Forget Finance: How Personal Finance Will Fade to the Background

Forget Finance: How Personal Finance Will Fade to the Background

Filene

November 06, 2025

The future of finance is frictionless. Biometric payments, embedded experiences, and intuitive, conversational tools are blurring the lines between digital and human connection. Credit unions can lead this shift by building trust into systems so smart, they work almost invisibly.

See publication

Tags: Digital Transformation, Finance, FinTech

Stablecoins: What Are They, Really — and Why Are Institutions Paying Attention?

Stablecoins: What Are They, Really — and Why Are Institutions Paying Attention?

Lamont Black

October 01, 2025

Stablecoins aren’t fringe anymore.

Not long ago, they were seen as a niche corner of crypto — more novelty than currency. But things have shifted.

With the GENIUS and CLARITY Acts now in play, credit unions have a clear federal framework to issue, custody, and integrate stablecoins under regulatory oversight.

This isn’t about chasing hype. It’s about recognizing:

The legal rails are being built right now.

The definition of “money” is expanding.

Institutions must decide if they’ll operate on these rails — or watch others do it first.

Stablecoins are quickly becoming part of the mainstream financial system. The question is whether credit unions will take advantage of this opening.

See publication

Tags: Digital Disruption, Emerging Technology, FinTech

AI Isn’t Just for Tech Giants: Why Local Institutions Need to Pay Attention

AI Isn’t Just for Tech Giants: Why Local Institutions Need to Pay Attention

Lamont Black

October 01, 2025

AI has been in credit unions longer than we think.

AML monitoring. Fraud detection. 2FA triggers.

These are all AI-driven systems that have quietly been part of institutional operations for years — just not branded as “AI.”

What’s changing now is visibility.

With the NCUA aligning to the NIST AI Risk Management Framework, credit unions finally have a structured way to approach AI governance. The framework isn’t about scrapping systems or starting from scratch — it’s about:

Mapping where AI is already at work.

Assigning governance and accountability.

Managing exposure responsibly.

The real question isn’t “Should we adopt AI?”

It’s “Are we prepared to manage the AI we’re already using?”

This article digs into that shift — and why it matters for every board and leadership team thinking about AI strategy.

See publication

Tags: AI, AI Governance, Digital Disruption

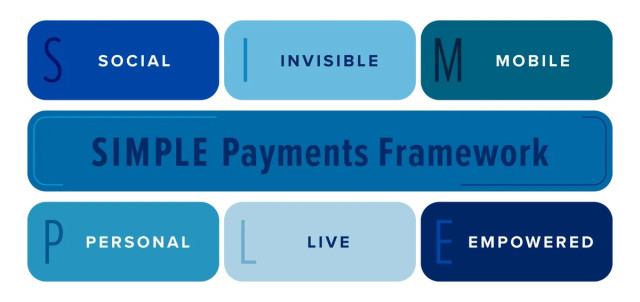

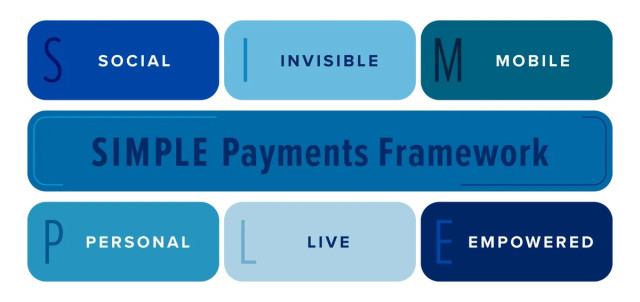

SIMPLE Payments: Six Consumer Payment Trends Credit Unions Must Embrace

SIMPLE Payments: Six Consumer Payment Trends Credit Unions Must Embrace

Filene Research Institute

August 18, 2025

The future of payments is here, and credit unions must move fast to keep up. The SIMPLE Payments framework reveals six important trends reshaping how members pay and interact with money. This brief shows how credit unions can embed payments into daily life, deliver real-time experiences, and thrive in a digital-first world.

