Chris Skinner is known as one of the most influential people in technology and a best-selling author. He is an independent commentator on the financial markets and fintech through his blog, the Finanser.com, which is updated daily. His latest book (seventeenth!) is Digital for Good, focusing upon how technology and finance can work together to address the environmental and social issues we face today and make a better world. His previous books include Doing Digital, which shared the lessons of how to do digital transformation through interviews with leading global banks such as BBVA, China Merchants Bank, DBS, ING and JPMorgan Chase; Digital Human, which showed how digitalisation how is a revolution that allows everyone from the plains of Africa to the mountains of Tibet to be included and served by the network; and Digital Bank that provides a comprehensive review and analysis of the battle for digital banking and strategies for companies to compete. Chris has recently been added to The Mad 33 List for Inspirational change and transformation leaders - making a difference - making the future a reality.

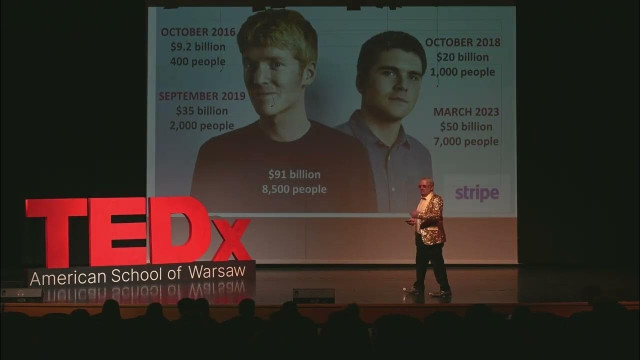

He is a non-executive director of 11:FS and on the advisory boards of many FinTech and financial firms. Mr. Skinner has been an advisor to the United Nations, the White House, the World Bank and the World Economic Forum, and is a visiting lecturer with Cambridge University as well as a TEDx speaker. In recent years, he has been voted one of the UK’s foremost fintech observers by The Telegraph and one of the most influential people in financial technology by the Wall Street Journal’s Financial News and Thomson Reuters. Chris is also a successful children's author with a series, focused upon Captain Cake and the Candy Crew, released in 2021 Captain Cake. He is also co-founder with renowned artist Basia Hamilton of The Portrait Foundation, Portrait Foundation, a non-profit platform to encourage children and the arts.

Available For: Advising, Authoring, Consulting, Influencing, Speaking

Travels From: Poland

Speaking Topics: How can we use technology and finance to improve society and the planet?, Tomorrow's bank: digital, open and human, Doing Digital - Lessons from Leade

| Chris Skinner | Points |

|---|---|

| Academic | 0 |

| Author | 443 |

| Influencer | 815 |

| Speaker | 0 |

| Entrepreneur | 0 |

| Total | 1258 |

Points based upon Thinkers360 patent-pending algorithm.

Why bank branches still matter

Why bank branches still matter

Tags: Climate Change, Finance, FinTech

The Finanser’s Week: 15th December – 21st December 2025

The Finanser’s Week: 15th December – 21st December 2025

Tags: Climate Change, Finance, FinTech

The end of search engines and browsers

The end of search engines and browsers

Tags: Climate Change, Finance, FinTech

Bankers and climate change: a disaster waiting to happen?

Bankers and climate change: a disaster waiting to happen?

Tags: Climate Change, Finance, FinTech

Is an Islamic loan a loan or a borrowing?

Is an Islamic loan a loan or a borrowing?

Tags: Climate Change, Finance, FinTech

Financial bubbles destroy everything. Industrial bubbles create the future. [Jeff Bezos]

Financial bubbles destroy everything. Industrial bubbles create the future. [Jeff Bezos]

Tags: Climate Change, Finance, FinTech

The UK government’s digital identity scheme arrives, dead on arrival

The UK government’s digital identity scheme arrives, dead on arrival

Tags: Climate Change, Finance, FinTech

The Finanser’s Week: 29th September – 5th October 2025

The Finanser’s Week: 29th September – 5th October 2025

Tags: Climate Change, Finance, FinTech

Key take-away from #SIBOS 2025: it’s no longer banking and payments

Key take-away from #SIBOS 2025: it’s no longer banking and payments

Tags: Climate Change, Finance, FinTech

Revolut opens its new HQ and takes over the world?

