1Q2023 Results: The Insurtech Rollercoaster: Riding the Waves of Innovation and Challenge

1Q2023 Results: The Insurtech Rollercoaster: Riding the Waves of Innovation and Challenge

Insurtech Advisors

May 10, 2023

The first quarter of 2023 was a mixed bag for Insurtech. On the one hand, there was a lot of innovation, with new products and services being launched at a rapid pace. On the other hand, there were also some challenges, such as rising rates and increased competition.

See publication

Tags: Startups, InsurTech, Mergers and Acquisitions

Old is Gold: The timeless appeal of small carriers and brokers

Old is Gold: The timeless appeal of small carriers and brokers

Insurtech Advisors

April 27, 2023

In the rapidly evolving world of technology and digitalization, it’s easy to get swept up in the excitement of innovation and the allure of new-age insurance companies. The cutting-edge features and seamless online experiences promised by these digital players are undoubtedly tempting, especially in comparison to traditional insurance institutions. However, as a small insurance company, traditional broker, or MGA executive, you have a unique set of benefits that should not be underestimated. In fact, there are instances when new isn’t always better, and the tried-and-true methods of yesteryear still hold value today.

We will explore the timeless appeal of being small, the importance of maintaining your unique value proposition, and the undeniable value of personal connection. As we navigate through these points, let’s draw inspiration from classic movies and TV shows that have stood the test of time, reminding us that older doesn’t always mean outdated.

See publication

Tags: Business Strategy, InsurTech, Mergers and Acquisitions

How ChatGPT Can Help You Sell More Insurance Than a Talking Gecko in 2023

Insurtech Advisors

February 01, 2023

ChatGPT is the latest in a line of generational AI that is set to revolutionize the way we interact with machines. It uses natural language processing to understand and respond to customer queries in real-time. It can help streamline your internal processes, such as claims management, and policy underwriting, by automating repetitive tasks. It can also help you explore new product offerings or target markets and much more.

See publication

Tags: Generative AI, Innovation, InsurTech

Onward and Skyward: Our first IPO and Insurtech 2022 in review

Insurtech Advisors

January 17, 2023

The article discusses the insurtech industry in 2022, highlighting the successful IPO of Onward and Skyward, a new player in the market. The article also provides insights into the growth and trends in the industry, including the increased focus on personalized insurance products and the use of AI and data analytics to improve underwriting and claims processing. The article concludes by predicting continued growth and disruption in the insurtech space in the coming years.

See publication

Tags: AI, InsurTech, Mergers and Acquisitions

Size doesn’t matter. Lemonade vs Root 3Q22 Results

Import from wordpress feed

November 10, 2022

Lemonade and Root announced their third-quarter results this week. There were some positive developments for both companies, but there are still many challenges ahead for both. Indeed, their results remind me of a quote from former President Harry Truman: “It doesn’t matter how big a ranch you

See publication

Tags: Digital Disruption, Innovation, InsurTech

Insurtech Hippo vs the Beaver 2Q22 Results Unpacked

Import from wordpress feed

August 12, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Root and Lemonade 2Q22 – a tale of country roads

Import from wordpress feed

August 09, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

The Emperor Loves Cash: Insurtech Woes in 2022

Import from wordpress feed

June 13, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Butterflies and Insurtech Hippo’s 2022 Promising Spring

Import from wordpress feed

May 13, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Insurtech Lemonade’s ‘Structural Nuisance’ 1Q2022 Results

Import from wordpress feed

May 11, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

The Root of Moats Past: 1Q 2022 Results

Import from wordpress feed

April 28, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Insurtech Hippo’s 2021 results resemble Disney’s Fantasia and the Dance of the Hippos

Import from wordpress feed

March 10, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Can Metromile Sweeten the Lemonade in 2022?

Import from wordpress feed

February 28, 2022

[...]Read More

See publication

Tags: Digital Disruption, Innovation, InsurTech

Does Insurtech 2.0 = Insurance 101? Root and Lemonade Struggle

Import from wordpress feed

February 24, 2022

At the close of trading last night, two of the early darlings of the VC and investment community, Root and Lemonade, announced their results for the fourth quarter of 2021 and the full year 2021. After-hours trading punished Lemonade with a 20.6% fall to $18.40, while Root reports a small drop of 4.

See publication

Tags: Digital Disruption, Innovation, InsurTech

Chatbots: Insurtech vs Big Tech

Chatbots: Insurtech vs Big Tech

linkedin

November 06, 2019

Insurtech funding thru Q3 2019 has hit record levels totaling about $4.4B (approximately 60% being P&C and 40% L&H). Surprisingly, little funding attention has been made to the “Chatbot.” Even though the simple chatbot provides immediate benefits to customers, agents, and employees.

See publication

Tags: InsurTech, Agentic AI

Friday Health Plans collapse caused by rapid growth, unsustainable pricing

Friday Health Plans collapse caused by rapid growth, unsustainable pricing

S&P Global

June 08, 2023

Friday Health Plans, a notable and high-flying #Insurtech, has shut down, impacting approximately 400K policyholders. Tyler Hammel from S&P Global provides in-depth insights. My key takeaway that I shared: This shutdown underscores a human cost - many will face higher health insurance costs. Friday's founders, health tech pros, lacked #insurance discipline, a recurring issue in insurtechs. Are there more to come?