See publication

Tags: Digital Transformation, Finance, FinTech

Credit Unions and the Quickly Changing Stablecoin Conversation

Credit Unions and the Quickly Changing Stablecoin Conversation

Filene

July 18, 2025

Stablecoins are back in the spotlight—and credit unions need to be in the conversation.

In my latest article for Filene Research Institute, I break down the recent surge of stablecoin activity—from Amazon and Walmart to major financial players—and what it all means for credit unions.

With federal legislation like the GENIUS Act advancing and institutional interest growing fast, now is the time for credit union leaders to get clear on:

What stablecoins are (and aren’t);

How they could reshape payments, liquidity, and member expectations;

Why waiting on the sidelines is no longer a safe strategy;

At Wide Open Ventures, we’re helping credit unions and mission-driven orgs explore these emerging technologies with confidence and clarity. Want to talk strategy? Let’s connect.

See publication

Tags: Cryptocurrency, Emerging Technology, FinTech

Why AI adoption involves every executive leader

Why AI adoption involves every executive leader

CUInsight.com

July 08, 2025

Check out my new article “Why AI adoption involves every executive leader” for CUInsight.com. This explains the focus of my work with executive teams

See publication

Tags: AI, Business Strategy, Leadership

Still Hiring Humans: What the Best Workers Will Do in the Age of AI

Still Hiring Humans: What the Best Workers Will Do in the Age of AI

Lamont Black

May 24, 2025

AI fluency is the new baseline. So what’s still worth doing yourself?

AI can generate, recommend, and support - but it can’t lead, decide, or care. That’s your edge.

The best workers won’t just prompt well. They’ll judge well. They’ll know when to lean on AI - and when to lean in themselves.

The future belongs to the Prompt Directors:

Those who combine tech with taste, automation with empathy, and speed with strategy.

AI is the intern. You’re still the CEO of your work.

So ask yourself:

What’s still worth me doing?

See publication

Tags: AI, Digital Disruption, Digital Transformation

From Typing to Prompting: The Next Workplace Skill You Can’t Ignore

From Typing to Prompting: The Next Workplace Skill You Can’t Ignore

Lamont Black

May 20, 2025

Typing used to be optional. Then it became essential.

We’re seeing the same shift again—with AI. At Wide Open Ventures, we believe AI fluency is quickly becoming a core skill in the workplace. Not a nice-to-have. A must.

That’s why we just published our first blog, written by our CXO Ryan Best:

“From Typing to Prompting: The Next Workplace Skill You Can’t Ignore”

It breaks down the quiet but undeniable shift that’s underway—and offers simple, actionable steps to help you start experimenting today.

Download a tool like ChatGPT

Try it on one personal task

Try it on one professional task

Get your reps in

This is the first in a series aimed at helping #leaders, #teams, and organizations get practical about #AI. We hope it gives you something useful—and if it does, we’d love to hear what resonates.

See publication

Tags: AI, Digital Transformation, Future of Work

Prompt Practice: How I’m Building AI Fluency (and Why You Might Want To, Too)

Prompt Practice: How I’m Building AI Fluency (and Why You Might Want To, Too)

Lamont Black

May 15, 2025

You don’t need to master AI. But you do need to start practicing. Here’s what that looks like for me.

In my last post, I made the case that learning to work with AI is a lot like learning to type. At first, it’s awkward. Slow. Maybe even frustrating. But over time, it becomes second nature—and gives you a serious edge.

That edge is growing fast.

The professionals getting ahead right now aren’t necessarily smarter. They’re just showing up and getting more reps in with AI than everyone else. A recent study by the St. Louis Federal Reserve found that workers using generative AI saved an average of 5.4% of their work hours per week—that’s more than two hours saved in a typical 40-hour week. The more integrated AI use became, the more time people got back. They’re learning how to prompt better, review faster, and fold AI into their workflow naturally. And it’s starting to show up in how quickly they move, how polished their work is, and how many opportunities come their way.

