Future of Finance Outlook 2023: Insights from NayaOne Network and Platform Usage

Future of Finance Outlook 2023: Insights from NayaOne Network and Platform Usage

Thought Leadership

January 09, 2023

2022 has been the year where several trends withstood the shift from buzzwords to reality. And while the world was just wrapping its heads around the digital transformation accelerated by the pandemic, a new wave of geopolitical and economic instability emerged. Inflation pressures, rising interest rates, a talent shortage, and a looming recession – it’s a choose-your-uncertainty situation everywhere you look. To remain viable, the industry must work proactively to improve its positioning so that it can withstand external shocks.

With the focus now being redirected to financial resilience and economic health, fintech-bank collaborations are becoming mutually valuable. Fintech companies bring fresh perspectives and innovative ideas to the table, while banks have established credibility and a loyal customer base. By collaborating with a fintech company, banks can endure external disruptions, build on their long-term success and functionality, and appeal to a wider audience.

As we look into 2023, we reflect upon the firsthand insights and learnings we gained through our ecosystem interactions with regulators, financial institutions, fintechs, and tech providers. We also had the opportunity to uncover insights from the annual usage data of the NayaOne platform by a variety of clients and ecosystem partners. Many of our clients have been using the platform to run business transformation and corporate innovation experiments, which span emerging tech mandates, new product developments, digital transformation initiatives, and launching novel use cases. On that basis, here’s our rundown of the 2023 outlook for the financial services industry:

