From Policy to Prevention – Sustainable Insurance with Data and Services

VVP

March 24, 2025

Whether it concerns property, casualty, pension, health, or life: the insurance sector provides a crucial safety net for individuals and businesses and is indispensable as the lubricant of economic activity and our daily lives. At the same time, we recognize that we are reaching the limits of the traditional insurance model. The sector faces a multitude of challenges: customer expectations, sustainability, responsible investing, all against a backdrop of climate change, new risks, stricter laws and regulations, and a turbulent global environment. How can the insurance world evolve in these turbulent times to maintain its role as a reliable partner?

See publication

Tags: Digital Transformation, Innovation, InsurTech

From Policy to Prevention – The Sustainable Future of Insurance

LinkedIn

April 09, 2024

Ten years ago, innovation in the insurance world was primarily driven by the seemingly boundless possibilities of technology. Now, there is a much more fundamental reason to question the existing framework: the rapidly changing risk landscape. The key to a sustainable, future-proof sector and meaningful customer relationships lies in smartly combining insurance and prevention.

See publication

Tags: InsurTech, IoT, Risk Management

De duurzame toekomst van verzekeren (article in Dutch)

New Financial Forum / VVP

March 22, 2024

"Tien jaar geleden werd vernieuwing in de verzekeringswereld vooral aangejaagd door de schijnbaar onbegrensde mogelijkheden van technologie. Nu is er een fundamentelere reden om de bestaande inrichting ter discussie te stellen, namelijk het sterk veranderende risicolandschap. De sleutel voor een duurzame, toekomstbestendige sector en een betekenisvolle klantrelatie ligt in het slim combineren van verzekeren en preventie. Voor verzekeraars de kans om nu de regie te nemen in een onvoorspelbare en onzekere wereld.

See publication

Tags: InsurTech, IoT, Risk Management

An innovation culture starts with an innovation structure

An innovation culture starts with an innovation structure

LinkedIn

April 28, 2022

We often talk about the culture of an organization. In the corridors or in the coffee corner. In meetings and brainstorm sessions. We all want to work on a more innovation-oriented culture.

Everyone has his or her own ideas about what exactly that organizational culture is. For now, let's describe culture as the norms, values and expressions of behavior that are shared by the members of an organization. Every organization has its own unique culture. But to say that it has now become a tangible concept? Sure, you can describe and categorize elements of a culture, but can you really put your finger on it?

Yet culture is seen as a crucial factor for the functioning of organizations. This can make the difference between going down ingloriously or surviving successfully. Between coloring neatly within the lines or cutting a corner when no one is looking. Between responding to change or sticking to the existing. We are all familiar with countless examples of the effects of culture, whether this has a positive or negative effect.

At the same time, we would like to work in organizations where entrepreneurship, personal responsibility and innovation are stimulated. Where there is room to experiment. Where failure is allowed without ending your career. In short: where there is a real innovation culture.

Does this mean we should let go of the reins and let everyone do their thing in freedom? On the contrary. My thesis: an innovation culture requires an innovation structure.

[Article in Dutch]

See publication

Tags: Business Strategy, Culture, Innovation

Insurtech Trends Update – 2022

Insurtech Trends Update – 2022

Insurance Thoughtleadership

January 03, 2022

The insurance sector is facing unprecedented change in a rapidly evolving environment.

Energy transition, circular economy, urbanization, digitization: these trends have far-reaching consequences for the way we live and work. From sustainable investing to healthy living, from sensor revolution to climate change – the playing field has become incredibly varied and complex over a relatively short period of time. How is this playing out for the insurance sector?

Amidst the abundance of sector reports by industry analysts, reinsurers, sector associations and consultancies, we provide you with a recap of what we believe are the key trends to monitor closely – for 2022 and beyond.

See publication

Tags: Innovation, InsurTech, Business Strategy

Insurtech Trends Update – 2022

Insurtech Trends Update – 2022

Holland Fintech

November 13, 2021

The insurance sector is facing unprecedented change in a rapidly evolving environment.