The good news? You don’t need to overhaul your job to start building AI fluency. You just need to treat it like a skill—and practice.

See publication

Tags: AI, Digital Transformation, Emerging Technology

LAMONT BLACK / WOV - End of Year 2024 Newsletter

LAMONT BLACK / WOV - End of Year 2024 Newsletter

LinkedIn

December 30, 2024

As 2024 winds down, I find myself reflecting on the many milestones and special moments that have marked the past year. From celebrating my 50th birthday with a 750-mile bike ride down the beautiful West Coast to connecting with so many incredible credit unions across the country, I feel a profound sense of gratitude for what this year has been.

See publication

Tags: Leadership

Looking Towards New Adventures in 2025

Looking Towards New Adventures in 2025

Linkedln

November 30, 2024

As 2024 winds down, I find myself reflecting on the many milestones and special moments that have marked the past year. From celebrating my 50th birthday with a 750-mile bike ride down the beautiful West Coast to connecting with so many incredible credit unions across the country, I feel a profound sense of gratitude for what this year has been.

See publication

Tags: Careers, Innovation, Leadership

Cryptocurrency Comes to U.S. Banking

Cryptocurrency Comes to U.S. Banking

LinkedIn

February 11, 2021

Crypto is coming to the world of banking! Today, Bank of NY Mellon Corp. (BK) announced that it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients.

See publication

Tags: Leadership

The Stablecoin Roadmap for Credit Unions

The Stablecoin Roadmap for Credit Unions

GoWest Credit Union Association

January 09, 2026

Join Dr. Lamont Black for "The Stablecoin Roadmap for Credit Unions," a timely presentation that explores the most significant payment disruption facing financial institutions in decades. With the GENIUS Act signed into law in July 2025 and NCUA rulemaking due by mid-2026, credit unions have less than 18 months to develop their stablecoin strategy before this new payment rail becomes operational in 2027. Dr. Black demystifies cryptocurrency through his accessible "MAP" framework (Money, Asset, Platform), explaining how stablecoins function as digital cash—combining blockchain technology with the stable 1:1 value of the US dollar—and why major players like PayPal, Chase, and Amazon are racing to implement them. You'll learn the critical strategic choices credit unions face (issue or intermediate?), understand the competitive landscape as industry organizations prepare their own solutions, and discover concrete next steps for education, board engagement, and strategic planning. Whether you're a CEO, board member, or innovation leader, this session provides the essential knowledge needed to navigate what Dr. Black calls the "gold rush" moment for credit union stablecoin adoption and avoid being left behind as the payment ecosystem fundamentally transforms.

See publication

Tags: Cryptocurrency, Digital Transformation, Emerging Technology

Artificial Intelligence in Financial Services

Artificial Intelligence in Financial Services

North Carolina Office of the Commissioner of Banks

January 06, 2026

I spoke about the growing use of AI by financial institutions for operational efficiency, customer/member service, and personalization. Examiners will need to address the risks while navigating the reality of this adoption curve. Lastly, we talked about how this could impact the role of supervision. Reviewing documents, even financials, and writing supervisory letters. This will become a productivity tool for the examiners themselves.

See publication

Tags: AI, Digital Disruption, Digital Transformation

The Stablecoin Roadmap for Credit Unions

The Stablecoin Roadmap for Credit Unions

Filene Research Institute

December 03, 2025

KEYNOTE SPOTLIGHT! Want to understand stablecoin fundamentals and how credit unions can adapt to the passage of the GENIUS Act?

Join me for an insightful session – “The Stablecoin Roadmap for Credit Unions” – at big.bright.minds. 2025.

This session will provide a stablecoin roadmap for credit unions in 2026 as the Act enters its implementation phase, addressing potential disruption of interchange fees alongside emerging opportunities for innovation.

Discover how credit unions can:

Educate boards and executive teams.

Develop strategic plans.

Position themselves as key facilitators of stablecoin payments.

Empower members to receive, store, transfer, and spend stablecoins securely.