Macroeconomic Influences

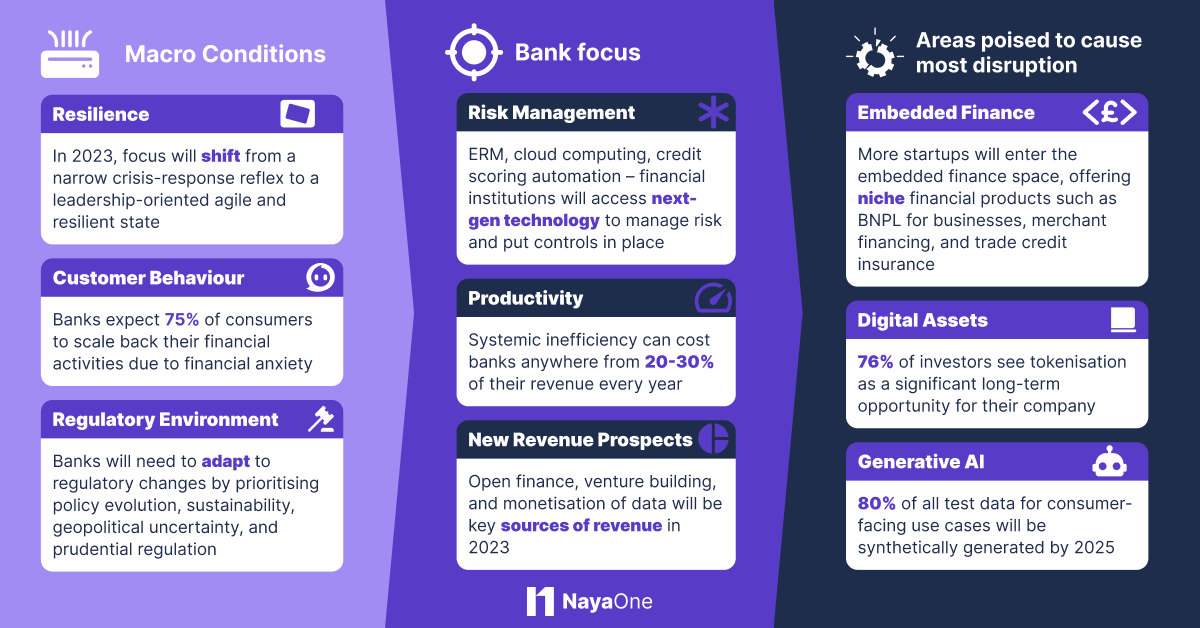

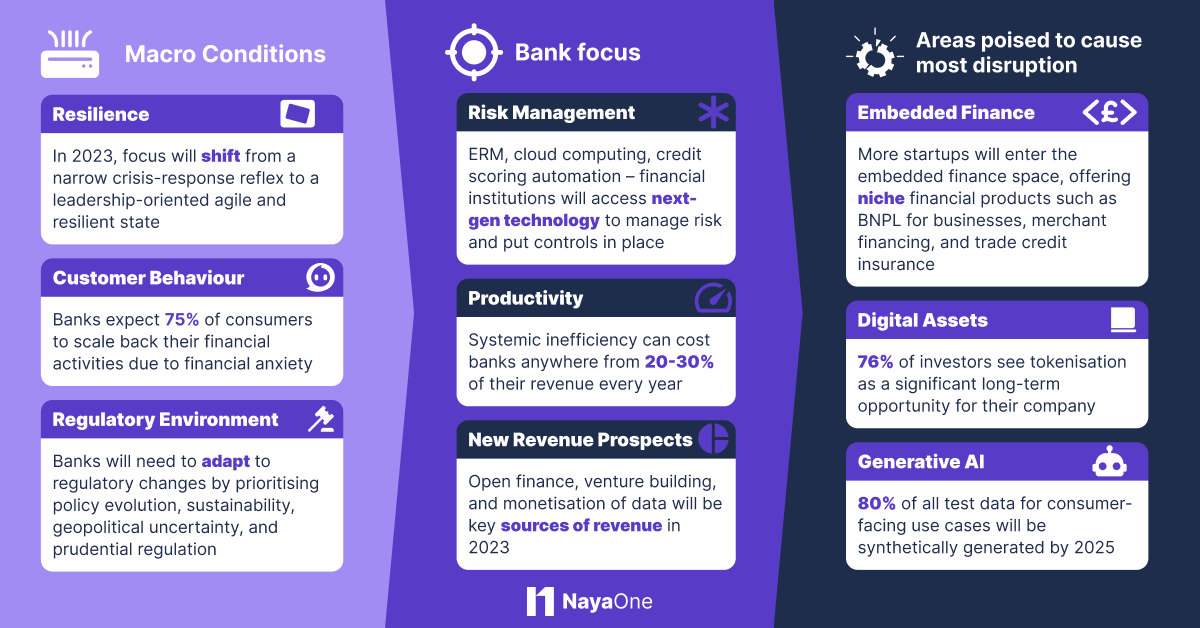

There are several complex, interconnected factors at play in the global macroeconomic outlook for the coming year. Industry players are facing challenges with tightening regulatory policies, falling consumer confidence, and building operational and technical resilience to continue to serve their clients.

By capitalising on the insights from each of these areas, banks can get the needed springboard to navigate conversations with customers and tailor bespoke solutions on a case-by-case basis based on individual needs.

Let’s explore these in more detail to understand how banks can pause, plan, and prepare their next steps of action.

1. Consumer Behaviour

The possibility of recession or stagflation is affecting the behaviour of banks, insurers, and consumers. The scarcity of key goods, fragility in local supply chains, and tight labour markets also add to upside pressure on prices. As a result, banks expect 75% of consumers to scale back their financial activities due to financial anxiety. Financial well-being and addressing financial inclusion and exclusion are top of mind. The use of big data to realign products and services for personal finance management is not new to the agenda but will continue to grow in 2023.

Against such a backdrop, consumers expect lower fees, competitive rates, and guidance on how to save and grow their money during challenging economic times. They also expect additional support in the form of recession strategy planning and one-to-one financial planning from financial institutions. Financial institutions will need to prioritise humanising the customer experience across all channels in order to build trust and resilience, with products and services that are more relatable to lifestyles and holistic needs. The UK’s Consumer Duty principle accelerates this further by requiring firms to put the customer needs first by ensuring they receive fair communication, value, and support while pursuing their financial objectives. Consumer duty will remain a big topic in 2023 as banks look to evaluate and adjust their customer engagement systematically.

As a growth opportunity banks have an opportunity to be part of consumer’s lifestyle and part of SME business processes through embedded finance. By integrating an empathy-focused and low-friction approach, banks can sustain valuable customer engagement across all touch points.

2. Regulatory Landscape

The regulatory picture for the banking and the broader financial services ecosystem collectively points towards certain key areas of supervisory and regulatory priority and focus, including (but not limited to) digitalisation; crypto and digital assets; climate-related risks; merger activities; and fairness, access, and inclusion.

Here are the regulatory developments that I’m watching closely for the upcoming year:

Supervisors are increasingly scrutinising and holding banks accountable for their social and environmental impact. In the EU, the Taxonomy Regulation is being reviewed to extend its coverage to social objectives. In the UK, Consumer Duty is being introduced in 2023 to ensure that financial institutions serve the best interests of retail customers, which will impact product development, customer experiences, and communication strategies.

The Consumer Data Right (CDR) in Australia is strictly regulated to enable consumers to derive maximum value out of their data by defining the elements for consent.