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

Insurtech funding flight to quality to accelerate after SVB collapse

S&P Global

March 17, 2023

The collapse of SVB and poor performance in the public market for insurtechs has led investors to focus on quality and a smaller number of companies with the potential to be successful. This has made it more difficult for insurtech companies to raise capital.

This could lead to further consolidation in the industry, as smaller companies are unable to compete with the larger, more well-funded companies.

See publication

Tags: InsurTech, Mergers and Acquisitions

Molina, Centene stocks biggest losers among US insurers so far in 2023

Molina, Centene stocks biggest losers among US insurers so far in 2023

S&P Global

March 03, 2023

Discussing as spring and Medicaid changes loom, managed care insurers like Molina Healthcare Inc. and Centene Corp. have seen their stock prices decline over the first two months of 2023.

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

Duck Creek shares skyrocket after $2.6B go-private deal

S&P Global

January 13, 2023

Quoted in an article about Vista Equity Partner's acquisition of DuckCreek.

See publication

Tags: InsurTech, Mergers and Acquisitions

US P&C 2023 outlook: reinsurance costs, M&A slowdown, E&S evolution

US P&C 2023 outlook: reinsurance costs, M&A slowdown, E&S evolution

S&P Global

January 05, 2023

The prospects for more of this type of M&A in the sector are uncertain at best, according to Insurtech Advisors analyst Kaenan Hertz, who said he is surprised that the larger incumbent carriers have not been acquiring some of the insurtech start-ups for either their teams or for the intellectual capital.

See publication

Tags: Risk Management, InsurTech, Mergers and Acquisitions

A tough year for insurtechs raises questions about the future

A tough year for insurtechs raises questions about the future

Modern Healthcare

January 04, 2023

Startup health insurers spent 2022 scaling back their businesses as investors are no longer willing to contribute the billions of dollars necessary for subsidizing them. Insurtechs Oscar Health, Clover Health and Bright Health Group’s failure to thrive at a time when most health insurers are making more money than ever has left some wondering what their future holds.

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

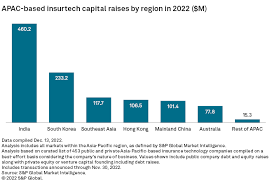

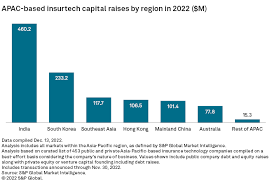

Niche players top Asia insurtech 2022 fundraising charts

Niche players top Asia insurtech 2022 fundraising charts

S&P Global

December 28, 2022

Insurtechs that have managed to carve out a niche within the insurance industry were some of the biggest fundraisers in Asia in 2022 even as the overall dollars raised declined sharply from the previous year.

See publication

Tags: Emerging Technology, InsurTech, Mergers and Acquisitions

Trupanion shares in the doghouse despite pet insurance boom

S&P Global

December 02, 2022

See publication

Tags: InsurTech, Mergers and Acquisitions, Startups

GoHealth's reverse split stock fails to inspire; auto insurers continue to hike

S&P Global

November 18, 2022

GoHealth Inc. is the latest insurtech company to initiate a reverse stock split, joining a growing list of embattled disrupters attempting to weather a changing market.

The move was announced earlier in the month and was likely done to keep the insurtech from being delisted from the New York Stock Exchange, according to Kaenan Hertz, managing partner with Insurtech Advisors.

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

Hippo's stock yet to resurface despite reverse split, layoffs

S&P Global

October 10, 2022

GoHealth Inc. is the latest insurtech company to initiate a reverse stock split, joining a growing list of embattled disrupters attempting to weather a changing market.

The move was announced earlier in the month and was likely done to keep the insurtech from being delisted from the New York Stock Exchange, according to Kaenan Hertz, managing partner with Insurtech Advisors.

See publication

Tags: InsurTech, Mergers and Acquisitions, Startups

DOJ mulls appeal of UnitedHealth-Change Healthcare ruling

S&P Global

September 20, 2022

The Justice Department is weighing whether to appeal a federal judge’s decision that denied its legal challenge to UnitedHealth Group’s $13 billion proposed acquisition of technology company Change Healthcare.

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

DOJ's UnitedHealth-Change challenge to hinge on competitor data

S&P Global

September 15, 2022

An article by S&P Global discusses the proposed merger of United Healthcare and Change Healthcare.

See publication

Tags: HealthTech, Mergers and Acquisitions, Healthcare

Insurtechs battling persistent losses, slumping stocks bring in seasoned execs

S&P Global

April 07, 2022

Though the model of insurance seems pretty straightforward, insurers simply charge more for coverage than they pay out in claims and operating expenses, the mechanics of making that work are very nuanced, said Kaenan Hertz, managing partner at Insurtech Advisors LLC. Many insurtechs did not have the expertise or the institutional history to understand these nuances and ended up performing poorly in terms of profitability, said Hertz.

