Apr10

In an era where the impacts of climate change are increasingly impossible to ignore, innovative solutions that bridge the gap between technology and sustainability are more crucial than ever. A recent episode of the Climate Confident podcast, which I had the pleasure of hosting, shed light on an intriguing approach that uses finance to combat climate change. My guests, Joe Pretorius and Paul Rowett, discussed their pioneering project, Toco, a currency backed by carbon mitigation outcomes, supported by the independent, non-profit Carbon Reserve and advocated for by the Carbon is Moneymovement. This conversation not only highlighted the potential of financial technology (FinTech) in the fight against global warming but also underscored the vital role of sustainability in reshaping our financial systems.

The intersection of finance and technology has birthed FinTech, a sector that's revolutionising banking, investment, and now, sustainability. Toco represents an innovative model where digital currency is directly tied to actions that reduce carbon emissions. This model is groundbreaking: it transforms every transaction into a step towards combating climate change, making the act of spending an act of saving the planet.

The concept is straightforward yet profound. By backing currency with verified carbon reduction efforts, such as reforestation projects, mangrove regeneration, or advancements in carbon capture technology, Toco aims to provide a tangible way for individuals and businesses to contribute to environmental sustainability. This initiative is a testament to the potential of leveraging financial markets to support ecological restoration and conservation efforts on a global scale.

The success of Toco's pilot in Stellenbosch, and its current expansion into Europe, signifies a growing recognition of the importance of sustainable finance. As Joe and Paul shared, the initiative has already mobilised communities and businesses, proving that a currency can do more than facilitate transactions—it can also foster a culture of sustainability and act as a catalyst for widespread environmental action.

This approach is not isolated. Around the globe, there's a surge in green bonds, sustainable investments, and eco-friendly startups. For instance, the rise in impact investing, which focuses on generating positive environmental and social impacts alongside financial returns, is evidence of a broader shift towards sustainability in the financial sector. These trends reflect a growing awareness among investors and consumers alike that financial decisions have far-reaching implications for the planet.

However, Toco's model goes a step further by integrating carbon mitigation directly into the fabric of daily financial transactions. This innovative approach not only amplifies the impact of individual actions but also challenges traditional financial and economic models to evolve towards sustainability.

The significance of this cannot be overstated. Climate change poses an existential threat, and the window for action is narrowing. Solutions like Toco offer a glimpse into a future where finance and technology unite to address this crisis head-on. They demonstrate that with creativity and innovation, the tools for making a significant impact are already at our fingertips.

The integration of FinTech and sustainability exemplifies how reimagining the purpose and potential of finance can lead to meaningful environmental progress. But this is just the beginning. The journey towards a sustainable financial system is ongoing, and it requires the participation and support of individuals, businesses, and governments worldwide.

If you're intrigued by the potential of using finance to fight climate change and want to delve deeper into the strategies discussed in this episode, I encourage you to listen to the full conversation with Joe and Paul on the Climate Confidentpodcast. Their insights offer valuable perspectives on how we can leverage financial innovations to make a real difference for our planet.

let us remain committed to the vision of a world where economic activity supports, rather than undermines, our planet's health and well-being

The fight against climate change is a collective endeavour, and it's clear that financial technology will play a pivotal role in shaping our shared future. As we continue to explore and implement sustainable financial solutions, let us remain committed to the vision of a world where economic activity supports, rather than undermines, our planet's health and well-being. Together, through innovation and action, we can pave the way towards a more sustainable, resilient, and prosperous world for all.