Another regime to look out for in the EU is the Markets in Crypto Assets (MiCA), a comprehensive framework to address custody, trading, exchanges and other services pertaining to digital currencies and digital assets. The regulation intends to modernise financial services legislation in the EU and support a digital economy that benefits society.

In the US, both the Office of the Comptroller of the Currency (OCC) and the US Department of the Treasury have initiated consultation towards policy and regulatory approaches to promote responsible innovation in the wake of increasing bank-fintech partnerships. Blue Ridge’s OCC Agreement represents a case in point, highlighting the regulatory concerns with regard to banks ensuring risk, due diligence, and IT architecture oversight when undertaking third-party fintech alliances.

The US is also evaluating various consumer and investor protection issues, such as housing insecurity, fees and expenses, and access to credit for minority-owned businesses, through regulatory compliance activities. These include the Equal Credit Opportunity Act, Paycheck Protection Program, and Foreign Contribution Regulation Act.

Climate risk is a major focus for international standard-setting bodies, such as the Financial Stability Board (FSB), Basel Committee on Bank Supervision (BCBS), and Financial Action Task Force (FATF). The Network for Greening the Financial System (NGFS) and International Sustainability Standards Board (ISSB) have been established specifically to address this issue. However, there is less alignment on climate stress testing procedures and sustainability taxonomies, which are at different stages of development in different countries, with no clear global standard set in place as of yet.

Regulatory priorities are shifting from a narrow focus on financial stability to a broader emphasis on economic stability and financial inclusion. Banks must now adapt to regulatory changes, maintain their pandemic response, and focus on policy evolution, sustainability, geopolitical uncertainty, and prudential regulation in order to promote sustainable and equitable economic growth and compete in the current environment.

3. Developing Resilience

The rapid digitisation of financial services and the interconnected nature of the system increases operational risk with potentially severe ripple effects through value chains. Firms will continue to review this to ensure the effectiveness of their controls to meet the new rules. To be resilient, firms must focus on shifting from a narrow, crisis-response reflex to a leadership-oriented agile and resilient state. Particularly considering the evolving nature of the cyber threat landscape, it’s important to continuously enhance operational, security, and technology resilience posture. Banks and insurance firms should regularly review and test their cybersecurity defences to identify vulnerabilities and potential risks through simulation exercises and qualitative approaches at all levels.

The regulated business environment has become more complex, and as dependence on third-party service providers and digital tools increases, it is increasingly important for financial firms and FMIs to have robust plans in place to ensure operational and technological resilience. This means measuring the enterprise readiness in the ability to withstand and recover from disruptions, no matter their cause, in order to protect customers, assets, and reputation.

To innovate and transform financial offerings at a time when the macro environment is driving higher expectations, more regulation and a need for efficiency , banks will need to rely on fintech solutions and third-party tech providers to provide new services much faster than they can develop solutions in-house. Overcoming the multiple contemporary crises will require banks to prioritise resilience as a key component of the systemic risk.

Growth Opportunities

As customers shift from wealth generation to financial well-being, financial institutions now realise the greater purpose of creating awareness about long-term financial well-being and safety. The collaborative approach to areas like Open Banking, venture building and open data, which are generally seen as productive plays, has further opened up new, innovative services for end-users. In spite of the headwinds the industry presently faces, there’s a window for corporations to leverage sources of revenue and reinforce current practices by enhancing their productivity and implementing strategic risk management processes.

1. New Revenue Prospects

Banks today have the opportunity to generate new revenue streams from their existing customer base, boosting their income without increasing marketing expenses. The 3 areas below have featured in multiple conversation in H2 22.

Open Finance: Open APIs continue to be the favoured option for banks and third-party providers, reaching unprecedented levels as people rely on open banking technology for all aspects of their financial lives — from finding tailored savings suggestions, to personalised loans and credit options. Open finance is benefiting the financial sector by allowing non-bank lenders and superannuation providers to access the financial data of their customers, which can be used to provide a more complete picture for lending and financial advice purposes. For lenders, APIs can enhance underwriting models by providing additional financial data and allowing them to verify a borrower’s income and employment easily. This data can help lenders assess a borrower’s risk. In the approaching year, data sharing is being implemented on a sector-by-sector basis, with certain organisations being required to comply with mandatory data-sharing obligations.

Venture Building: By adopting curated external sourcing, financial institutions can use venture building as a tool for corporate innovation. Through combining the strengths of venture capital, private equity, and accelerator programs, companies can create business models that bridge the gap between internal governance structure and shared economy.