Energy transition, circular economy, urbanization, digitization: these trends have far-reaching consequences for the way we live and work. From sustainable investing to healthy living, from sensor revolution to climate change – the playing field has become incredibly varied and complex over a relatively short period of time. How is this playing out for the insurance sector?

Amidst the abundance of sector reports by industry analysts, reinsurers, sector associations and consultancies, we provide you with a recap of what we believe are the key trends to monitor closely – for 2022 and beyond.

See publication

Tags: IoT, InsurTech

From policy to purpose: Safety as a compass for the insurance sector (article in Dutch)

From policy to purpose: Safety as a compass for the insurance sector (article in Dutch)

Beursbengel

June 11, 2021

In these special times we realize that we are more vulnerable than thought, both personally and in our working lives. We try we get to grips with the risks we face. It's not obvious that after an unforeseen event everything can be undone be with money, care or repair. Prevention is therefore better than cure. With new risks and less and less predictive power from historical data, we are facing the challenge to increase our social resilience. In front of insurers - the experts in this field - this naturally offers opportunities: to

develop new propositions that contribute to sustainable value, long-term customer relevance and social responsibility. But that's not so easy.

See publication

Tags: Digital Transformation, Innovation, InsurTech

How Insurers Can Help Reduce Car Accidents

How Insurers Can Help Reduce Car Accidents

Insurance Thoughtleadership

September 29, 2020

It's high time to complement government's top-down approaches on road safety with bottom-up activities addressing behavioral change by individuals.

See publication

Tags: Digital Transformation, InsurTech, Predictive Analytics

Can the government actually change? (article in Dutch)

IT Executive

May 12, 2020

The world around us is changing at a rapid pace. This brings opportunities and threats for organizations in every sector. In order to set up the preconditions for a successful transformation towards a digital government, we should not only outline the IT services perspective but also take a close look at performance when it comes to successfully realizing large-scale transformations. The importance of a well-developed organizational change capacity cannot be emphasized enough. Change capacity therefore deserves attention in the context of the NL IT Delta Plan initiative.

See publication

Tags: Change Management, Digital Transformation, Project Management

The Future of Insurance Is… Not Insurance

The Future of Insurance Is… Not Insurance

LinkedIn

April 06, 2020

The classical insurance business model has been successful for a long time but does not stack up to modern standards. Nowadays, just a policy no longer provides the best solution for managing risks. Why wait until something happens when the technology and data are available to actually reduce the chance or impact of an unforeseen event?

See publication

Tags: Digital Transformation, Innovation, InsurTech

Future of Insurance Is… Not Insurance

Future of Insurance Is… Not Insurance

Insurance Thoughtleadership

February 07, 2020

There is only one sensible way forward: to rebalance insurance and prevention, going from managing policies to managing risks.

See publication

Tags: Digital Transformation, Innovation, InsurTech

The dark matter problem in Insurance

The dark matter problem in Insurance

LinkedIn

August 14, 2019

The dark matter problem astronomers are struggling with is a metaphor for traditional insurance companies. It feels invisible matter makes it difficult to effectively change the course of such an organisation.

See publication

Tags: Change Management, Innovation, InsurTech

Lack of Organisational Adaptability Threatens Digital Transformation

Lack of Organisational Adaptability Threatens Digital Transformation

linkedin

July 24, 2018

An often overlooked critical competency of an organisation is its adaptability – the capacity of an organisation to effectively respond to new demands and circumstances, whether it’s customer-, regulator- or technology-driven.

See publication

Tags: Change Management, Digital Transformation, Innovation

It's life insurance, Jim. But not as we know it – Part 3

It's life insurance, Jim. But not as we know it – Part 3

linkedin

March 12, 2018

The article below has been based on a keynote presentation delivered at the Euro Events Life Insurance & Pensions Conference in Amsterdam on November 16th 2017. This is part 3. The previous parts can be found here and here.

See publication

Tags: Business Strategy, Innovation, InsurTech

It's life insurance, Jim. But not as we know it – Part 2

It's life insurance, Jim. But not as we know it – Part 2

linkedin

January 29, 2018

The article below has been based on a keynote presentation delivered at the Euro Events Life Insurance & Pensions Conference in Amsterdam on November 16th 2017. This is part 2, written with co-author Sophie Reynvaan. Part 1 can be found here.