Revolut opens its new HQ and takes over the world?

Tags: Climate Change, Finance, FinTech

My data is my data

My data is my data

Tags: Climate Change, Finance, FinTech

From data to knowledge to wisdom

From data to knowledge to wisdom

Tags: Climate Change, Finance, FinTech

How ya doing Pardna?

How ya doing Pardna?

Tags: Climate Change, Finance, FinTech

64% of payments people fear deep fakes

64% of payments people fear deep fakes

Tags: Climate Change, Finance, FinTech

Focus on the jobs we are creating, not the ones we have lost

Focus on the jobs we are creating, not the ones we have lost

Tags: Climate Change, Finance, FinTech

Are stablecoins really stable?

Are stablecoins really stable?

Tags: Finance, FinTech, Public Relations

Where is fintech going?

Where is fintech going?

Tags: FinTech, Future of Work, Public Relations

When regulators crackdown on crypto, you know that crypto has crept out

When regulators crackdown on crypto, you know that crypto has crept out

Tags: Climate Change, Digital Transformation, FinTech

Digital is the core, data is the asset

Digital is the core, data is the asset

Tags: Climate Change, FinTech

Why is Goldman Sachs dropping the Apple?

Why is Goldman Sachs dropping the Apple?

Tags: Climate Change, Digital Transformation, FinTech

AII: Artificially Intelligent Islam

AII: Artificially Intelligent Islam

Tags: Climate Change, Finance, FinTech

The digital transformation disillusionment

The digital transformation disillusionment

Tags: Climate Change, Finance, FinTech

From A2A to B2B

From A2A to B2B

Tags: Climate Change, Finance, FinTech

Intelligent Money

Intelligent Money

Tags: Finance

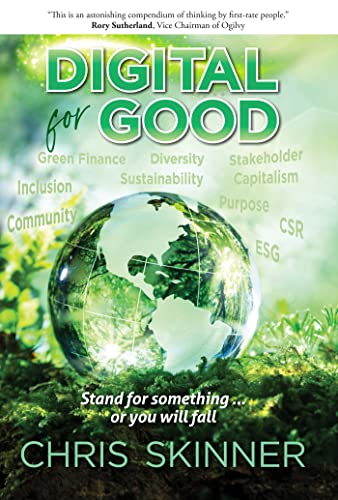

Digital For Good: Stand for something… or you will fall

Digital For Good: Stand for something… or you will fall

Tags: FinTech, Climate Change, Ecosystems

Doing Digital: Lessons from Leaders

Doing Digital: Lessons from Leaders

Tags: Digital Transformation, Finance, FinTech

Digital Human: The Fourth Revolution of Humanity Includes Everyone

Digital Human: The Fourth Revolution of Humanity Includes Everyone

Tags: Finance

ValueWeb: How Fintech Firms are Using Bitcoin Blockchain and Mobile Technologies to Create the Internet of Value

ValueWeb: How Fintech Firms are Using Bitcoin Blockchain and Mobile Technologies to Create the Internet of Value

Tags: Finance, IoT, FinTech

Digital Bank: Strategies to Launch or Become a Digital Bank

Digital Bank: Strategies to Launch or Become a Digital Bank

Tags: Finance

The Future of Banking: In a Globalised World (The Wiley Finance Series)

The Future of Banking: In a Globalised World (The Wiley Finance Series)

Tags: Finance

Why bank branches still matter

Why bank branches still matter The Finanser’s Week: 15th December – 21st December 2025

The Finanser’s Week: 15th December – 21st December 2025 The end of search engines and browsers

The end of search engines and browsers