Monetisation of Data: A new source of value in payments is being brought about by monetising data, where insights generated from consumer and merchant information can unfurl new revenue streams through product cross-selling, strengthening customer relationships, and generating intuitive applications. In the near future, banks will be utilising sanitised data sets to help with stock predictions, marketing campaigns and to fuel artificial intelligence (AI) tools for credit decisions.

To promote the expansion of reliable open data, the UK government is developing Smart Data initiatives in collaboration with the Department for Business, Energy, and Industrial Strategy (BEIS). This enables the secure sharing of data with authorised third parties while taking into account the concerns, desires, and priorities of consumers. These schemes, which are at various stages of development, aim to ethically create and provide services that address customers’ hesitation about sharing sensitive data through Smart Data schemes such as Open Banking.

2. Risk Management

New fintech offerings and collaborations with banks have created new areas of risk that financial regulators are paying attention to. It’s important for every company to identify the type of risk they face, assign numerical values to it, and make decisions based on that data. The banks continually iterate through this process and establish an efficient risk management approach, one which is able to adapt to new macro risk vectors such as a the pandemic and conflicts. This is systemic to protect the customers.

An example to consider is that of the Office of the Comptroller of the Currency’s (OCC) Responsible Innovation Framework, which establishes an ongoing dialogue with banks, nonbanks and other stakeholders, where both sides must accurately gauge their risks on an ongoing basis through a robust risk assessment. In a recent release, the White House outlined recommendations to protect diverse stakeholders across government, industry, academia, and civil society. The proposed comprehensive framework aims to support the responsible development of digital assets, access to reliable financial services, mitigation of cyber vulnerabilities, and aggressive enforcement against unfair practices to foster overall financial stability in a digital economy.

Legacy systems will hinder centralised access to financial data and limit the extraction of valuable insights to generate accurate forecasts in areas such as fraud detection, anti-money laundering, and expected credit loss modelling. Today, corporates have the opportunity to partner with wide-ranging industry players to implement next-gen risk management tools. Enterprise Risk Management (ERM) systems utilise advanced artificial intelligence capabilities — including data analytics, risk aggregation automation, risk simulation, and risk reporting — to provide holistic solutions for reducing exposure to financial risks. Credit scoring automation is revolutionising the provision of actionable insights through machine learning across various credit use cases. Cloud computing is equally being used to produce sophisticated cybersecurity mechanisms via software-as-a-service models powered by AI algorithms. Scenario and stress testing are also being used increasingly for financial risk management, particularly in the banking sector but also in insurance. Work is underway to create regulatory frameworks for sustainability investing, which will impact the investment management industry.

3. Productivity

Systemic inefficiencies act as one of the major ways that can seriously undermine the long-term viability of a business, cause operational friction and impact consumer outcome. As per International Data Corporation, inefficiency can cost banks anywhere from 20% to 30% of their revenue every year. By integrating modern core technologies, banks can streamline and simplify time-consuming efforts, provide real-time auditing to ensure compliance, and extract meaningful insights for data-driven decision-making. These strategies are essential for turning today’s clients into lifelong customers and maximising profits.

As much as scaling technological components is at the core of achieving future readiness, it is essential to emphasise workforce, public and business investments to ensure more offerings are produced at a lower cost per unit. Investments in core infrastructure frameworks will have to go hand-in-hand with training and development of capabilities, team-centric redesigning, and pushing more internal mobility to foster talent and overall productivity.

We are also seeing a strong comeback and increased investment in Robotic Process Automation (RPA) as a priority for a number of banks in our network. The current economic climate is seeking higher productivity from all group functions and revenue generation from front line. Applying RPA and simplification within the business processes increases the chances to getting more done with less.

Market Disruptors

The renewed focus on digital assets, the ability of embedded finance to make banking frictionless, and the ongoing AI revolution will all play a significant role in driving the growth of financial inclusion. The fintech industry is poised to see these emerging trends go from theory to practical application, disrupting the status quo in the process.

1. Digital Assets

Current macroeconomic factors have contributed to a forbidding environment for the crypto industry. For digital assets however, the long-term prospects remain undiminished.

I am particularly keen on the traction of asset tokenisation, where tokenising real-world assets such as real estate, precious metals, and intellectual property is unlocking previously inaccessible assets to a wider range of investors. Tokenisation is also being viewed positively by many stakeholders, with 76% of investors seeing it as a significant long-term opportunity for their company. In countries like Singapore and Indonesia, we see growing retail adoption of tokenised platforms, as in the case of Indonesia-based Nanovest — which gained 2 million+ users with its beta launch of the NanoByte Token (NBT) for trading US stocks and cryptocurrencies based in Indonesia.