See publication

Tags: Digital Transformation, Innovation, InsurTech

It’s Life, Jim, but Not as We Know It - Part 1

It’s Life, Jim, but Not as We Know It - Part 1

Insurance Thoughtleadership

December 14, 2017

Can life insurance become as hot and sexy as sci-fi, or at least an iPhone? Article based on a keynote presentation delivered at the Euro Events Life Insurance & Pensions Conference in Amsterdam on Nov. 16, 2017

See publication

Tags: Digital Transformation, Innovation, InsurTech

Why the insurance industry has more on its plate than just Brexit!

Why the insurance industry has more on its plate than just Brexit!

POST

August 17, 2017

From change management to cyber risk, Onno Bloemers of Delta Capita explains why insurers need to look beyond Brexit to the wider challenges facing the industry.

“Brexit means breakfast” may now be a phrase forever synonymous with political gaffes, but for the insurance sector, it represents far more than a ketchup splash of poetic irony. While the uncertainty surrounding the type of Brexit deal agreed undeniably represents the bacon and sausage, UK insurers will be at a disadvantage from their international counterparts should they push the mushroom and beans to one side.

See publication

Tags: Change Management, Innovation, InsurTech

What Maslow means for keeping customers

Insurance Thoughtleadership.com

May 02, 2017

Many firms apply Maslow’s hierarchy of needs to seduce customers -- but stop once a sale is made. Why not continue?

See publication

Tags: Customer Experience, Customer Loyalty, Marketing

Het gedachtegoed van Maslow toepassen voor klantretentie

Consultancy.nl

March 27, 2017

Er is een tekort aan aandacht voor de bestaande klant. Dienstverleners zijn vooral bezig met het binnenhalen van nieuwe klanten. Leon Veenhuijzen, adviseur bij Improven, en Onno Bloemers, partner bij Delta Capita, gaan in op hoe banken en verzekeraars het gedachtegoed van Maslow kunnen toepassen om klanten te overtuigen om tot een aankoop over te gaan en vooral voor klantretentie.

See publication

Tags: Customer Loyalty, InsurTech, Marketing

2017: A Journey Toward Self-Disruption

Insurancethoughtleadership.com

January 27, 2017

A constant process of internal creative destruction is required to avoid becoming the victim of an external, competing creative force.

See publication

Tags: Digital Transformation, Innovation, InsurTech

Vier archetypen voor het intermediair van de toekomst

Consultancy.nl

March 08, 2016

Digitalisering en robotisering zorgen de komende jaren voor een verstoring van vrijwel iedere sector en zullen leiden tot nieuwe businessmodellen en een niet eerder geziene golf aan innovatie. Deze veranderingen kunnen hoge kosten voor de gevestigde orde met zich meebrengen. Om de bedreigingen tegen te gaan, omarmen en ontwikkelen deze spelers in toenemende mate toekomstbestendige strategieën en concepten. Ook in de verzekeringswereld en voor de duizenden werkzame intermediairs in de sector is dit niet anders. De boodschap voor deze spelers is duidelijk: grote veranderingen staan voor de deur en om te overleven in dit veranderende marktlandschap is mee veranderen essentieel.

See publication

Tags: Digital Transformation, Innovation, InsurTech

From policy to prevention - How data and services are future-proofing the insurance industry

Vereniging Haags Verzekeringscentrum

September 18, 2025

The insurance sector is at a tipping point. Where the traditional model revolves around compensating damages, the current reality of climate change, new risks, changing customer expectations and technology forces us to rethink. Insurance alone is therefore no longer the best or only solution for dealing with risks. The future lies in combinations of insurance and additional services, made possible by increasingly fine-grained data and technology.

But how will this shift take shape? Which models do we see? And what will this mean for the role of insurers, advisors and customers? That is the subject of this introduction.

Onno Bloemers is a partner of First Day Advisory Group – drivers of innovation. He has been involved in the shift to prevention-oriented insurance models for 15 years now, both with insurers and with Insurtechs at home and abroad.