Originally published on TomRaftery.com

By Tom Raftery

Keywords: Climate Change, FinTech, Sustainability

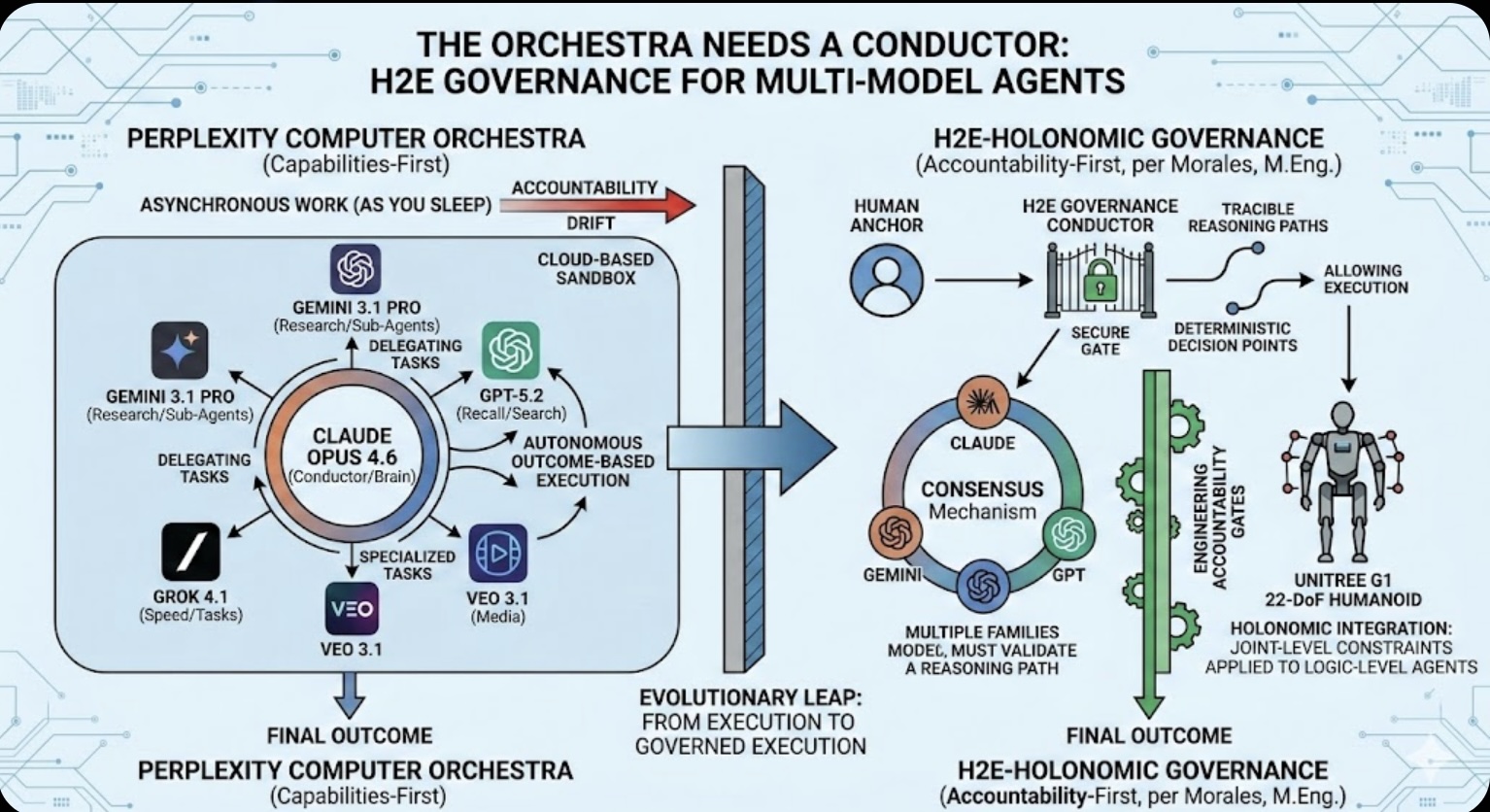

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance

The Orchestra Needs a Conductor: Why Multi-Model Agents Require H2E Governance The Role of Memory in Modern-day Business