Asset tokenisation powered by Decentralised Ledger Technology (DLT) will continue significantly contributing to trade finance and KYC checks. Banks can leverage tokenised transparency to solve friction points, access solvency in real-time, and reduce data security breaches.

Experiments on Central Bank Digital Currencies (CBDCs) continue to take place globally, with over 100 countries (representing 95% of the global GDP) currently exploring a CBDC. Ten of these have already launched a digital currency, where China takes the lead with its digital currency electronic payment (DCEP). While the U.S. Federal Reserve and the EU-ECB are likely to have their national digital currencies ready by 2025, the Bank of International Settlements has suggested that a framework for an international approach to these and other digital assets could come as early as 2023.

The CBDC journey from philosophical to practical is a complex one, and a regulatory sandbox can help bring this to life. The NayaOne Digital Sandbox provides a single platform for the experimentation of emerging technologies, designed with pre-vetted datasets for the regulated industry. I’d be happy to discuss this further via DM.

2. Embedded Finance

Embedded finance will continue its ascent in 2023, with more and more startups entering the embedded finance space, offering niche financial products for businesses, merchant financing, and trade credit insurance. Point solutions will take centre stage, where a carefully chosen selection of financial tools will play a key role in facilitating a smooth onboarding and orchestration process for an unparalleled payments experience.

Consumer businesses can use white-label banking solutions provided by third-party providers to offer financial services to their customers under their own brand name. This allows them to capture more value from the consumer journey, differentiate themselves from competitors, and offer value for money to their customers. However, it is important for businesses to carefully consider the potential regulatory and compliance risks and choose a reputable third-party provider to ensure the security and effectiveness of their white-label banking services.

Banks can even go beyond open banking and open finance by leveraging the opportunity presented by Banking-as-a-Service (BaaS) to create customer-centric products and services. BaaS will allow banks to leverage the cloud to attract new, diverse customers and offers a new route to market for their products and services.

3. Generative Artificial Intelligence (AI)

Applications across functions of personalised marketing, improved customer support chatbots, generation of data tables, and detection of fraudulent activities are already making an early impact. It’s only a matter of time before this makes its way into enterprise productivity and personalisation space.

We recently contributed to a Gartner report, where they predict that 20% of all test data for consumer-facing use cases will be synthetically generated by 2025. As the amount of data that financial institutions handle continues to grow, it becomes increasingly important for them to thoroughly understand their customers through a diverse set of variables. By analysing a wide range of data points, financial institutions can gain a more complete and accurate picture of their customers, which can inform everything from their risk assessments to the products and services they offer.

Most of us are familiar with ChatGPT, a generative AI language platform that employs deep learning for articulated responses. Such natural language generation tools can be implemented at different parts of the business value chain. From making loan decisions by risk scoring to extracting, reviewing and highlighting important themes from regulatory documents, the implications have only begun to stem for endless possibilities tomorrow.

Conclusion

Most financial organisations are investing heavily in technology to help drive efficiencies and support more evolving business models. Integration of automation tools, agile platforms, and digitisation — banks are already in the loop of “what” to do to elevate the efficiency game.

It’s time to narrow in on the “how”. Hyper-personalisation will persist in the next year, as well as the continuous emphasis on mapping the intermediaries for risk management objectives. With cloud services, third-party ecosystems, and other “as-a-service” models intensifying, banks will have to take imperative action on utilising a data and digital platform, use the proper KPIs, define critical economic functions, and set impact tolerance to drive scalability and ensure end-to-end operational excellence.

Cross-industry collaboration is at the forefront of driving innovation, productivity and new product development via secure and compliant mechanisms.

Thank you for reading and if you would like discuss any of the threads above and how they could be of benefit to your organisation or how your tech companies fit in one of the them, our DMs are always open.

See publication

Tags: Digital Transformation, Emerging Technology, Innovation

NayaOne has the opportunity to provide the Digital Identity Sandbox for The Department for Science, Innovation and Technology

NayaOne has the opportunity to provide the Digital Identity Sandbox for The Department for Science, Innovation and Technology

Fintech: PoC and Pilot Best Practices Workshop

Fintech: PoC and Pilot Best Practices Workshop

Fintech Week London

Fintech Week London

Future of Finance Outlook 2023: Insights from NayaOne Network and Platform Usage

Future of Finance Outlook 2023: Insights from NayaOne Network and Platform Usage