See publication

Tags: Innovation, InsurTech, Risk Management

Insurance alone is not enough! From managing policies to managing risks:

Insurance alone is not enough! From managing policies to managing risks:

Baloise

November 21, 2019

The insurance value chain has been centered around policies, which have offered tremendous value to society over centuries. Nowadays, just a policy no longer provides the best solution for managing customer risks. The near future: we embrace a preventative approach integrating sensor technology, services, data science and behavioural psychology. And insurance of course.

Let’s improve people's safety and well-being by developing solutions integrating technology and services to improve the way we handle risks.

In my keynote, I cover the new integrated value chain for managing safety & risk and discuss how to implement this. And I address some of the barriers for traditional insurers in making the transformation and share ideas how to break through.

See publication

Tags: Digital Transformation, Innovation, InsurTech

How to Mobilize Your Insurance Organization for Digital Transformation

How to Mobilize Your Insurance Organization for Digital Transformation

Betty Blocks

March 14, 2019

Keynote on implementing a new digital services entity within mutual insurance company Univé, in order to develop a capability to quickly launch risk reducing and preventing products and services augmenting the available insurance solutions. The new platform and structures helps to reduce time to market of new value propositions while ensuring scalable growth in a consistent, controllable manner. Leveraging Low Code platform Betty Blocks reduced the critical path drastically, ensuring delivery on even in a complex organisational environment.

See publication

Tags: Change Management, Innovation, InsurTech

It’s life insurance, Jim, but not as we know it

It’s life insurance, Jim, but not as we know it

Euro Events

November 16, 2017

Keynote on 2-day event focusing on strategies to make life insurance interesting and attractive!

Insurers are increasingly aware of the gap between the products offered and customer expectations, fueled by the digital revolution. We see how other sectors have been disrupted by concepts powered by the latest tech, allowing us to manage our lives increasingly through easy, friendly, highly integrated apps and digital infrastructures. People are actually waiting in long lines to buy the latest Apple product!

Can insurance become as hot and sexy as an iPhone? Can it become something that customers actively engage in? That seduces people to actively manage future risks? That becomes urgent, relevant, an integral part of your life, even fun?

The answer: Yes. But it’s going to take some changes from current insurance practices.

The key note covers 2 distinct approaches to make this happen.

See publication

Tags: Digital Transformation, Ecosystems, InsurTech

Benchmark Organisational Adaptability in The Netherlands 2020

Benchmark Organisational Adaptability in The Netherlands 2020

First Day Advisory Group

March 01, 2020

The world around us is changing rapidly. We do not live in an era of change but in a change of era. For organisations in every sector this creates opportunities and threats. The importance of a well-developed capacity for change - Organisational Adaptability - is critical. The better this is developed, the greater the chance of success in remaining future-proof. In many organizations, this adaptability to change receives still insufficient attention.

Business Fitscan has partnered with First Day Advisory Group to map thisOrganisational Adaptability

in the Netherlands. The independent research was carried out by RenM | Matrix. This benchmark study offers a number of insights into the state of affairs in the Netherlands.

One of the learnings here is that is in fact possible to measure Organisational Adaptability. Once measured, you can develop this with targeted solutions and interventions but always goal-oriented, practical and with objective outcomes. This data-driven approach may provide guidance and help.

[Full Report in Dutch avalaible at request, included is summary in English]

See publication

Tags: Change Management, Digital Transformation, Innovation

Benchmark Adaptability Financial Services in The Netherlands 2018

Benchmark Adaptability Financial Services in The Netherlands 2018

Delta Capita & Net Change Factory

May 28, 2018

Lack of adaptability is a significant risk for financial services organisations. For that reason, it is important to pay attention to this. A first step is to measure this Adaptability. This has been mapped for the 2nd time for the Netherlands in the 2nd National Benchmark Adaptability 2018 and now for the first time

specifically for the Financial Services sector.

Adaptability

It turns out that the Organisational Adaptability in the Financial Sector is quite low. On a scale of +100 to -100 the sector scores -20. This is comparable with the overall score in the Netherlands across all sectors. However, within Financial Services we see significantly different results. The results among banks are in

line with the average result in The Netherlands (-21). Insurers (including pension funds and service providers) are lagging behind with a score of -38. Only the government has a lower score with -42.