See publication

Tags: Cryptocurrency, Digital Disruption, FinTech

Artificial Intelligence and Stablecoins for Credit Unions

Artificial Intelligence and Stablecoins for Credit Unions

Catalyst

October 23, 2025

My keynote at the Catalyst Corporate Federal Credit Union conference was half AI and half Stablecoins. Two technologies that are no longer “emerging” but actively shaping the future of financial services. I explored how credit unions can use AI to improve the internal (fraud detection, lending workflows, and productivity tools) and the external (serving members). On the stablecoin side, we unpacked the GENIUS Act, market adoption, and what a roadmap might look like for integration.

See publication

Tags: AI, Cryptocurrency, Emerging Technology

AI for Credit Unions and Fintechs

TruStage Ventures

September 24, 2025

Diving into how artificial intelligence is reshaping financial services. The session focused on practical insights, emerging risks, and strategic opportunities for credit unions and fintech leaders navigating this rapidly evolving space.

See publication

Tags: AI, AI Governance, FinTech

AI for Financial Institutions: Embracing the Future of Intelligent Finance.

AI for Financial Institutions: Embracing the Future of Intelligent Finance.

AICPA & CIMA

September 16, 2025

Financial institutions are rapidly moving into a future where AI integrates into every facet of business—from operations to customer experience. At the conference, I shared insights on the latest developments in Generative AI and Agentic AI, along with practical applications for driving growth, efficiency, and innovation across the financial services sector.

See publication

Tags: Agentic AI, AI, Generative AI

FUELmi YP Leadership Summit - Innovation Is Essential for Leadership

FUELmi YP Leadership Summit - Innovation Is Essential for Leadership

Michigan Credit Union League and Affiliates

June 04, 2025

As technological change in the business world continues to accelerate, young professionals will need to embrace a culture of innovation. This session highlights the importance of an entrepreneurial mindset and how emerging leaders can lead with innovation in their organization. It begins with young leaders! And in the world of innovation, vision and passion must be stronger than fear. Every young professional in the session will be challenged to make innovation a daily routine and regular conversation to develop a leadership style for the future.

See publication

Tags: Careers, Innovation, Leadership

Agentic AI and the Future of Work

Agentic AI and the Future of Work

Lamont Black

November 17, 2025

Agentic AI is the new frontier. We recently did a strategy session with Greylock Federal Credit Union focused entirely on Agentic AI. We explored how AI is evolving from automation to delegation - from answering questions to taking action. That’s the promise of agentic systems. And in the world of financial services, this evolution is already here. We walked through real use cases for credit unions: internal AI agents that optimize operations and external agents that help members manage money more proactively.

See publication

Tags: Agentic AI, AI, Digital Disruption

Stablecoins for Financial Institutions

Stablecoins for Financial Institutions

Lamont Black

November 07, 2025

Stablecoins are a fast-emerging form of digital money that combine the technology of crypto with the trust of the U.S. dollar. For financial institutions, they represent a potential shift in how payments are made, recorded, and settled—introducing both opportunity and disruption. This session will outline what stablecoins are, why they matter, and how they could impact operations and client/member relationships.

See publication

Tags: Cryptocurrency, Finance, FinTech

Artificial Intelligence in Financial Services

Artificial Intelligence in Financial Services

Lamont Black

November 04, 2025

This week, I had the opportunity to speak with state regulators and financial leaders at Conference of State Bank Supervisors (CSBS) about the role of AI in financial services. We talked about the practical side of how AI is already shaping lending, fraud detection, and customer experience. But we also looked at the big picture: how generative and agentic AI are changing what it means to lead, supervise, and serve in this industry.

See publication

Tags: AI, Digital Transformation, Finance

The Credit Union Roadmap for Becoming an Intelligent Enterprise

The Credit Union Roadmap for Becoming an Intelligent Enterprise

EDGE 2025

May 08, 2025

What does it take to become an intelligent enterprise—where data acts as a force multiplier, elevating member experiences, streamlining operations and sharpening competitive strategies?