"As the publicly traded insurtechs have seen their share prices crater, and they have had to report performance results, it became evident that the insurance part of 'insurtech' wasn't working," Hertz said.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

Hippo's stock rises even as Q4'21 loss widens; Brown & Brown down after deal

S&P Global

March 11, 2022

Insurtech Advisors analyst Kaenan Hertz was a bit more skeptical. While Hippo has posted rising revenues in the last year, expenses are higher as well.

"There is no evidence that Hippo has been able to control the underlying overall insurance economics," Hertz said.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

Lemonade's shares sour as insurtech posts bigger earnings losses

S&P Global

February 25, 2022

Insurtech Advisors analyst Kaenan Hertz said Schreiber's explanation is difficult to understand given that the losses occurred in the company's rental market. Hertz said the cause is more "systemic," rather than one or two large liability claims and that it seems the company had a challenge in "adequately understanding insurance."

"This, to me, is what has become self-evident this year," Hertz said in an interview.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

Insurtech funding train rolls on with big Devoted Health haul

S&P Global

October 14, 2021

The real test of Devoted Health's value will come when the company decides to go public, said Kaenan Hertz, managing partner at Insurtech Advisors LLC. Hertz in an email noted that the prices of many insurtech companies that have gone public in recent years are now trading below their IPO prices. The share prices of Clover Health Investments Corp. and Oscar Health Inc., which are significantly larger than Devoted Health, are down more than 50% from their 52-week highs, Hertz noted.

See publication

Tags: HealthTech, InsurTech, Mergers and Acquisitions

Clover Health new 'meme stock'; Fla. insurers rise amid homeowners reform effort

S&P Global

June 11, 2021

Analyst Kaenan Hertz called it another instance of investors' favoring insurtech companies without proper regard to financial basics.

"The capital markets right now are willing to provide these insurtechs the freedom to operate in a nonprofitable way," said Hertz, managing partner for Insurtech Advisors LLC. Those companies could benefit from inflated "meme" prices if they issue stock and raise money to keep themselves above water, he added.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

'Flight to quality' as private insurtechs draw big investments

S&P Global

June 11, 2021

Kaenan Hertz, managing partner for Insurtech Advisors LLC, said insurtechs are focused on "taking out friction" in the market, primarily with consumers or small businesses whose owners are more like individuals, making "slick, simple products with easy interaction."

Lemonade Inc.'s IPO and the subsequent "meteoric rise" by its stock are probably playing a role in attracting private investment, according to Hertz. Additionally, private equity and venture capital companies need a place to make investments with government bonds yielding so little. Hertz called it a "classic case" of excessive demand in the form of capital chasing too little supply of insurtechs.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

Root's stock continues slide amid release of financial results; life shares rise

S&P Global

December 04, 2020

Also troublesome to Insurtech Advisors partner Kaenan Hertz was Root's high customer acquisition costs. Given its advertising spend, a favorable, though nontraditional calculation of that metric, during the last nine months puts that cost at about $600 per customer, which is "still way too high," Hertz said in an interview.

"In a traditional way, when you look at cost of acquisition ... at best they were at almost $2,200 per policy," Hertz said. "It's not sustainable."

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

Root Insurance's stock may soar after IPO, experience challenges later

S&P Global

October 27, 2020

However, the company's financial statements reveal a potentially troubling loss experience and a still-low underlying retention rate of about 54%, Hertz noted. Root seems to be attracting riskier drivers, and its technology platform does not appear to be aptly pricing for loss trends, he said.

"It makes you wonder if their AI is appropriately tuned," Hertz said. The company's loss numbers and churn rate give them an insurance profile that resembles a nonstandard auto carrier, he said.

See publication

Tags: InsurTech, Mergers and Acquisitions, Risk Management

The Care Voice Advisory Board

The Care Voice Advisory Board

1Q2023 Results: The Insurtech Rollercoaster: Riding the Waves of Innovation and Challenge

1Q2023 Results: The Insurtech Rollercoaster: Riding the Waves of Innovation and Challenge

Old is Gold: The timeless appeal of small carriers and brokers

Old is Gold: The timeless appeal of small carriers and brokers

Chatbots: Insurtech vs Big Tech

Chatbots: Insurtech vs Big Tech

Racial Threat and Partisan Identification

Racial Threat and Partisan Identification

Friday Health Plans collapse caused by rapid growth, unsustainable pricing

Friday Health Plans collapse caused by rapid growth, unsustainable pricing

Molina, Centene stocks biggest losers among US insurers so far in 2023

Molina, Centene stocks biggest losers among US insurers so far in 2023

US P&C 2023 outlook: reinsurance costs, M&A slowdown, E&S evolution

US P&C 2023 outlook: reinsurance costs, M&A slowdown, E&S evolution

A tough year for insurtechs raises questions about the future

A tough year for insurtechs raises questions about the future

Niche players top Asia insurtech 2022 fundraising charts

Niche players top Asia insurtech 2022 fundraising charts

Virtual 4th National Medicare Advantage Summit

Virtual 4th National Medicare Advantage Summit

Insurtechs and Regional Insurance Carriers

Insurtechs and Regional Insurance Carriers