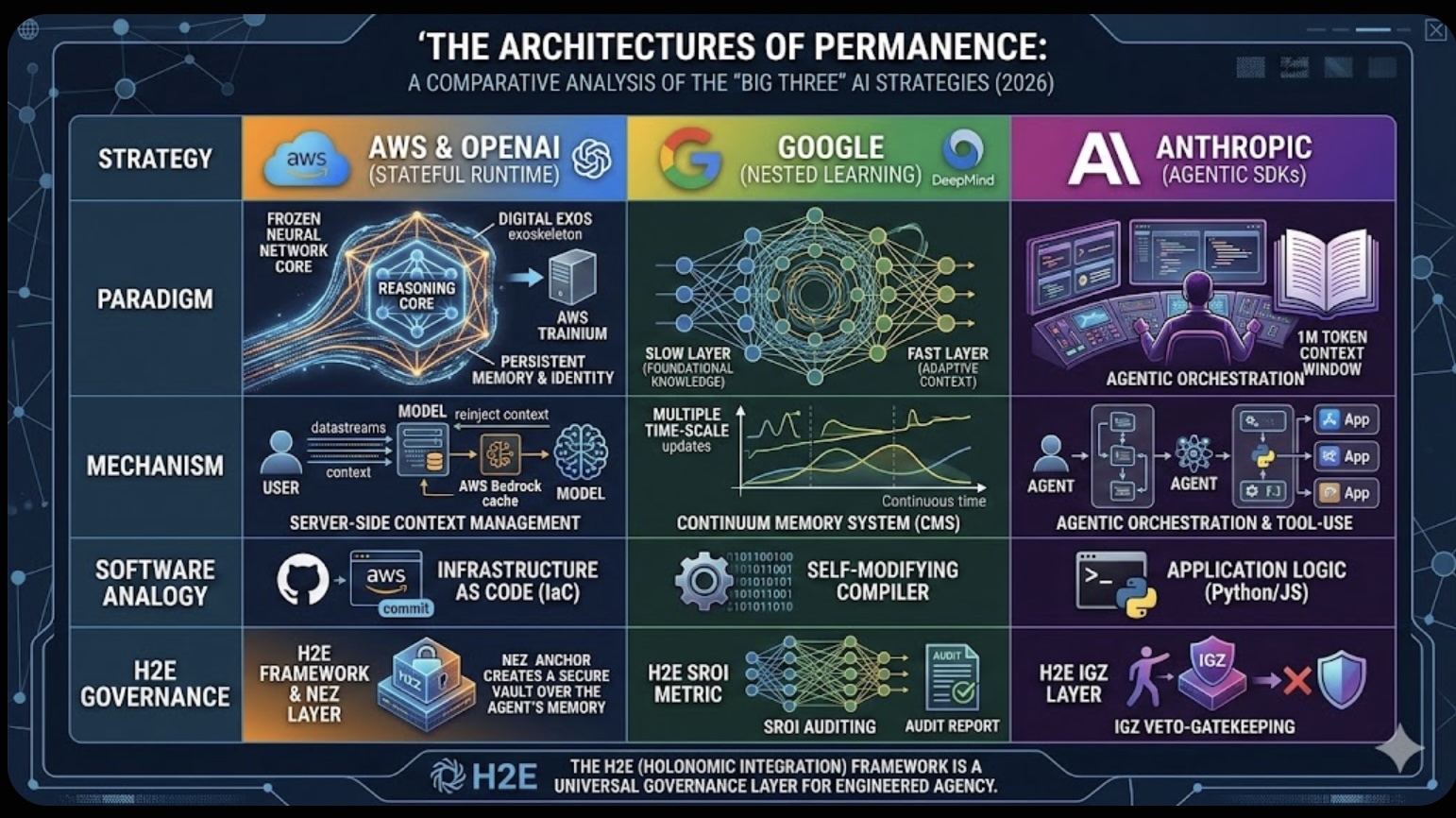

The Role of Memory in Modern-day Business The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026)