In this opening session, Filene Fellow Lamont Black will set the stage for the next two days by exploring these questions with an optimistic—yet realistic—perspective on the key drivers of analytics mastery. Through real-world insights, attendees will gain a deeper understanding of how credit unions can become intelligent cooperatives, harnessing data and digital innovation to become even better at what they do best.

Attendees can expect:

- Illustrations of how intelligent enterprises gain insights, predict outcomes and personalize experiences

- Real-life success stories of improved decision-making and end-user interactions

- Candid discussion of the challenges credit unions may face on the journey to becoming intelligent enterprises and ideas for overcoming them

See publication

Tags: Analytics, Digital Transformation, Innovation

Getting Started with AI: A Hands-On Guide for Small Credit Unions

Getting Started with AI: A Hands-On Guide for Small Credit Unions

NASCUS

January 22, 2026

Designed for credit unions under $100M, this session explores practical ways to use AI tools like Microsoft Copilot and ChatGPT to improve efficiency—without big budgets or technical complexity. Attendees will also receive a simple framework for building an introductory AI policy.

See publication

Tags: AI, AI Governance, Digital Transformation

Stablecoins - Digital Dollars, Real Impact

Stablecoins - Digital Dollars, Real Impact

TruStage

November 14, 2025

Stablecoins are programmable dollars, and their potential to reshape finance is fast approaching. The question for every credit union is: will you issue, facilitate, or wait?

We covered:

- Why stablecoins are now the leading crypto use case following the GENIUS Act.

- The shift from “digital asset” to payment rail.

- How public blockchains and tokenized money could disrupt legacy payment networks.

- Why credit unions need to start building a strategy now, ahead of the 2026 acceleration.

See publication

Tags: Blockchain, Cryptocurrency, FinTech

AI and Executive Leadership: How CU Execs Should Approach AI Strategy

AI and Executive Leadership: How CU Execs Should Approach AI Strategy

Filene

August 06, 2025

AI & Executive Leadership: How Should CU Leaders Approach AI Strategy?

Join me on August 6 for a live webinar hosted by Filene Research Institute —designed specifically for credit union executives navigating the rapidly evolving AI landscape.

This session will explore:

What AI means for leadership—not just IT;

How to align your teams around a clear AI vision;

Common roadblocks (and how to overcome them);

Practical steps to move from exploration to execution.

If you’re shaping strategy in your credit union, you don’t want to miss this.

See publication

Tags: AI, Business Strategy, Leadership

AI for Credit Unions

AI for Credit Unions

Lamont Black

December 02, 2025

Eight hours of AI strategy with Consumers Credit Union. I met with the executives in the morning and then with a series of four departments to prioritize and develop specific goals for their AI initiatives. There is so much happening across Consumers that most of the work was deciding where to focus efforts in 2026. I helped facilitate the discussions among the teams to help them identify a clear and measurable direction.

See publication

Tags: AI, AI Governance, AI Infrastructure

SNC AI Workshop

SNC AI Workshop

Lamont Black

November 16, 2025

A great morning in Dallas at State National Companies (SNC) meeting with their advisory council for an AI workshop. We explored:

• How generative and agentic AI are reshaping operations and member experience

• What an internal + external AI roadmap can look like

• Why this is about tech AND strategy

• How leaders can align innovation with long-term values

See publication

Tags: Agentic AI, AI, AI Governance

An AI Roadmap for Credit Unions

An AI Roadmap for Credit Unions

Credit Union Executives Society

January 28, 2025

In this engaging and forward-thinking session, Dr. Lamont Black guides credit union CEOs and executives through the rapidly evolving landscape of Artificial Intelligence. Tailored for leadership teams, the session breaks down what AI really means for the future of financial services—beyond the buzzwords—and explores how credit unions can adopt these technologies strategically and responsibly.

Attendees will walk away with a practical AI adoption roadmap, insights into current and emerging use cases, and a deeper understanding of how to align innovation with mission.

