strong signal of stock market crashes.

In a confusing market where overconfidence leads to instability, there are few IPOs and SPACs that are truly worth investing in. Is this the case?

A thought to ponder whilst I continue looking for the next unicorn.

Tags: Business Strategy, Mergers and Acquisitions, Risk Management

Why we need to fix the plastic pollution problem

Why we need to fix the plastic pollution problem

Marine litter and plastic pollution endangers aquatic life, threatens human health and results in myriad hidden costs for the economy. Such a global threat requires a global response, and the upcoming United Nations Environment Assembly (UNEA) is an important stage for governments and policymakers to catalyse change.

At the resumed fifth session of UNEA – held virtually and in-person in Nairobi between February and March – world leaders will focus on plastics and deliberate on proposals with the aim of establishing an Intergovernmental Negotiating Committee INC to work towards a legally binding global agreement.

Marine litter and plastic pollution can alter habitats and natural processes, reducing ecosystems’ ability to adapt to the climate crisis, according to UNEP’s From Pollution to Solution report. This affects millions of people’s livelihoods, food security and social well-being. Urgent, multilateral action is needed to identify where plastic waste enters waterways and how to put in place ‘prevention’ incentives to minimise this occurrence.

In North America, through the Mississippi River Plastic Pollution Initiative, UNEP engages citizen science by working with thousands of community volunteers to track upstream and coastal plastic pollution data along the Mississippi River. This data is collected using a free, open-source mobile app called the Marine Debris Tracker.

In South-East Asia, UNEP’s CounterMEASURE project identifies sources and pathways of plastic pollution in river systems, particularly the Mekong and the Ganges. With the use of technologies and innovative approaches like GIS, machine learning and drones, the project has developed plastic leakage models for localities in six countries that can be scaled and replicated across continents.

To highlight the scale of the issue, UNEP has prepared a plastics exhibit in Nairobi for UNEA. The exhibit presents visitors with a visual representation of key data related to the plastic pollution problem by using plastic waste collected on the Kenyan coast.

UNEP’s body of work demonstrates that the problem of plastic pollution doesn’t exist in a vacuum. The environmental, social, economic and health risks of plastics need to be assessed alongside other environmental stressors, like climate change, ecosystem degradation and resource use.

Identifying where plastic emissions are coming from really matters for how we tackle it. Rich countries emit very little – this means domestic strategies to reduce plastics in these countries will not make much difference to ocean plastics.

What rich countries can do is support low-to-middle income countries in improving waste management infrastructure - it’s key to tackling plastic pollution. And, importantly, they can ban the export of any plastics to other countries where it could be mismanaged.

Understanding the distribution of emissions across the world’s rivers is also crucial. Our strategy for tackling this problem is vastly different if we only must focus on a few or even tens of the world’s largest rivers (as previous studies suggested) versus thousands of smaller ones.

To stop plastic pollution in our oceans we need a global approach to reducing plastic waste and managing it appropriately to stop it leaking into the natural environment. Focusing on a few rivers will not be enough.

Tags: Ecosystems, Emerging Technology, Sustainability

TCFD reporting - ESG data

TCFD reporting - ESG data

The UK is becoming and will become a world leader in sustainability reporting, being the first major economy to implement regulation on the TCFD framework, this April.

Time will tell.

The TCFD framework was developed by the Task Force on Climate-related Financial Disclosures, established by the G20 - to encourage companies to report on their climate-related financial risks and opportunities, setting expectations of investor requirements of better understanding company’s exposure and how they manage risk.

I don’t like, ‘To encourage companies’ (Too soft)

There are two sets of recommendations, one for non-financial companies, and one for financial institutions, whilst not mandatory yet, but are intended to provide guidance on how companies can provide relevant information about climate change risks and opportunities in a consistent way.

ESG reporting has its challenges –confusing voluminous data, not standardised and lacking consistency.

To start with. (I can see my English teacher frowning already!)

We have a long way to go.

Let us have a chat.

Tags: Analytics, Climate Change, Risk Management

Chief Executive Officer and Founder

Chief Executive Officer and Founder

Location: Global, based in the United Kingdom Fees: 1500 per day

Service Type: Service Offered

Chief Executive Officer and Founder

Chief Executive Officer and Founder

Location: Global, based in the United Kingdom Fees: 1500 per day

Service Type: Service Offered