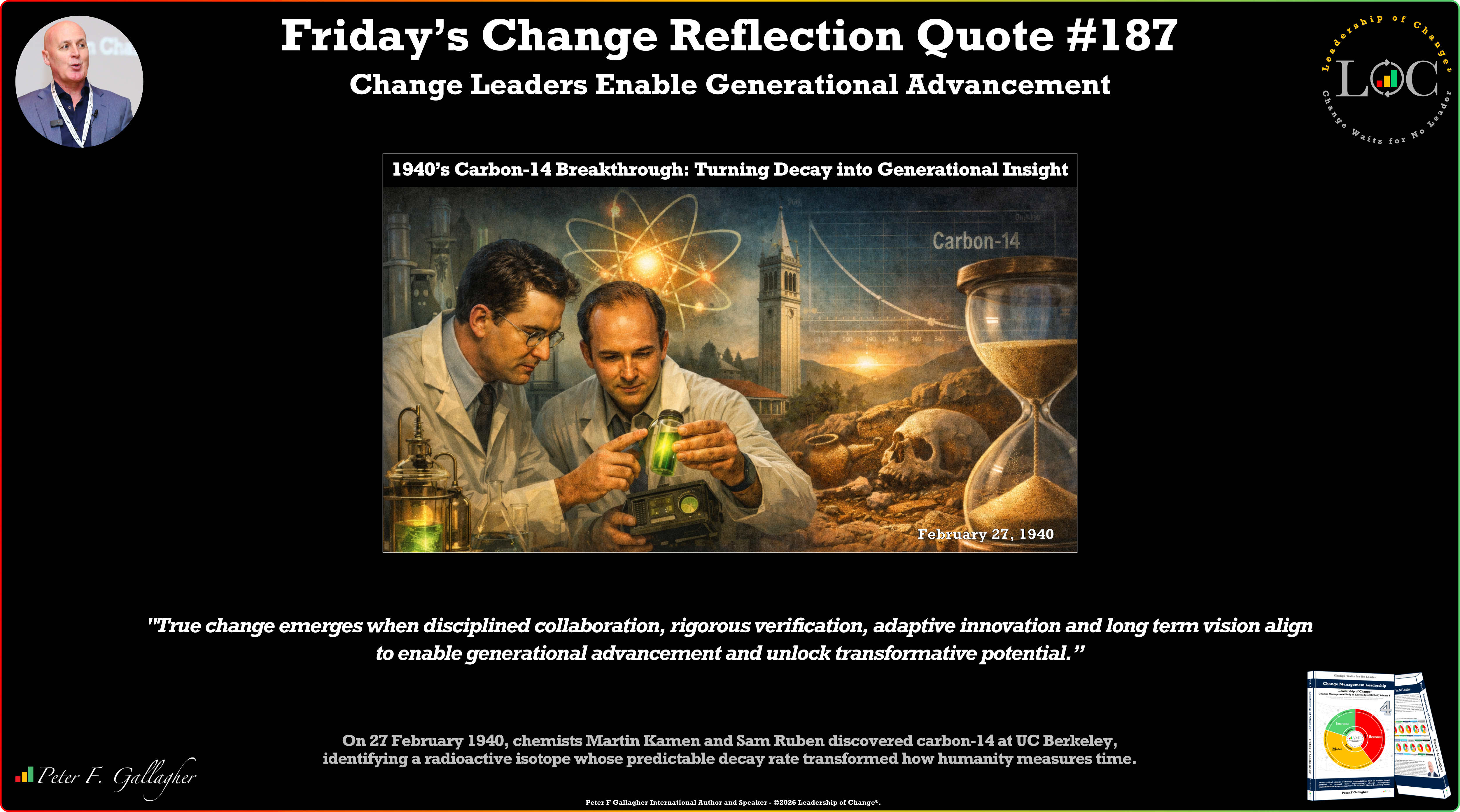

The Architectures of Permanence: A Comparative Analysis of the "Big Three" AI Strategies (2026) Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement

Friday’s Change Reflection Quote - Leadership of Change - Change Leaders Enable Generational Advancement The Corix Partners Friday Reading List - February 27, 2026

The Corix Partners Friday Reading List - February 27, 2026