This session empowers leaders to move from uncertainty to action with clarity and confidence.

See publication

Tags: AI, Digital Transformation, Emerging Technology

Forget Finance: How Personal Finance Will Fade to the Background

Forget Finance: How Personal Finance Will Fade to the Background

Stablecoins: What Are They, Really — and Why Are Institutions Paying Attention?

Stablecoins: What Are They, Really — and Why Are Institutions Paying Attention?

AI Isn’t Just for Tech Giants: Why Local Institutions Need to Pay Attention

AI Isn’t Just for Tech Giants: Why Local Institutions Need to Pay Attention

SIMPLE Payments: Six Consumer Payment Trends Credit Unions Must Embrace

SIMPLE Payments: Six Consumer Payment Trends Credit Unions Must Embrace

Credit Unions and the Quickly Changing Stablecoin Conversation

Credit Unions and the Quickly Changing Stablecoin Conversation

Why AI adoption involves every executive leader

Why AI adoption involves every executive leader

Still Hiring Humans: What the Best Workers Will Do in the Age of AI

Still Hiring Humans: What the Best Workers Will Do in the Age of AI

From Typing to Prompting: The Next Workplace Skill You Can’t Ignore

From Typing to Prompting: The Next Workplace Skill You Can’t Ignore

Prompt Practice: How I’m Building AI Fluency (and Why You Might Want To, Too)

Prompt Practice: How I’m Building AI Fluency (and Why You Might Want To, Too)

LAMONT BLACK / WOV - End of Year 2024 Newsletter

LAMONT BLACK / WOV - End of Year 2024 Newsletter

Looking Towards New Adventures in 2025

Looking Towards New Adventures in 2025

Cryptocurrency Comes to U.S. Banking

Cryptocurrency Comes to U.S. Banking

The Stablecoin Roadmap for Credit Unions

The Stablecoin Roadmap for Credit Unions

Artificial Intelligence in Financial Services

Artificial Intelligence in Financial Services

The Stablecoin Roadmap for Credit Unions

The Stablecoin Roadmap for Credit Unions

Artificial Intelligence and Stablecoins for Credit Unions

Artificial Intelligence and Stablecoins for Credit Unions

AI for Financial Institutions: Embracing the Future of Intelligent Finance.

AI for Financial Institutions: Embracing the Future of Intelligent Finance.

FUELmi YP Leadership Summit - Innovation Is Essential for Leadership

FUELmi YP Leadership Summit - Innovation Is Essential for Leadership

Agentic AI and the Future of Work

Agentic AI and the Future of Work

Stablecoins for Financial Institutions

Stablecoins for Financial Institutions

Artificial Intelligence in Financial Services

Artificial Intelligence in Financial Services

The Credit Union Roadmap for Becoming an Intelligent Enterprise

The Credit Union Roadmap for Becoming an Intelligent Enterprise

Getting Started with AI: A Hands-On Guide for Small Credit Unions

Getting Started with AI: A Hands-On Guide for Small Credit Unions

Stablecoins - Digital Dollars, Real Impact

Stablecoins - Digital Dollars, Real Impact

AI and Executive Leadership: How CU Execs Should Approach AI Strategy

AI and Executive Leadership: How CU Execs Should Approach AI Strategy

AI for Credit Unions

AI for Credit Unions

SNC AI Workshop

SNC AI Workshop

An AI Roadmap for Credit Unions

An AI Roadmap for Credit Unions

Stablecoins and the Genius Act

Stablecoins and the Genius Act

AI Webinar

AI Webinar

Money, Banking and Financial Markets

Money, Banking and Financial Markets

Getting Started with AI: A Hands-On Guide for Small Credit Unions

Getting Started with AI: A Hands-On Guide for Small Credit Unions The Stablecoin Roadmap for Credit Unions

The Stablecoin Roadmap for Credit Unions Artificial Intelligence in Financial Services

Artificial Intelligence in Financial Services Stablecoins and the Genius Act

Stablecoins and the Genius Act