It is striking that in the sector 1/3 (33%) of employees indicate to have little or no confidence in the adaptability of their organisations. Among insurance respondents, this amounts to nearly half with 45%. On the other hand, only 13% demonstrate to have a lot of confidence; this is only 7% among insurers.

Change Drivers

The explanation for these outcomes scores needs to be found in the Change Drivers - the relevant and influenceable factors of Adaptability.

Conclusion

In general we can conclude that among banks and particularly among insurers there is substantial room to improve the organisational adaptability. With each one of five Change drivers there is potential gain.

Especially among insurers there is urgency.

See publication

Tags: Change Management, Innovation, InsurTech

Visie op schade - Op weg naar het nieuwe verzekeren

Visie op schade - Op weg naar het nieuwe verzekeren

Van Ameyde

November 01, 2015

The wave of digitization causes a fundamental reassessment of the traditional business model in the insurance sector. Technological developments have an exponential impact on traditional businesses. Can the gap between providers and customers be bridged ? Can an established market party arm itself

against the disruptive violence of new entrants? And is there still a role for the traditional intermediary?

See publication

Tags: Digital Transformation, Innovation, InsurTech

Visie op Schadeverzekeringen - Het ABC van Innovatie

Visie op Schadeverzekeringen - Het ABC van Innovatie

Deloitte Nl, Aquila

September 01, 2011

Stagnation means decline. This will be what many non-life insurers think when contemplating innovation. A virtual tour across insurer websites shows how important innovation is for their business. But is it real innovation? And what exactly is that? What is the motivation to innovate and what prevents insurers from achieving radical, breakthrough innovation? What does it take to to claim the market of tomorrow? Deloitte and Aquila look ahead and together with the expert panel show how innovation changes the personal lines non-life insurance in 2020.

See publication

Tags: Digital Transformation, Innovation, InsurTech

An innovation culture starts with an innovation structure

An innovation culture starts with an innovation structure

Insurtech Trends Update – 2022

Insurtech Trends Update – 2022

Insurtech Trends Update – 2022

Insurtech Trends Update – 2022

From policy to purpose: Safety as a compass for the insurance sector (article in Dutch)

From policy to purpose: Safety as a compass for the insurance sector (article in Dutch)

How Insurers Can Help Reduce Car Accidents

How Insurers Can Help Reduce Car Accidents

The Future of Insurance Is… Not Insurance

The Future of Insurance Is… Not Insurance

Future of Insurance Is… Not Insurance

Future of Insurance Is… Not Insurance

The dark matter problem in Insurance

The dark matter problem in Insurance

Lack of Organisational Adaptability Threatens Digital Transformation

Lack of Organisational Adaptability Threatens Digital Transformation

It's life insurance, Jim. But not as we know it – Part 3

It's life insurance, Jim. But not as we know it – Part 3

It's life insurance, Jim. But not as we know it – Part 2

It's life insurance, Jim. But not as we know it – Part 2

It’s Life, Jim, but Not as We Know It - Part 1

It’s Life, Jim, but Not as We Know It - Part 1

Why the insurance industry has more on its plate than just Brexit!

Why the insurance industry has more on its plate than just Brexit!

https://fintechcircle.com/insights/insurtech-managing-risks-fintec

https://fintechcircle.com/insights/insurtech-managing-risks-fintec

Co-founder & CCO of safety-based home insurance start-up InConnect.io

Co-founder & CCO of safety-based home insurance start-up InConnect.io

First Day Advisory Group

First Day Advisory Group

Insurance alone is not enough! From managing policies to managing risks:

Insurance alone is not enough! From managing policies to managing risks:

How to Mobilize Your Insurance Organization for Digital Transformation

How to Mobilize Your Insurance Organization for Digital Transformation

It’s life insurance, Jim, but not as we know it

It’s life insurance, Jim, but not as we know it

Two out of three transformation plans fail due to lack of leadership

Two out of three transformation plans fail due to lack of leadership

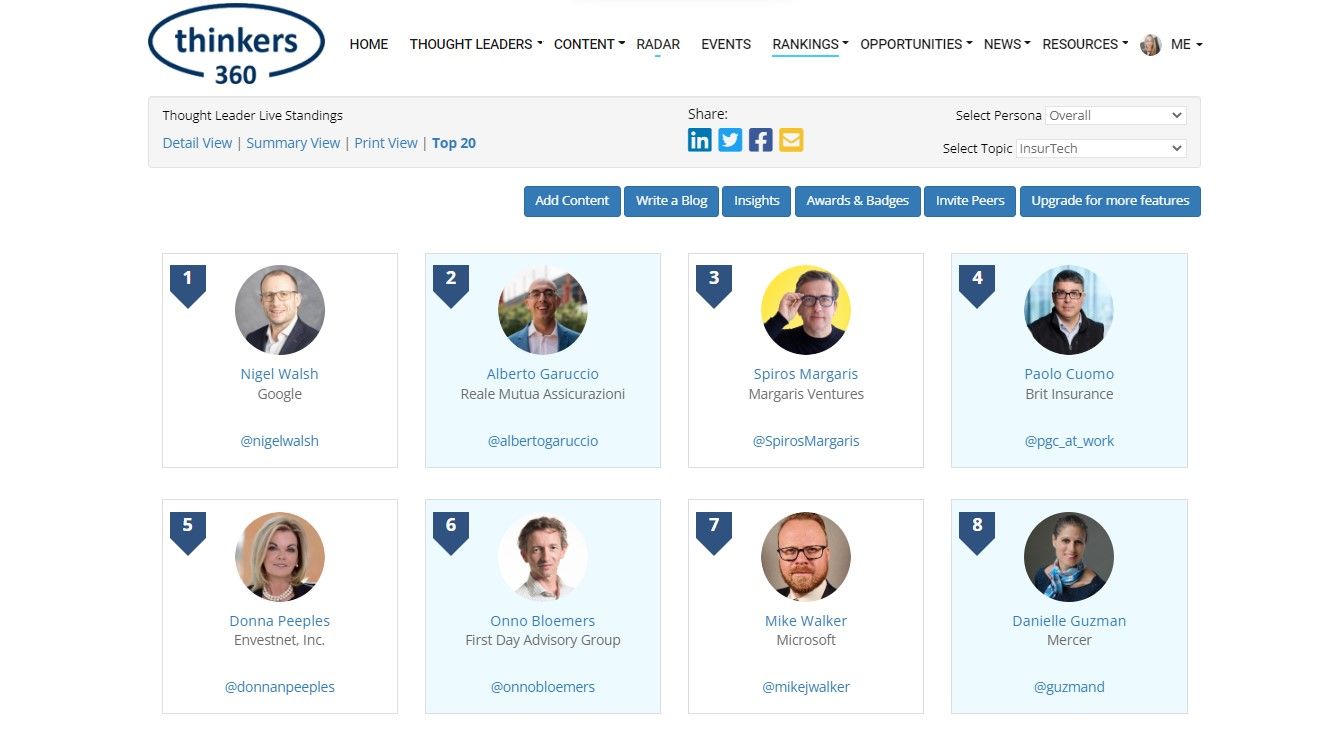

Top Insurtech Influencers Leaderboard

Top Insurtech Influencers Leaderboard

The DIA After

The DIA After

Round Table: The future of Insurance

Round Table: The future of Insurance

Insurtech trends for MicroFinance

Insurtech trends for MicroFinance

Round Table 1 – The Future of Insurance

Round Table 1 – The Future of Insurance

Benchmark Organisational Adaptability in The Netherlands 2020

Benchmark Organisational Adaptability in The Netherlands 2020

Benchmark Adaptability Financial Services in The Netherlands 2018

Benchmark Adaptability Financial Services in The Netherlands 2018

Visie op schade - Op weg naar het nieuwe verzekeren

Visie op schade - Op weg naar het nieuwe verzekeren

Visie op Schadeverzekeringen - Het ABC van Innovatie

Visie op Schadeverzekeringen - Het ABC van Innovatie